Market Update

Freight Market Update: February 19, 2020

Freight Market Update: February 19, 2020

Flexport is monitoring developments of the Coronavirus and its impact on supply chains. The Chinese New Year (CNY) holiday is officially over, but supply chains are still struggling to bounce back. For more on how global trade is being affected by the Coronavirus, read our blog.

Want to receive our weekly Market Update via email? Subscribe here.

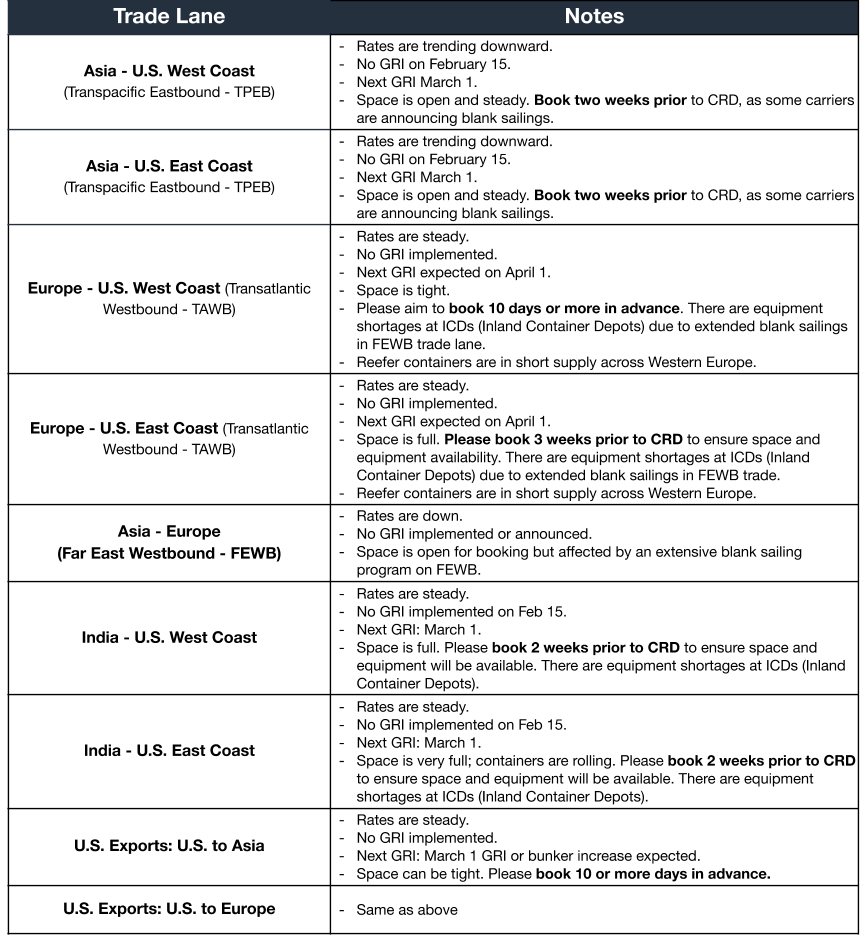

Ocean Freight Market Update

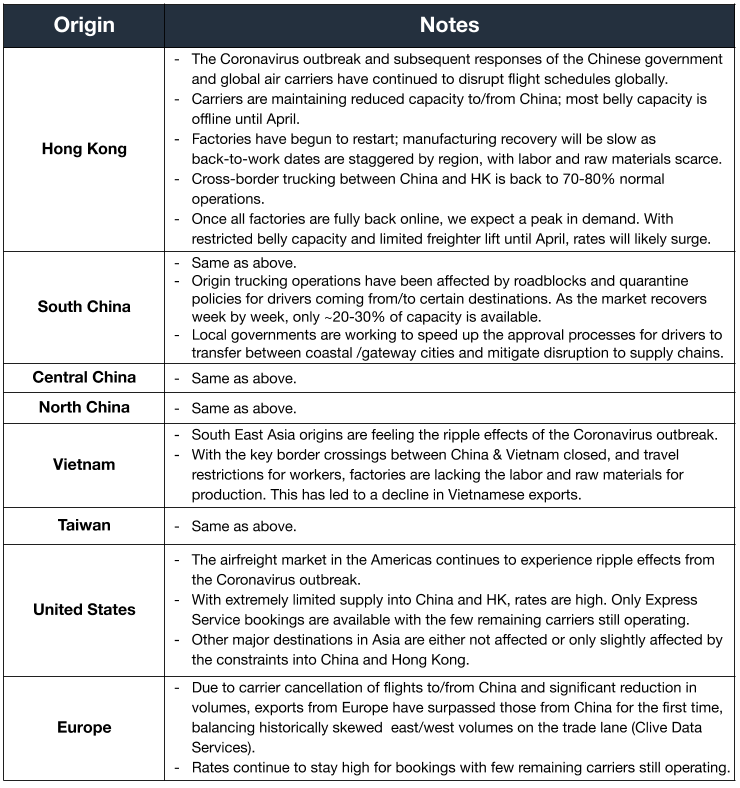

Air Freight Market Update

Freight Market News

Coronavirus Reshapes Global Supply Chain

As factories shuttered by Coronavirus continue to cripple supply chains, multinational companies are moving parts production from China—possibly for good. The virus may be a tipping point for a “fundamental review of Asia supply chains,” reports Nikkei Asian Review, as Chinese wages rise and a US-China trade deal fails to remove most tariffs.

IMO Plans to Review Scrubber Rules

An IMO sub-committee meets in London this week to finalize a March ban on carriage of heavy fuel oils by ships without scrubbers and to review guidelines for open-loop scrubbers. The Loadstar reveals more than 80 ports have banned the open-loop scrubbers in response to new reports that their wash water may harm marine life.

Shipping Chamber Opposes Panama Price Hike

The International Chamber of Shipping (ICS) suggests the Panama Canal Authority postpones recent freshwater charges intended to offset low water levels. The new charges come ahead of April rate increases; together, they could raise transit prices by 30%, according to World Maritime News. The ICS cites Coronavirus and IMO2020 transitional costs as extenuating circumstances in its plea.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- Japan’s Q4 GDP fell at a 6.3% annual rate, the biggest drop since 2014 Q2 and significantly worse than the median forecast of a 3.7% fall. In each case, the contraction followed a sales tax hike.

- Inflation hit China last week with its government reporting food prices are up 20% and the consumer price index rose 5.4% over a year earlier. Though the food price increase included a 116% rise in pork prices, following a fever that affected supply, it also included a 17% jump in vegetable prices.

- In light of the virus outbreak, China’s central bank cut a key interest rate and urged forbearance on bad loans. The policies reinforce pre-existing concerns about high levels of Chinese debt.

- Mixed US data shows industrial production fell 0.3% in January from the month before, while consumer sentiment rose.

- The annual increase in the broad consumer price index was 2.5%, while core CPI—excluding food and energy—rose 2.3%.

- Industrial output fell in the Eurozone at a 2.1% rate in December and was down 4.1% across 2019.

Customs and Trade Updates

Increase on Tariffs in EU Aircrafts

The USTR released a notice that stated the EU Civil Aircraft subsidies tariffs that are currently in place at 25% for non-aircraft parts will stay at 25%. The tariffs on airplanes imported under 8802.40 will now have their Section 301 tariff raised from 10% to 15%. The scheduled implementation date for that tariff hike is March 18th, 2020. The notice also stated that if retaliatory measures are imposed by the EU, there could be immediate revisions of the additional duties levied. The original published list of tariffs is here for reference.

ACE Deployment Schedule

CBP released an updated ACE deployment schedule that outlines when the trade community can expect additions and updates that will be made through the year. There are also more details on each of the features they are rolling out here.

Bill Introduced on Allowable De Minimis for Export of Huawei Goods

Senator Rick Scott proposed a bill to make it more difficult for US companies to do business with Huawei. Existing legislation lets foreign-made goods that contain 25% of material made in the US to be exported to blacklisted companies. However, the proposed legislation would knock that 25% threshold down to just 10% for any goods exported to Huawei or its inhouse semiconductor business. Given that Huawei has already been added to the Business of Industry and Security (BIS), it's still unclear how much more restrictive it would make things for the company.

**For a roundup of tariff-related news, visit Tariff Insider.

Also, pre-register now for FORWARD 2020, a three-day event that brings together the greatest minds in global trade for ideas and insights to advance the industry.