Global Logistics Update

De Minimis to End for All Nations on Aug. 29; Congestion Persists on TAWB

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: July 31, 2025

Trends to Watch

Talking Tariffs

- De Minimis Exemption Set to End for All Countries on August 29: On July 30, President Trump signed an executive order that will suspend the de minimis exemption for all countries of origin on August 29, 2025.

- The U.S. suspended the de minimis exemption for Chinese-origin goods on May 2, 2025. And with the One Big Beautiful Bill Act (OBBBA) signed into law earlier this month, de minimis was originally expected to end for all other trade partners on July 1, 2027. According to the July 30 executive order, President Trump is suspending de minimis “more quickly than the OBBBA requires … to save American lives and businesses now.”

- Details on applicable duties—including those that apply to low-value goods shipped via the international postal system vs. those shipped through other means—can be found on our live blog.

- This order comes just ahead of this year’s peak season. Retailers, including those that had begun implementing a China Plus One strategy, may face significant disruptions. For more insight into what’s at stake for businesses and supply chains, check out CEO Ryan Petersen’s April 2 blog post.

- President Trump Signs Executive Order Increasing Tariffs on Brazil: On July 30, President Trump also signed an executive order that will increase the tariff rate on Brazil from 10% to 50%, effective August 6, 2025. Goods loaded onto a vessel and in their final mode of transit before August 6 and “entered for consumption, or withdrawn from warehouse for consumption” before October 5 will remain subject to the current 10% duty rate.

- President Trump Signs Proclamation on Copper Tariffs: On July 30, President Trump signed a proclamation that will impose a 50% Section 232 tariff on copper imports, effective August 1.

- The tariff will apply to products’ copper content, while non-copper content will remain subject to reciprocal tariffs or other applicable duties. These tariffs will not stack.

- Products subject to Section 232 auto tariffs will be exempt from the upcoming copper tariff.

- U.S. and EU Reach Preliminary Trade Agreement: On July 27, the U.S. and the EU reached a preliminary trade deal, though it remains unclear when the agreement will take effect. According to the White House, terms include:

- EU goods imported into the U.S.—including autos and auto parts, pharmaceuticals, and semiconductors—will face a 15% tariff.

- The EU will continue to face 50% sectoral tariffs on steel, aluminum, and copper.

- By 2028, the EU will purchase $750 billion in U.S. energy products and invest an additional $600 billion in the U.S.

- The EU will work with the U.S. to eliminate various tariffs, and will establish quotas for certain products.

- The EU will work with the U.S. to address certain non-tariff barriers, including those related to digital trade and food and agricultural products. The EU will also streamline its requirements and “red tape” imposed on U.S. exporters.

- The EU will purchase significant amounts of U.S. military equipment.

- U.S. and China Seek Out Potential Extension of Temporary Tariff Agreement: Following the latest round of U.S.-China trade negotiations—which wrapped up on July 29, just two weeks ahead of the nations’ August 12 deadline for finalizing a trade deal—the U.S. and China have agreed to push for an extension of the 90-day agreement that took effect in May. The final decision lies with President Trump, said U.S. Treasury Secretary Scott Bessent.

- U.S. to Announce Results of Semiconductor Probe: The U.S. is expected to announce the results of a Section 232 investigation into semiconductors in about two weeks. Depending on the results, chip imports may potentially face new duties.

- Other Tariff Developments:

- On July 30, President Trump announced on Truth Social that the U.S. will impose a 25% tariff on India, effective August 1. India will also face an unspecified penalty for purchasing military equipment and energy products from Russia.

- Over the past few weeks, President Trump has announced his proposed reciprocal tariff rates for more than two dozen trade partners. These rates are expected to take effect on August 1, pending official confirmation via executive order or Federal Register notice. For a full list of announced rates, check out our live blog.

- Other potential duties President Trump has recently suggested include a 10% tariff on BRICS countries and a 200% tariff on pharmaceuticals.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- Market demand in August is expected to remain stable, similar to July levels.

- Capacity is at 70-80% of normal levels. There have not been any significant reductions in capacity, meaning the market is continuing to experience overcapacity relative to flat demand.

- Overall, space availability is open.

- Equipment:

- Space availability has improved slightly since late July. Equipment shortages remain an issue primarily for CMA and HMM, while other carriers are seeing better conditions.

- Typhoons impacting Ningbo and Shanghai this week have resulted in a pause in empty container pickups and some anticipated vessel delays.

- Freight Rates:

- The Peak Season Surcharge (PSS) has been removed from the market for August.

- The August 1 General Rate Increase (GRI) has been withdrawn. Rates for the first half of August have been extended, with further mitigation for the East Coast and Gulf. This can be attributed to flat demand and the full removal of the PSS in the fixed market.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- Vessel capacity for the first two weeks of August is being filled up, with current market demand stable.

- With major retailers planning volume increases for September, expect a booking surge in late August.

- Equipment:

- Space availability has improved slightly since late July. Equipment shortages remain an issue primarily for CMA and HMM, while other carriers are seeing better conditions.

- Typhoons impacting Ningbo and Shanghai this week have resulted in a pause in empty container pickups and some anticipated vessel delays.

- Freight Rates:

- August Freight All Kinds (FAK) rates have stabilized, with an overall increase of around 5-8% compared to the second half of July.

- The Shanghai Containerized Freight Index (SCFI) is expected to see a slight rise in the coming weeks.

- High vessel utilization is expected in early August. As a result, rates could increase later in August as the market prepares for September volume growth.

- Following Maersk’s PSS announcement on long-term deals, other carriers are also adjusting PSSs to reflect anticipated rate increases for August and September.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand:

- Antwerp is continuing to experience its worst congestion since Covid‑19, with dwell times exceeding eight days and yard utilization north of 90%.

- Rotterdam, Hamburg, and Bremerhaven are seeing yard utilization in the 80–85% range, resulting in vessel delays of two to four days.

- Piraeus, Genoa, and Valencia continue to report significant yard overcrowding, with vessel wait times of two to five days, aligned with prior April–July trends.

- Additional stressors include drying river levels, strike actions, and rail disruptions, affecting landside flows in Europe.

- The blank sailing rate is currently around 4–7%, dropping month over month. Capacity is stable.

- Equipment:

- Container and chassis shortages persist across Austria, Slovakia, Hungary, Southern/Eastern Germany, and Portugal, with no marked improvement.

- Freight Rates:

- In Northern Europe and the West Mediterranean, all carriers have postponed implementing PSSs announced for July. Rates are expected to remain stable until the end of Q3. In the East Mediterranean, some carriers have started to announce GRIs for September.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- Capacity to the U.S. East Coast has increased, given the start of the Indian subcontinent’s traditional peak season this month. A carrier is adding vessels back to their Northeast India to U.S. East Coast service, but temporarily omitting Charleston for enhanced service reliability.

- Capacity to the U.S. West Coast is opening, in line with the TPEB market.

- Freight Rates:

- For cargo moving to the U.S. East Coast: GRIs and PSSs were announced for the second half of July, but in general, those increases have not been implemented. Based on what carriers are seeing, there appears to be a large spread in the market across booking intakes and utilization. There may be a lack of typical peak season demand to support the rate increases, especially in light of capacity being reinjected into the Indian subcontinent to U.S. East Coast trade.

- For Indian subcontinent cargo moving to the U.S. West Coast: GRIs did not stick in the market and PSSs have come down, in line with TPEB lanes.

- Exports from Pakistan continue to see elevated cost and transit times due to additional feeder services needed to service the country in light of the India-Pakistan conflict.

Air

WEEK 29: JULY 14 - JULY 20, 2025

No Surge Ahead of U.S. Tariff Deadlines

- Global Volumes Dip -2% Week over Week: In Week 29 (July 14–20), global air cargo tonnages fell -2% WoW, driven by a seasonal summer slowdown. Most origin regions saw a -3% decline, except the Middle East and South Asia (MESA) (-1%) and North America (flat).

- Asia-Pacific to Europe Down -6% Week over Week: Volumes dropped significantly from China (-8%), Hong Kong (-7%), South Korea (-9%), and Japan (-3%). Even so, rates were largely stable (+1% WoW to $3.86/kg), with Japan spot rates rebounding +13%.

- Asia-Pacific to U.S. Rebounds +3% Week over Week: Following the previous week's drop (-5%), tonnages bounced back from Southeast Asia: Indonesia (+52%), Thailand (+18%), Malaysia (+13%), and Vietnam (+10%). This appears to be a correction, not a tariff-driven surge.

- Rates Mixed, Slightly Below 2024: Global average rates rose +1% WoW to $2.44/kg, but were still -1% YoY. Asia-Pacific to U.S. rates dipped -1% WoW to $4.82/kg; South Korea fell sharply (-16%), while Japan rose +8%.

(Source: WorldACD)

Please reach out to your account representative for details on any impacts to your shipments.

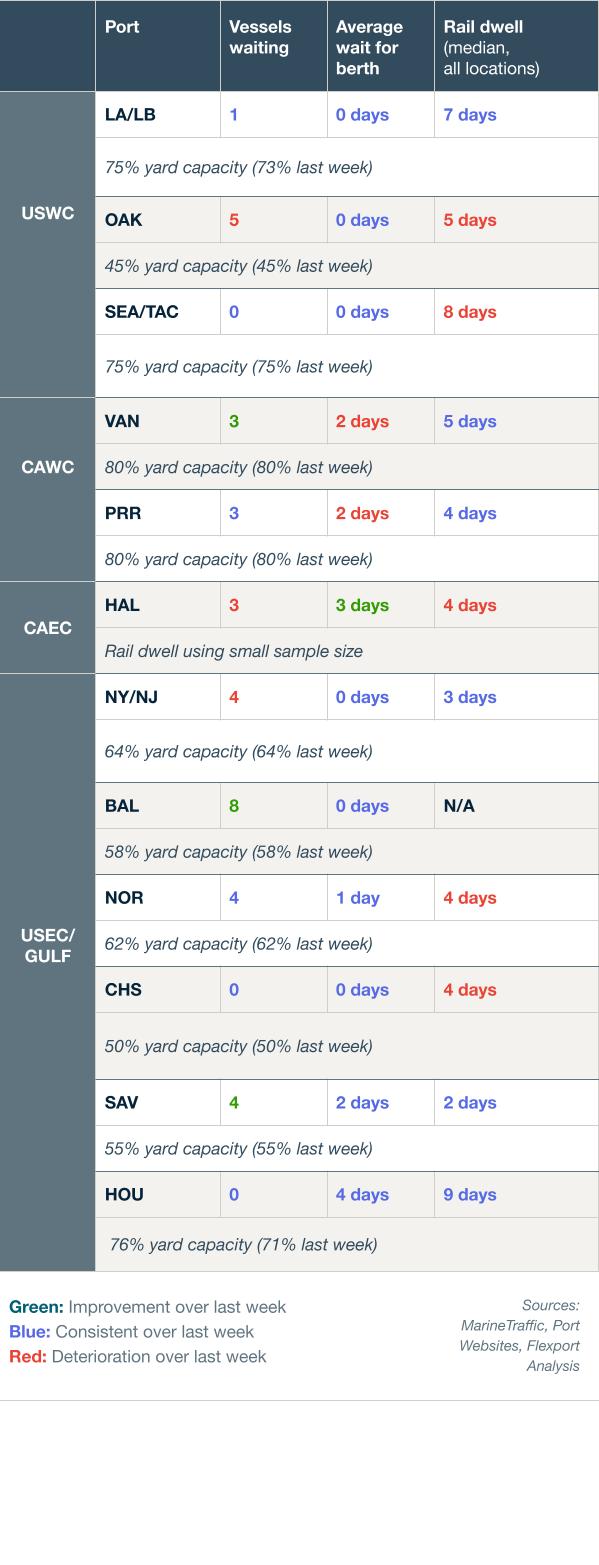

North America Vessel Dwell Times

Upcoming Webinars

Tariff Trends 2025: Expert Insights on the New U.S. Customs Landscape

Wednesday, August 6 @ 8:00 am PT / 11:00 am ET / 16:00 BST / 17:00 CEST

North America Freight Market Update Live

Thursday, August 14 @ 9:00 am PT / 12:00 pm ET

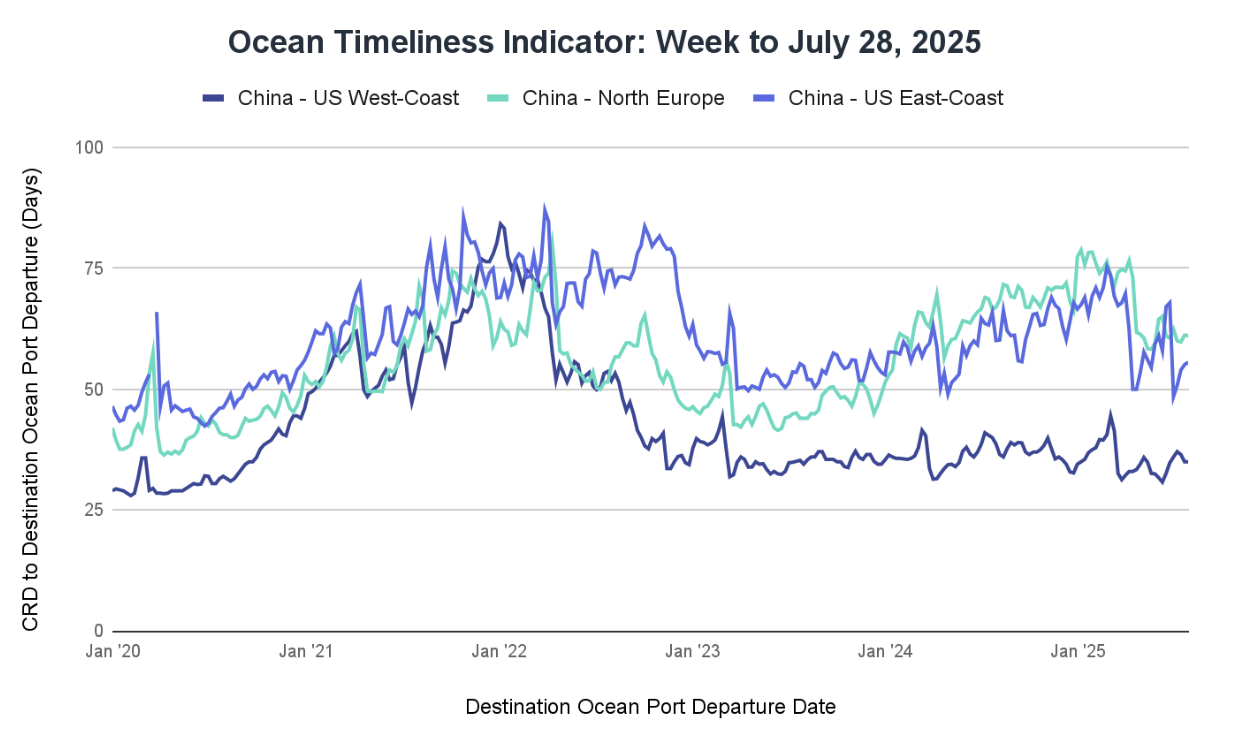

Ocean Timeliness Indicator

Transit time from China to the U.S. West Coast remained stable, while China to North Europe experienced a slight decrease. The transit time from China to the U.S. East Coast saw a minor increase.

Week to July 28, 2025

Transit time from China to the U.S. West Coast remained unchanged at 35 days. The China to North Europe route saw a 0.1-day decrease, falling from 61.2 to 61.1 days. Meanwhile, the transit time from China to the U.S. East Coast increased by 0.5 days, rising from 55.1 to 55.6 days.

See the full report and read about our methodology here.

About the Author