Global Logistics Update

President Trump Suggests Potential 155% Tariff on China; Demand Remains Soft on TPEB and FEWB

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: October 23, 2025

Trends to Watch

Talking Tariffs

- U.S.-China Tariff Developments: At an October 21 news conference, President Trump confirmed that tariffs on Chinese goods may rise to 155% on November 1 if the U.S. and China do not reach a trade agreement by then. President Trump initially proposed the 100% tariff increase in an October 10 Truth Social post.

- Under the existing tariff truce, the total combined tariff rate on China is currently 55%: a 10% IEEPA reciprocal tariff, a 20% IEEPA “fentanyl” tariff, and a 25% Section 301 tariff implemented during President Trump’s first term.

- President Trump confirmed that he still intends to meet with President Xi at next week’s Asia-Pacific Economic Cooperation (APEC) Forum in South Korea. At that meeting, “we’ll probably work out a very fair deal with China,” President Trump stated on October 21.

- China’s export controls on rare earth metals—a critical manufacturing component of semiconductor chips, MRI machines, aerospace systems, and more—remain an ongoing point of contention in U.S.-China trade negotiations. On October 9, China announced its latest set of rare earth controls, including a licensing requirement for those exporting or re-exporting rare earth products that originated in China or were produced with Chinese technology. Whether China removes these controls will be a deciding factor in whether President Trump proceeds with implementing the 100% tariff hike, said U.S. Treasury Secretary Scott Bessent last week.

- According to a recent U.S. Trade Representative (USTR) notice, the U.S. will impose a 100% duty on certain Chinese ship-to-shore cranes and cargo handling equipment beginning November 9.

- Check out our live blog for more details.

- Medium- and Heavy-Duty Truck (MHDV) Tariffs to Take Effect on November 1: On October 17, President Trump issued a proclamation that will implement a 25% tariff on MHDVs and MHDV parts beginning November 1. Buses and other vehicles classified under HTSUS heading 8702 will be subject to a 10% tariff.

- United States-Mexico-Canada Agreement (USMCA) treatment: Importers of USMCA-compliant MHDVs may submit documentation detailing the amount of U.S. content in each truck, and pay the 25% tariff only on non-U.S. content. USMCA-compliant MHDV parts will be exempt from the 25% tariff until the Secretary of Commerce and U.S. Customs and Border Control (CBP) establish a process for applying the tariff to MHDVs’ non-U.S. content.

- Exemptions: MHDVs and buses manufactured 25+ years before their date of entry will be exempt from these upcoming tariffs.

- Stacking: Imports subject to MHDV tariffs will not face any other Section 232 tariffs (steel, aluminum, copper, or timber), or any IEEPA tariffs (reciprocal, “fentanyl” on Canada/Mexico, or other levies). This is the case with automobile and auto part tariffs.

- Other Recent Updates:

- On October 19, President Trump indicated he may soon increase tariffs on Colombia. Earlier that day, President Trump wrote on Truth Social that Colombian President Gustavo Petro is “strongly encouraging the massive production of drugs,” and that the U.S. would soon halt all aid to Colombia.

- The USTR has proposed tariffs as high as 100% on Nicaraguan imports, following a Section 301 probe into unfair trade practices. Another measure proposed in the USTR report involves the full or partial suspension of benefits to Nicaragua under the Dominican Republic-Central America-United States Free Trade Agreement (CAFTA-DR), a move that would particularly impact Nicaraguan exports of yarn, fabric, and apparel.

- On October 14, the U.S. implemented port fees on Chinese-built and Chinese-operated vessels. The USTR has indicated that vessels subject to fee modifications, including Liquified Gas Carriers and roll-on/roll-off vessels, may defer fee payments until December 10. China has implemented countermeasures on American vessels calling at Chinese ports, also effective October 14. For details on the USTR’s scheduled fee increases and potential exemptions, check out our blog.

- The U.S. government shutdown has entered its fourth week. CBP continues to operate as normal, but will not issue any refunds during the shutdown. This applies to ACH and check refunds, drawback claim payments, protests, post-summary corrections, and any other payment involving a check from the Treasury Department. Read more on our blog.

Calculate your tariff and landed cost impacts in real time with the Flexport Tariff Simulator.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- Capacity is expected to bounce back to 84-86% for November, up sharply from the 60-70% in October and the capacity reduction implemented during China’s Golden Week holiday.

- Demand remains soft. We have not seen a dramatic surge, and the outlook remains flat.

- Carriers are monitoring tariff impacts, but have not observed any changes to booking profiles.

- Freight Rates:

- The October 15 General Rate Increase (GRI) was successfully implemented and is currently holding.

- The Shanghai Containerized Freight Index (SCFI) has increased 31.9% for the West Coast and 16.4% for the East Coast, which aligns with the October 15 GRI.

- Carriers have already announced another round of GRIs for November 1.

- The Peak Season Surcharge (PSS) was postponed to November.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- As of late October, the FEWB remains under capacity pressure despite carriers’ continued efforts to balance supply. According to Alphaliner, global fleet capacity has expanded nearly 5% year-on-year, while effective demand from Asia to Europe remains soft following China’s Golden Week. Major alliances have implemented blank sailings and service reductions to counter excess space. Overall availability on the FEWB remains sufficient.

- European import demand remains sluggish as high inventory levels and restrained consumer sentiment continue, limiting fresh orders from European consignees. While industrial and project cargo segments provide some stability, overall booking momentum into late October remains lower than seasonal norms. Carriers are expected to maintain strict space control measures to support utilization near the year-end period.

- Equipment:

- 40’ container availability in South China is currently tight, but manageable.

- Freight Rates:

- The Shanghai Containerized Freight Index (SCFI) has shown a consistent downward trend since mid-Q3, easing from its August highs before stabilizing slightly in late October. This development reflects a combination of oversupply and weak post-holiday demand.

- Carriers have reinstated General Rate Increases (GRIs) to prevent further softening. Load factors in the past two weeks have hovered around 80-85%, highlighting lingering pressure despite these rate-supporting measures.

- The market is expected to remain steady in November under carrier capacity management and selective booking control. Most carriers continue focusing on utilization optimization rather than advancing rate competition. Overall, rate movements have stabilized around a relatively narrow band compared to early Q3 levels.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand:

- Antwerp: The maritime pilots’ strike remains suspended until October 24. Yard utilization is at 90%, with berth delays of two to five days.

- Rotterdam: The port lasher strike concluded last week, but ports remain congested. Yard utilization is at 70-83%, with berth delays of two to eight days.

- Hamburg: Yard utilization is at 75%, with berth delays of seven days.

- Bremerhaven: Yard utilization is at 75-85%, with berth delays of one to eight days.

- South Mediterranean (Piraeus, Genoa, Valencia): Significant yard congestion persists, with vessel wait times of two to seven days.

- Equipment:

- Equipment challenges in Europe this month persist, with ongoing container and chassis shortages concentrated in Austria, Slovakia, Hungary, Southern and Eastern Germany, and Portugal. These shortages are contributing to persistent operational challenges.

- Freight Rates:

- As of mid-October, spot rates remain soft, holding around $1,800 to $1,900/FEU. This pricing reflects steady but subdued demand, along with balanced vessel and equipment availability on the route.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- Routes from the Indian subcontinent to the U.S. remain largely similar to previous weeks, with the exception of a slight booking uptick from India leading into the Diwali holiday.

- Capacity to the U.S. East Coast: Supply continues to outstrip demand, resulting in blank sailings throughout the month of October.

- Capacity to the U.S. West Coast: Capacity remains widely available, given oversupply on the TPEB into the U.S. West Coast. Capacity management is increasing as services connecting to the U.S. remain soft across Asia.

- Freight Rates:

- Cargo moving to the U.S. East Coast: Market rate levels continue to hold steady. Carriers continue to enact capacity management strategies, driving more balanced supply.

- Cargo moving to the U.S. West Coast: August’s tariff increases and oversupply on core TPEB lanes continue to keep rate levels low.

Air

- North China:

- The market continues to see strong momentum across key trade lanes. Demand remains elevated on the Trans-Pacific route, particularly from the technology and ecommerce sectors, keeping capacity tight and rates firm.

- Additional lift is entering the market, but has not yet made a meaningful impact on overall conditions. Rate levels are expected to remain steady in the near term.

- The China-Europe market is experiencing continued stability, with patterns similar to recent weeks. Demand is consistent but available capacity remains limited, sustaining the current rate environment. No major changes are anticipated in the short term.

- Overall, market conditions are firm, supported by resilient export activity and tightening space availability. Shippers are encouraged to plan their bookings in advance and maintain scheduling flexibility to help mitigate potential challenges.

- South China:

- The market continues to gain momentum across major trade lanes. Demand to Europe continues to rise and rates remain elevated, driven by strong ecommerce activity and steady general cargo volumes. Similar conditions are expected on routes to the U.S., where both West Coast and East Coast markets are likely to see firm demand and modest rate increases through the week.

- Capacity remains tight and space is filling quickly, with shippers moving goods ahead of seasonal peaks. To help secure space and manage costs, we recommend early bookings and flexible planning, as last-minute shipments may face higher rates due to limited availability.

- Vietnam:

- Demand remains strong, with activity increasing toward the end of the month.

- Both northern and southern gateways are experiencing capacity constraints, particularly on routes to major U.S. destinations. Congestion has been reported on services to key hubs, prompting some rerouting of cargo through alternate ports and additional trucking requirements to reach final delivery points.

- Market conditions at southern origins mirror those in the north, with significant pressure on space for shipments bound for the U.S. West Coast. Tight capacity and ongoing routing adjustments are expected to persist, and early booking remains essential to secure uplift and minimize potential delays.

- South Korea:

- The market remains steady, though the Trans-Pacific lane has seen slight tightening. Overall capacity remains manageable, and rate levels are holding firm without significant fluctuation.

- On the Korea-Europe route, demand remains consistent. However, rates are showing a gradual upward trend as space availability becomes increasingly limited, particularly on services to major European hubs. Market conditions are expected to remain stable in the near term, with moderate rate pressure likely to persist as demand continues to outpace available capacity.

- Malaysia:

- Demand remains strong, particularly on routes to Europe. Shipments into major European hubs continue to drive higher volumes, limiting space and gradually increasing rate levels. These capacity constraints are expected to persist in the coming weeks; early bookings are essential to secure uplift and prevent potential disruptions.

- Shippers are encouraged to plan ahead for Europe-bound shipments to ensure smooth operations, especially around the upcoming public holiday, when local offices will be closed for a short period before resuming normal activity.

- Trans-Pacific capacity and rates remain steady, with sufficient space still available at this time.

- Thailand:

- The market remains steady at present, though activity is expected to increase toward the end of the month. Airlines continue to experience tight capacity at major U.S. hubs, placing some upward pressure on pricing.

- With demand projected to rise, rates may edge higher in the near term. Shippers are encouraged to plan ahead and confirm bookings early to secure space and maintain schedule reliability.

- India:

- Demand remains steady, though we are observing slight rate increases as the month progresses.

- Capacity on the Trans-Pacific route is beginning to tighten, while space on the Europe lane remains open and stable. Current conditions suggest that capacity may grow more constrained toward the end of October; shippers are encouraged to book proactively to secure space and manage costs.

- Given the Diwali holiday earlier this week, local operations and carrier responses may slow for a few days. Normal activity is expected to resume once the holiday period concludes.

- Bangladesh:

- Operations have largely returned to normal following temporary disruptions caused by a recent fire at the main airport’s cargo terminal. Flights are now operating with only minor delays, and overall space availability remains relatively stable with minimal scheduling impacts.

- Market rates are holding steady, and capacity is manageable across key trade lanes.

(Source: Flexport)

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, November 13 @ 9:00am PT / 12:00pm ET

Flexport Fall Technology Release Live Broadcast

Available On-Demand

Tariff Trends 2025: Expert Insights on the New U.S. Customs Landscape

Available On-Demand

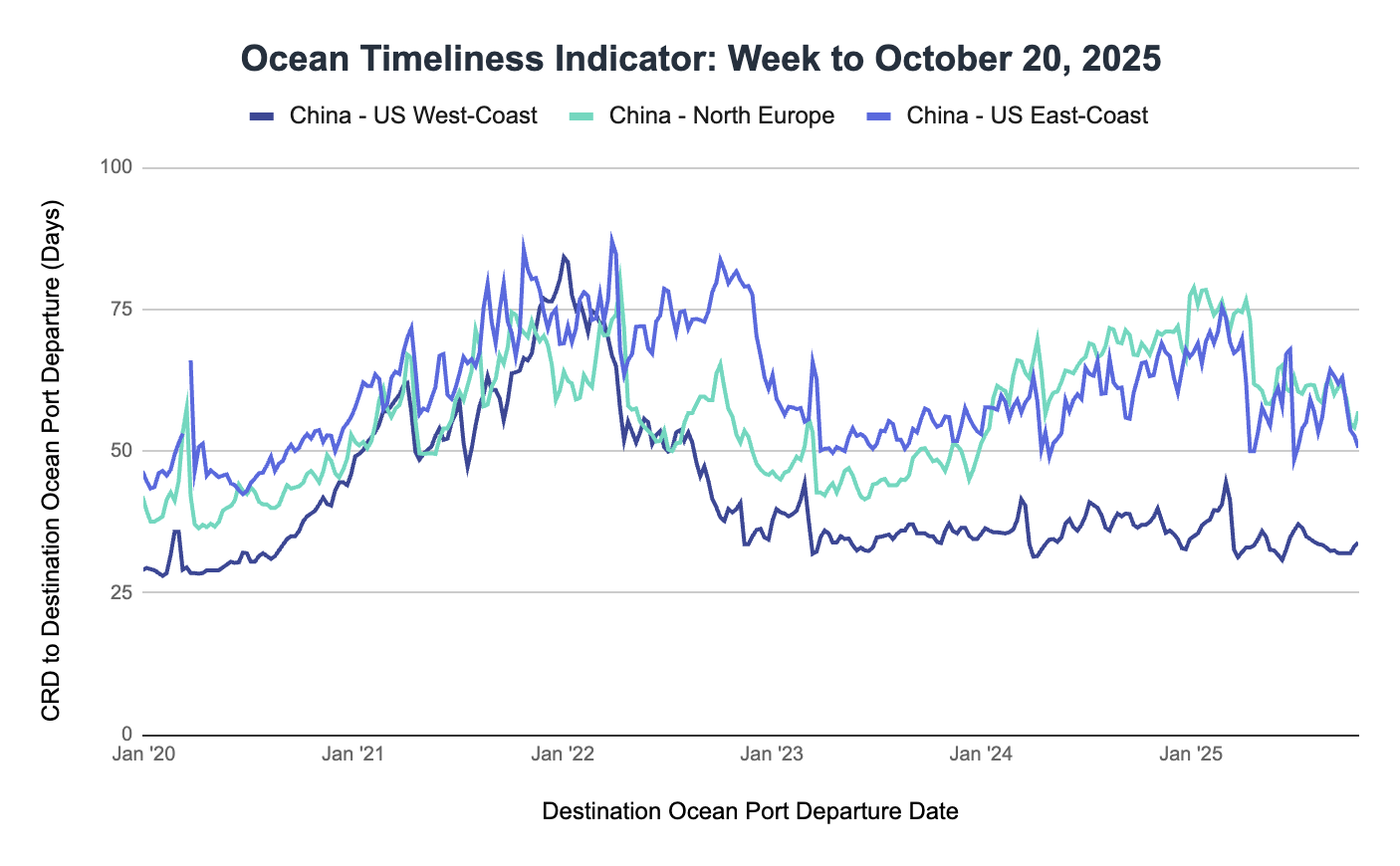

Ocean Timeliness Indicator

Transit time remained near-constant from China to the U.S. West Coast, decreased from China to the U.S. East Coast, and increased from China to North Europe.

Week to October 20, 2025

Transit time from China to the U.S. West Coast remained near-constant again, rising from 33.2 to 33.9 days. Transit time from China to the U.S. East Coast saw a decrease, dropping from 52.7 to 50.6 days. Meanwhile, transit time from China to North Europe increased from 54.2 to 57 days.

See the full report and read about our methodology here.

About the Author

Related content

![White House GettyImages-603224136 (1)]()

Blog

Live Updates: Trump Administration Tariffs, Trade Policy Changes, and Impacts on Global Supply Chains

![GettyImages-1411182583 1199x800]()

Blog

CBP’s Latest Guidance on Reporting Country of Smelt and Cast for Section 232 Aluminum Tariffs

更多

![WarehouseGettyImages-535667233]()

Global Logistics Update

U.S. and Taiwan Finalize Trade Deal; FEWB Spot Rates Soften Amid Lunar New Year Lull

![Ocean Port GettyImages-1083936322 (1)]()

Global Logistics Update

EU to Vote on Modified U.S. Trade Deal; Ex-Asia Demand Tapers Off Ahead of Lunar New Year

![Air GettyImages-1343405900]()

Global Logistics Update

U.S. to Cut Tariffs on India; TPEB and FEWB Carriers Plan Upcoming Blank Sailings