Global Logistics Update

Freight Market Update: November 7, 2018

Ocean, trucking, and air freight rates and trends for the week of November 7, 2018.

Freight Market Update: November 7, 2018

Want to receive our weekly Market Update via email? Subscribe here!

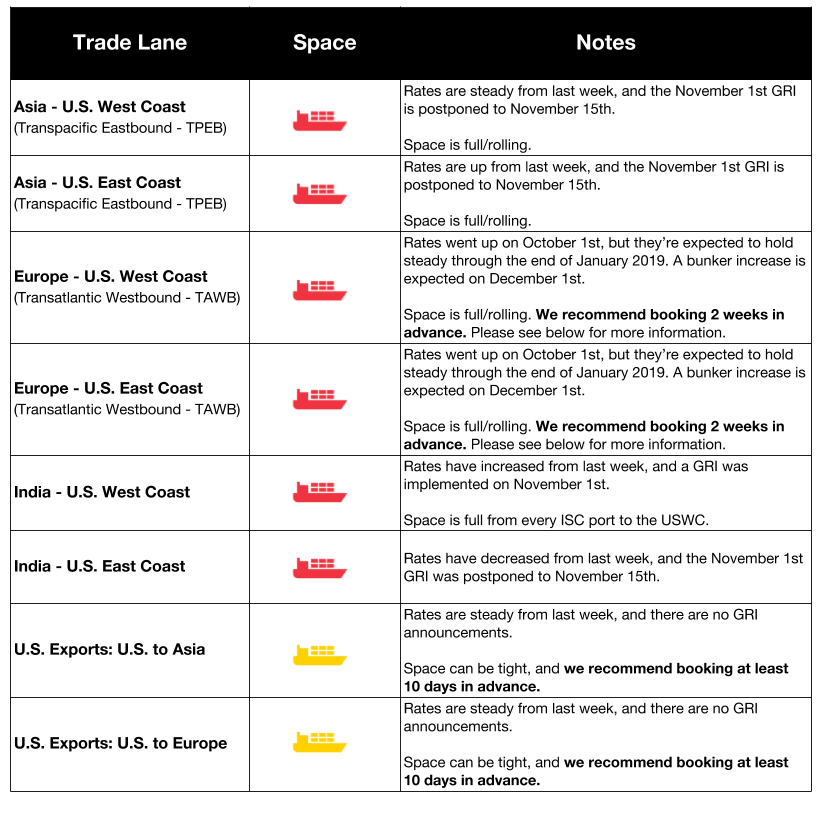

Ocean Freight Market Updates

Transatlantic Westbound Lane Experiencing Tight Capacity

UK ports are very congested, which is causing a decline in port productivity and tight trucking capacity. Trucking currently needs to be booked 15 days in advance.

LA-LB PierPass Flat Fee to Begin November 19th

On Monday, the West Coast Marine Terminal Operators Agreement (WCMTOA) announced that it would implement the PierPass 2.0 extended gates program in Los Angeles-Long Beach on November 19th. This will pass if the Federal Maritime Commission (FMC) doesn’t block the revised extended-gates program.

Excess Vessel Supply May Cause Blank Sailings (All Lanes)

Slow growth, additional container tonnage, and low vessel scrapping have created market overcapacity, so carriers may continue implementing blank sailings to avoid dropping rates. Note that the transpacific eastbound lane is maintaining some healthy growth in the rush to import in advance of 2019 tariffs.

Blank Sailings Ahead for Asia-Europe Lane

Carriers have not been able to raise freight rates on this lane despite already implementing several blank sailings. More blank sailings are anticipated as a result of these low rates and higher bunker costs than in previous years. 2M Alliance’s AE2/Swan Asia-North Europe loop will be reintroduced in December.

Maersk Launches Instant Booking Confirmation

Maersk contributes to the modernization of trade with the launch of their instant booking confirmation. The new system will provide visibility into sailings and available space, and reduce waiting times for the party booking the shipment.

Lowering Water Levels in the Rhine Discontinue Barge Service

Shipments moving via the Rhine have been largely discontinued due to the lowered water levels following a drought. Hapag-Lloyd has implemented low-water surcharges in an attempt to pass on the resulting costs.

China Port Group Proposes Consolidation Platform

The Port Group China Merchants has proposed to create the Qianhai Multi-Country Consolidation Platform (MCC Qianhai) to provide deconsolidation and transhipment services for imports. MCC Qianhai would compete with Singapore and Hong Kong’s free ports in an effort to keep up with China’s rising import volume.

Eastbound trans-Pacific Spot Rates Expected to Remain High

As shippers prepare for the impending 25% tariffs scheduled to take effect on January 1st, and the holiday season rush continues, vessel space is expected to remain tight. While peak-season for holiday shipping typically ends in November, spot rates are also expected to remain high through the end of the year.

CMA CGM to Raise Emergency Bunker Surcharge

Despite recent controversy surrounding the implementation of Emergency Bunker Surcharges (EBS), CMA CGM Group will raise their EBS to $100 per TEU beginning on December 1st. Other carriers are also preparing to implement a surcharge to compensate for the new low-sulfur fuel regulations in 2020.

Impact of New IMO ECA Regulations

The International Maritime Organization has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions to 0.5% from 3.5%.

Whether they upgrade their vessels or their fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

The practice of slow-steaming, reducing vessel speed to conserve fuel, may become mandatory to achieve the IMO’s long-term emissions reduction goals. Enforced speed limits would reduce capacity as transit times are increased.

Beginning on March 1, 2020, IMO is banning vessels from carrying high-sulfur fuel (fuel with a sulfur content higher than 0.5%) unless the vessel has a scrubber to clean the fuel.

U.K. Warehousing Shortage in Advance of Brexit

Similar to how U.S. import volume is up in anticipation of 2019 tariffs, U.K. warehouses are seeing a surge in demand in anticipation of continuing Brexit negotiations. With the short-term and long-term effects to trade practices still unknown, buyers are importing goods and storing them in the U.K. to avoid potential delays later.

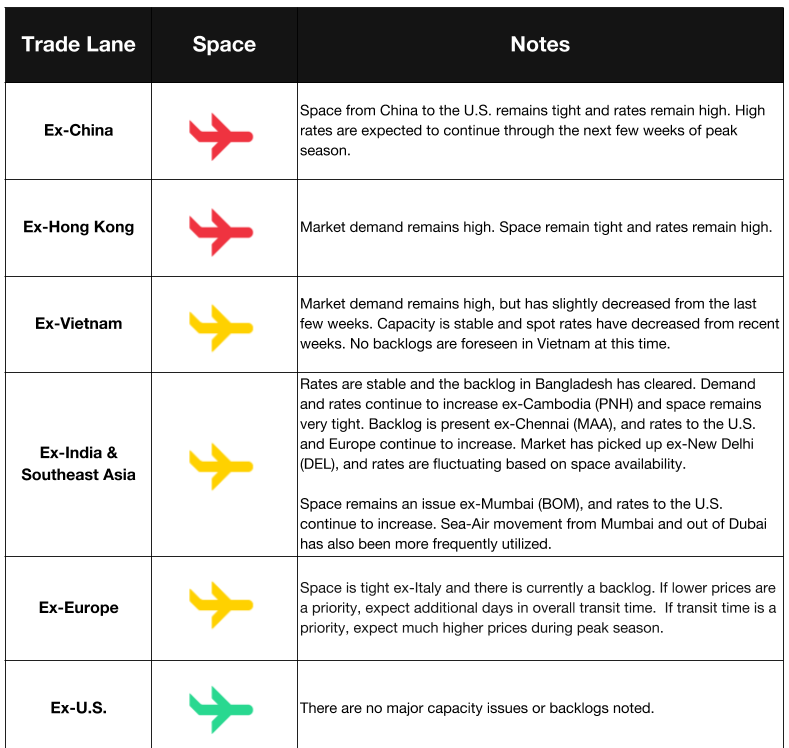

Air Freight Market Updates

Air Freight Prices Rise, Growth Slows

Global prices have risen 8.5% since September 2017, and airlines are continuing to generate revenue despite increasing fuel costs. The China to U.S. trade lane experienced some decline in growth this past September, which may be an initial effect of the trade war.

Ecommerce May Have Been Anomaly in Air Volume Commentary

FreightWaves reports that air freight growth may not have been as slow as previously reported. The ecommerce boom of 2016 may have skewed historical results, and moving forward we can expect manufacturing, not ecommerce, to boost growth.

E-air Waybills to Become Standard in 2019

International Air Transport Association (IATA) will consider electronic air waybills (eAWBs) standard and paper AWBs optional beginning on January 1st, 2019. IATA originally enabled e-air waybills in 2010 and has not seen significant implementation, but is hoping to see full adoption with this move.

Trucking Market Updates

U.K. Trucking Faces Number of Critical Issues

The Road Haulage Association (RHA) warns that ignoring the current trucking problems will lead to disaster for the market in the future. A shortage of truck drivers, high costs to train new and younger drivers, and constricting regulatory practices are stifling the U.K. trucking market and will lead to a “catastrophic cocktail of disaster” if not addressed.

Interstate 269 Completed, Shortening Transit Times

The 60-mile half-loop connects Hernando, Mississippi to Millington, Tennessee and allows truckers to bypass Memphis congestion. The Interstate, part of the larger Interstate 69 corridor project connecting Canada and Mexico, is projected to lower eastbound transit times and bring economic development to the communities along I-269.

FedEx to Raise Prices in 2019

FedEx will raise freight rates and increase accessorial fees in 2019. These prices increases are consistent with year-to-year increases, and will not apply to shipments moving under contract with FedEx. FedEx cited higher transportation costs and tight capacity as the cause of higher rates.

Severe Weather for Truckers

Winter weather and storms are expected to slicken roads in the Midwest and Mountain Prairie area, and thunderstorms in the South are expected to slow down freight movement.