海关

尊享 更好的清关体验 (1)

即便您不通过Flexport 飞协博发货,您也可以与我们的报关代理合作,将流程化繁为简,节约成本。我们的科技平台可以最大化地利用海关数据为您的其他业务提供分析价值。

Sign Up With Flexport

Introducing the Customs Technology Suite

A suite of products and tech to help forecast landed costs, surface real-time insights, improve product classification, provide duty minimization and avoidance, and enhance entry-filing compliance.

We give our customs brokers Iron Man suits

We're more than a tech compnany. Flexport’s team of licensed customs brokers work in our ground breaking AI-native customs tech platform to oversee all documentation, product classification, and regulatory filings. With AI-powered guardrails to correct mistakes and workflow technology to automate routine data entry, document ingestion and transmission of data to and from government agencies, we operate at levels of both quality and efficiency unmatched in the industry.

By staying ahead of changing trade regulations, our experts prevent costly delays and penalties before they happen. We deliver accurate submissions, identify duty savings, maintain audit-ready records, and resolve customs disputes, protecting your business and keeping your global supply chain running smoothly.

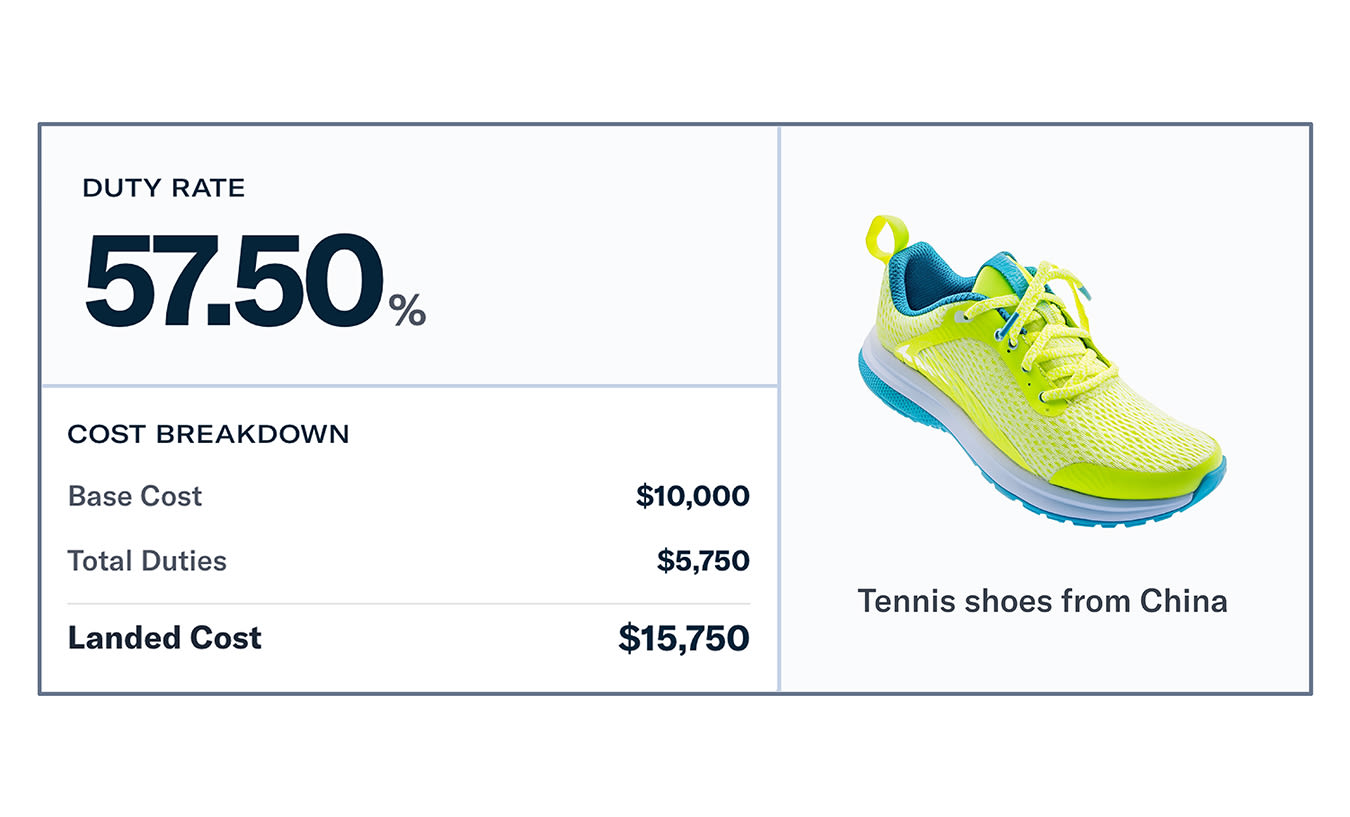

Calculate tariffs with confidence

The Flexport Tariff Simulator Pro gives importers real-time data, insights, and transparency to make smarter, faster decisions in a complex global trade environment. With features like bulk uploads, smart notifications for tariff changes, and landed-cost calculations, users can instantly compute duties, identify special rates, and stay ahead of shifting trade policies.

Join Thousands of Leading Brands On Flexport

Flexport 飞协博平台

报关代理引领,数据驱动,为洞见而生

Flexport 飞协博平台。在这里,您的报关代理加速清关发货,结合库存、提单及其他单据中的数据,提供到岸成本、历史比价及其他关键业务报告。

到岸成本,更易管理 (1)

计算 SKU 的到岸成本。 Flexport 飞协博平台提供进口报关数据、关税和其他物流支出分析功能,供您快速获取准确的答案

主动异常管理 (1)

显而易见,异常情况应提前预警,及时管控。携手 Flexport 飞协博报关代理,即可更快察知异常,内置升级方案能更大限度地减少附加成本和报关延误。

不只做报关代理 (1)

我们的报关代理不只是传递数据。他们善于总结模式,帮您改进进口策略,有力避税和更大程度减少关税,发现其他人错失的战略良机。

AI customs auditor for 10x better compliance

As a licensed customs broker we maintain responsible supervision and control through regular compliance audits. In 2025 we introduced the customs industry's first AI auditor which audits 100% of entries before we transmit them to the U.S. government. In our first quarter of operations, the AI auditor reduced the error rate detected in our manual compliance audits by experts to just 0.2%, a level we believe to be more than 10 times lower than any competitor.

Optimize your import strategy

Access ingested and completed entries and historical data through customizable reporting and analytics. Proactively focus on duty minimization and avoidance opportunities for your business and always be ready for governmental and regulatory changes with industry experts guiding you through any landscape.

Quick search at your fingertips

Search Everything. Stop at Nothing. Search for what you want—SKU, HS code, PO, style, or customs entry number—in any customs document. Then find it and related items all in one place. No more time lost bouncing between systems.

The most advanced product database, tailor-made for trade compliance teams

Our product library provides importers and exporters with a secure, cloud-based database tailor-made to capture every data element and compliance document required by any government agency in the world. By partnering with your trade compliance team to capture all relevant data elements and then keeping it constantly up to date and in the real-time flow of your customs entries as they're being processed, we turn this product library into a shared source of truth to power more accurate, timely and compliant customs clearances. We will meet you where you are, and then get you to where you need to be with a team of technologists who can cleanse messy data, create two-way syncs to ERP systems, and turn the parts database from a burden for your team into a strategic asset for your business.

Landed costs now within reach

Know exactly how much it costs to get a SKU into inventory. That’s a clear business advantage. Flexport makes calculating landed costs not only possible, but easy.

When it comes to tariffs and trade, 2025 has already proven to be a year of significant change and complexity. This guide dives into relevant importer strategies, tools, and technicalities—including ways to mitigate tariff impacts, reduce compliance risks, and recover costs where possible.

How Flexport customs brokerage works

Step 1

Pre-Clearance Preparation

- Flexport receives your shipment details and commercial documentation

- Brokers review paperwork for completeness and accuracy

- System flags any missing information or potential compliance issues

- You're prompted through the platform to provide any additional required documents

Step 2

Product Classification & Valuation

- Our latest automation and AI technology classify products with correct HTS codes

- Calculate duties, taxes, and fees based on accurate valuations

- Identify applicable duty savings (free trade agreements, exemptions, etc.)

- Determine which government agencies require clearance (FDA, USDA, etc.)

Step 3

Entry Filing

- Brokers electronically file entry documents with customs authorities

- Submit all required permits, licenses, and certifications

- Arrange customs bonds if needed

- Provide real-time filing status updates in your dashboard

Step 4

Customs Review & Clearance

- Customs authorities review the entry

- Flexport monitors for any holds, exams, or additional requests

- Brokers respond immediately to customs inquiries

- Handle payment of duties and fees on your behalf

Step 5

Release & Delivery

- Once cleared, goods are released from customs custody

- Flexport coordinates with freight partners for final delivery

- You receive notification of clearance and estimated delivery time

- All documentation is stored digitally for audit purposes

Step 6

Post-Clearance Support

- Brokers available for any follow-up questions or audits

- Reconciliation of duty payments

- Advisory on process improvements for future shipments

- Ongoing compliance monitoring

How do you avoid customs import delays or penalties?

Problem:

Incomplete or incorrect documentation

Challenge:

Missing or inaccurate paperwork is one of the most common causes of customs clearance delays.

Solution:

Flexport's brokers review and verify all documentation before submission, ensuring completeness, accuracy, and 100% compliance to prevent holds and rejections.

Problem:

Incorrect tariff classification

Challenge:

Misclassifying products can trigger duty re-assessments or penalties.

Solution:

Our internal technology can review 100% of entries and HTS codes where other brokers review on average 5-10%, and by ensuring full audits are done before submission even occurs, we significantly reduce the risk of fines, shipment delays, and late clearances.

Problem:

Compliance changes

Challenge:

Regulations change frequently, and noncompliance risks fines or confiscated goods.

Solution:

Flexport brokers stay current with evolving trade regulations across all agencies (CBP, FDA, USDA, etc.) and proactively alert you to compliance requirements, keeping your shipments moving and your business protected.

Compliance Programs

Assessments & Data Analysis, Responding to CBP inquiries, Training, Prior Disclosures

Tariff Classification

Tariff Engineering, Binding Ruling requests, Complex Classification Projects

Customs Valuation

First Sale, Bona Fide buying agents, Transfer Pricing, Reconciliation

Duty Drawback

Unused Merchandise, Manufacturing, Rejected, Petroleum, and USMCA Same Condition

ACE Analysis

Classification Trends and inconsistencies, Potential compliance concerns, Cost saving opportunities

Duty Refund/Savings

Post Summary corrections, Protests, Free Trade Agreements

Country of Origin Analysis

Substantial Transformation, Origin Engineering

Trade Remedy

Section 301, 232, 201, including exclusions; Antidumping and Countervailing duty support

Working with Flexport has been an excellent experience. They manage our global brokerage processing and implemented drawback services that delivered returns that were significantly higher than our prior approach, and also significantly outperforming their competitors. Their technology and expertise, including ACE analysis, have uncovered additional insights and savings that continue to drive supply chain optimization.

Arjun Lal

Chief Financial Officer, Life Fitness