海关

尊享 更好的清关体验 (1)

即便您不通过Flexport 飞协博发货,您也可以与我们的报关代理合作,将流程化繁为简,节约成本。我们的科技平台可以最大化地利用海关数据为您的其他业务提供分析价值。

Sign Up With Flexport

What is a customs broker?

Flexport’s licensed customs brokers handle all documentation, product classification, and regulatory filings to ensure fast, compliant customs clearance. By staying ahead of changing trade regulations, our experts prevent costly delays and penalties before they happen. We deliver accurate submissions, identify duty savings, maintain audit-ready records, and resolve customs disputes, protecting your business and keeping your global supply chain running smoothly.

Introducing the Customs Technology Suite

A suite of products and tech to help forecast landed costs, surface real-time insights, improve product classification, provide duty minimization and avoidance, and enhance entry-filing compliance.

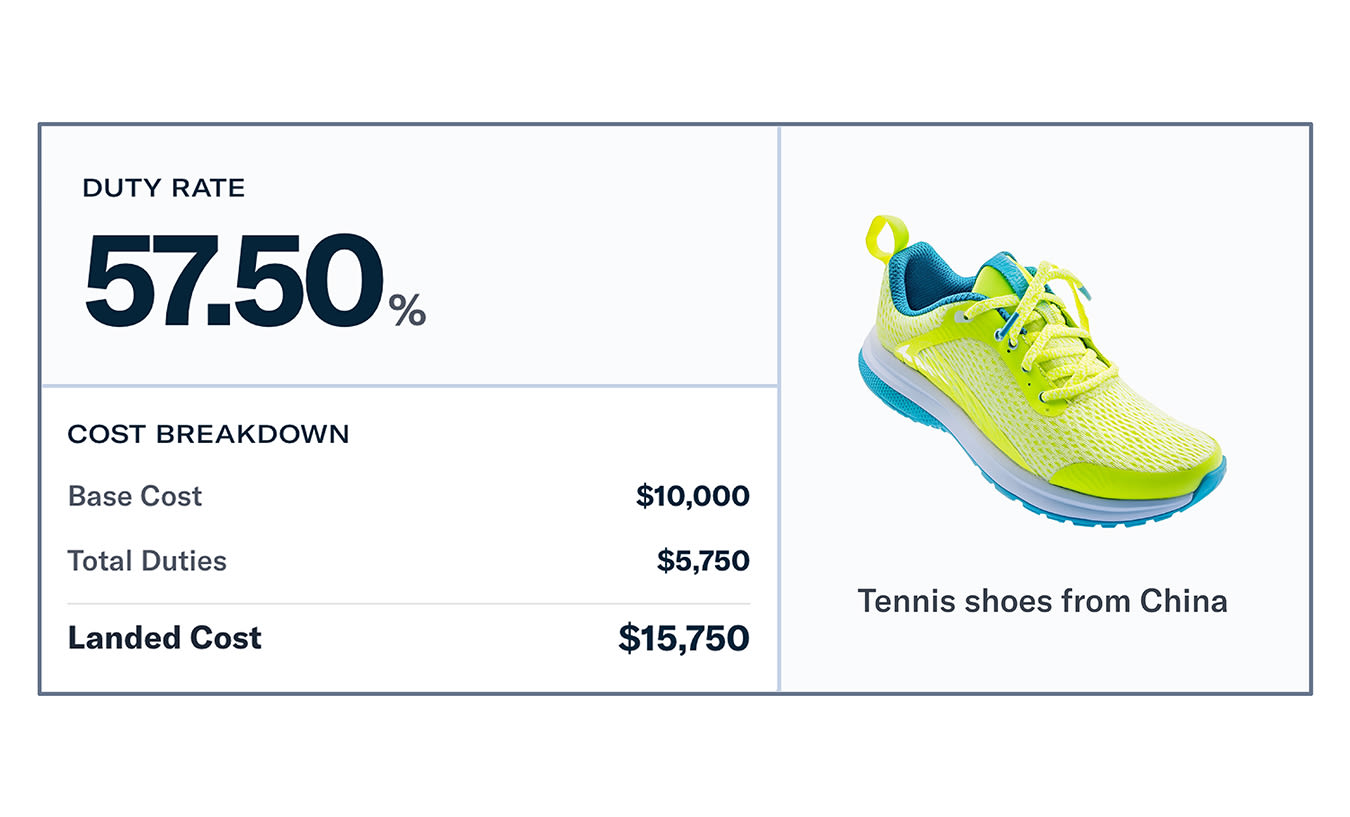

Calculate tariffs with confidence

The Flexport Tariff Simulator Pro gives importers real-time data, insights, and transparency to make smarter, faster decisions in a complex global trade environment. With features like bulk uploads, smart notifications for tariff changes, and landed-cost calculations, users can instantly compute duties, identify special rates, and stay ahead of shifting trade policies.

Join Thousands of Leading Brands On Flexport

Flexport 飞协博平台

报关代理引领,数据驱动,为洞见而生

Flexport 飞协博平台。在这里,您的报关代理加速清关发货,结合库存、提单及其他单据中的数据,提供到岸成本、历史比价及其他关键业务报告。

Improve speed and accuracy with tech-enabled customs

Drive timeliness and high accuracy filing rates with forwarder agnostic capabilities (4PL) for any cargo shipment, HS code classification and duty optimization services.

Optimize your import strategy

Access ingested and completed entries and historical data through customizable reporting and analytics. Proactively focus on duty minimization and avoidance opportunities for your business and always be ready for governmental and regulatory changes with industry experts guiding you through any landscape.

Quick search at your fingertips

Search Everything. Stop at Nothing. Search for what you want—SKU, HS code, PO, style, or customs entry number—in any customs document. Then find it and related items all in one place. No more time lost bouncing between systems.

Robust product library

Capture product data to speed imports. Simplify customs clearances through dynamic data associated with your products or SKUs. The secure Product Library is your central source of truth, enabling you and your customs broker to tackle exceptions immediately and identify saving opportunities through duty minimization and avoidance.

Landed costs now within reach

Know exactly how much it costs to get a SKU into inventory. That’s a clear business advantage. Flexport makes calculating landed costs not only possible, but easy.

When it comes to tariffs and trade, 2025 has already proven to be a year of significant change and complexity. This guide dives into relevant importer strategies, tools, and technicalities—including ways to mitigate tariff impacts, reduce compliance risks, and recover costs where possible.

How Flexport customs brokerage works

Step 1

Step 2

Step 3

Step 4

Step 5

Step 6

How do you avoid customs import delays or penalties?

Problem:

Problem:

Problem:

Working with Flexport has been an excellent experience. They manage our global brokerage processing and implemented drawback services that delivered returns that were significantly higher than our prior approach, and also significantly outperforming their competitors. Their technology and expertise, including ACE analysis, have uncovered additional insights and savings that continue to drive supply chain optimization.

Arjun Lal

Chief Financial Officer, Life Fitness