2020 年 03 �月 03 日

Coronavirus and the China Supply Chain through the Lens of Data

Coronavirus and the China Supply Chain through the Lens of Data

The Covid-19 outbreak continues to sweep across the globe even as supply chains are trying to restart following the Chinese New Year (CNY) lull. The World Health Organization (WHO) has declared that the world is now in ‘uncharted territory,’ pushing supply chains further into uncertain waters. The key question everyone is watching for: Will the revival come fast enough to head off financial distress? To answer that question, Flexport looks at market developments, as well as its own data.

In a fairly downbeat reading on U.S. manufacturing, the Institute for Supply Management noted concerns around reliable Asian supply. The official Chinese gauge of manufacturing activity hit a record low in February. Yet it has been difficult to get a clear read on developments across China. Key regions, such as Hubei and its capital Wuhan, have remained under quarantine. Some factories are reopening, but staffing capacity has remained unclear.

Adding to the difficulty of reading direct year-over-year measures of activity is the fact that CNY traditionally has such a large impact on production; numbers can swing wildly between January and February. So while a comparison of October 2018 to 2019 might be fair, a comparison of February 2018 to 2019 could be misleading. This has led to efforts to compare CNY periods across years. Meanwhile, uncertainty about how factories are doing has led observers to look at correlates of factory output—including road congestion, coal consumption, and daily property sales—to gain a clearer understanding of the numbers.

A Different Perspective

Flexport’s data offers a more direct perspective on the resumption of supply chain activity. On the plus side, freight bookings have bounced significantly up from their CNY low—by almost 5X. But it’s important to qualify that reading, because bookings typically rebound post-CNY. A second potential cause of the bounce: Bookings could be made for later dates, so the bounce need not mean impending factory restarts. As a result, bookings data leave us with only a fuzzy read on how quickly Chinese supply chains are coming back on line. But digging deeper into the data is more revealing.

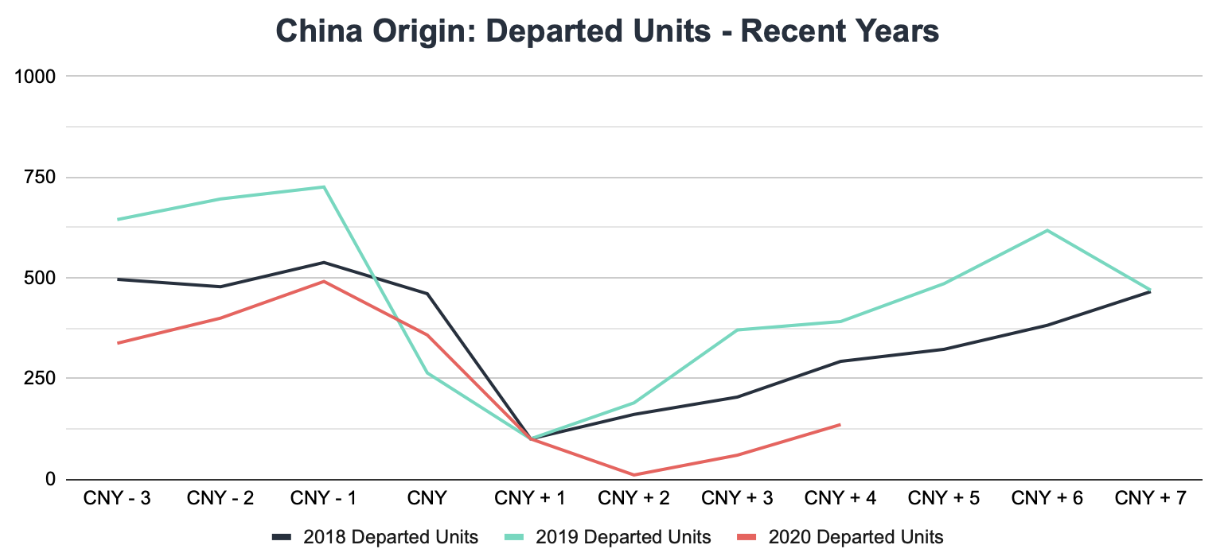

The chart above compares Flexport records of units shipped from China across holiday seasons, 2018-2020 based on both air and ocean freight and going to all destinations. This methodology normalizes the data in two ways: 1) It centers it around CNY each year (February 16, 2018, February 5, 2019 and January 25, 2020), counting weeks before and after CNY; and 2) It then sets volume = 100 for the week after CNY, when shipped units had generally hit their minimum.

In 2020, the volume of shipped units continued to fall in the second week after CNY. Rather than beginning a rebound, units fell an additional 90% from the week after CNY. In the two weeks after that—leading up to February 25—volumes recovered, but in limited fashion. Now, four weeks past CNY, 2020 shipped units are up only about 35% over the reference week—a far cry from 195% for the equivalent week in 2018 and 290% for 2019.

As Chinese supply chains sluggishly resume and more units are put on ships or planes, the stakes grow higher for a full recovery. And as more cases of COVID-19 crop up with other economic powerhouses such as South Korea, Italy and Japan, there will be new challenges to supply chains.

Flexport will continue to provide updates on the impact of Coronavirus on the supply chain as we see more data emerge.

Tune into our upcoming webinar, The State of Trade: Tactics and Strategies for Tackling Trade Turmoil for more insights.