Global Logistics Update

Market Update: December 6, 2017

Ocean and air freight rates and trends for the week of December 6, 2017.

Market Update: December 6, 2017

Want to receive our weekly Market Update via email? Subscribe here!

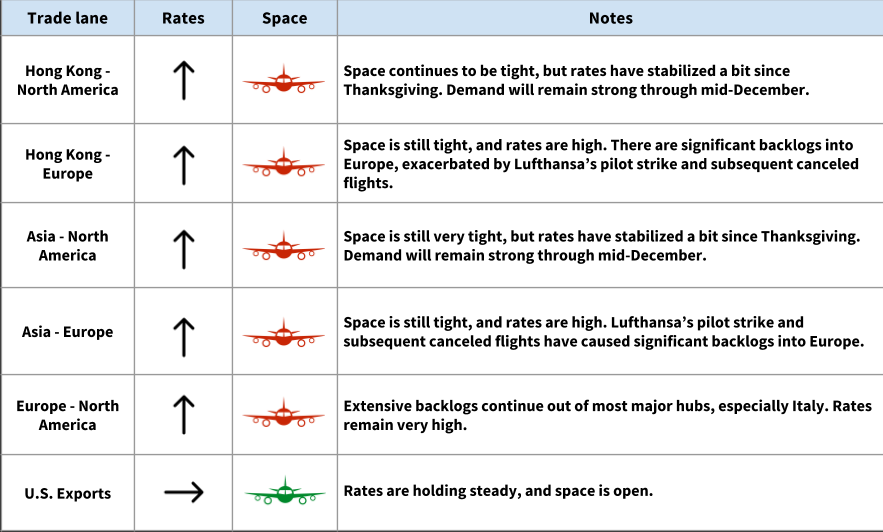

Air Freight Market Updates

High rates and strong demand will continue through December

All season, rates have stayed sky-high, and demand has been “crazy.” Rates have stabilized a bit since Thanksgiving, but capacity is still very tight.

E-commerce and general economic growth have continued to drive demand, and we expect this to last through mid-December (prior to Christmas).

Air carriers are congratulating themselves on an incredible year, which the JOC is calling the industry’s “strongest operational and financial performance since the post-global financial crisis rebound in 2010.”

Massive delays continue at FRA

The situation at FRA (Frankfurt Airport) continues -- waiting times are still very long due to personnel and traffic control issues, and the backlog remains significant. If your cargo is moving through FRA, you should expect delays and trucking wait fees.

This is likely to continue through the rest of 2017.

Congestion at JFK, LAX, ATL, and ORD

Truckers are reporting long wait times at JFK, LAX, ATL, and ORD with delays of hours or even days (which can quickly result in storage fees). If you have cargo routing through any of these airports, expect delays and possibly extra fees.

Severe congestion will continue at all four airports through the holidays.

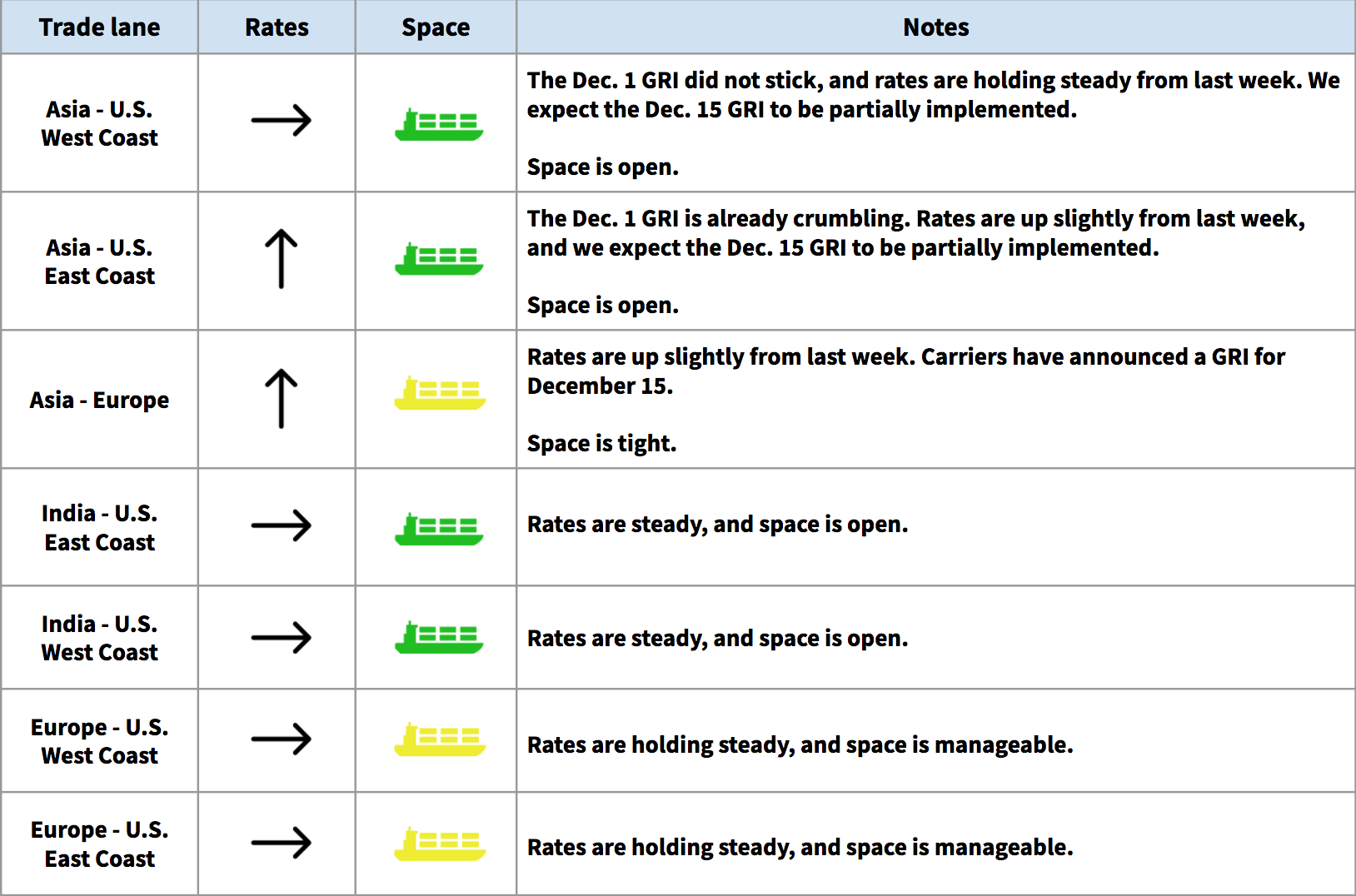

Ocean Freight Market Updates

The December 1 GRI is not holding

Carriers announced a December 1 GRI of $700/40’, but it has already fallen apart for the USWC. A small amount ($100 or so per FEU) has stuck for USEC.

December 15 and January 1 GRI announcements

Carriers have announced a December 15 GRI at $700/40’, and a January 1 GRI at $1000/40’. We expect the Dec. 15 GRI to be partially implemented.

Blank sailings will constrain capacity in December

As is typical for this time of year, carriers are planning blank sailings on many lanes. This will mean an 8% in capacity from Asia <> USEC during the last week of December, and a 2% reduction for Asia <> USWC.

Severe rail congestion in Chicago

We’re seeing huge backlogs of trains in Chicago, with containers that can’t discharge and not enough chassis. This is a common seasonal issue in Chicago, because it’s so centrally located and so many trains route through there. The backlog should clear up by late December.

U.S. Trucking Updates

The ELD mandate takes effect December 18

At this point, there’s a lot of uncertainty about the impact of the ELD mandate. Beginning on December 18, U.S. truckers will be required to use electronic tracking devices to record their driving hours, which will mean strict enforcement of federal hours-of-service rules.

We do know that this will impact deliveries of above 600 or so miles; what a driver could once turn in a day will now require 2 days, which will impact price and overall capacity within the market. Capacity will be further limited by the fact that some small carriers who have not purchased the tracking devices will go out of business.

“That disruption in truck utilization could remove 2 to 5 percent of available capacity, according to most sources,” writes the JOC, “though others believe the impact will be greater.”

We also expect less patience with long wait times, because each eligible driving hour will be more valuable than ever.

The drayage impact will be different, but we’ll see it with congested ports: If a trucker has to wait a long time to get into the terminal, that means they might turn their truck 3 times in a day instead of 4. Their overall pricing will be higher to compensate for fewer pickups.

Similar to the impact of LTL deliveries, longer-distance drays may also become more expensive.

**Rates will stay up through Christmas **

In advance of the big holiday crunch, carriers are repositioning assets to major markets, seeking to make as many pre-Christmas moves as possible. This will drive up rates in a time of already-tight demand.

Once we’re through the holidays, we expect January rates to trend downward.

Even higher rates in California

Over the past few months, we’ve seen a sharp rise in trucking rates out of California (especially Los Angeles).

There’s a combination of factors at play, especially: fuel cost increases, higher demand for trucking to Texas and Florida due to hurricane relief, and the general holiday surge. The market will likely only become tougher once the ELD mandate takes effect.

Rates will go down after Christmas, but due to the ELD mandate and fuel tax increase, rates out of California will remain higher than in previous years.