Global Logistics Update

Some Aluminum Imports Soon to Face 200% Tariff; FEWB Demand and Rates Continue to Rise

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: June 26, 2025

Trends to Watch

Talking Tariffs

- Aluminum with Unknown Country of Smelt Set to Face 200% Tariff: Effective June 28, 2025, derivative aluminum imports with an unknown or indeterminable country of smelt and cast will be subject to a 200% Section 232 tariff—the same duty assessed on Russian-origin aluminum imports.

- Announced by U.S. Customs and Border Protection (CBP) on June 13, this update will restore a CBP policy from March of 2025. Per the March 2025 policy, importers shipping aluminum with an unknown country of smelt and cast were to report Russia—and pay the resulting 200% duty—and later correct their entry via a post summary correction when they could prove that Russia was not the country of smelt and cast. CBP walked back this policy a few days after instituting it.

- CBP’s upcoming update, which will restore that policy, will require importers to report “unknown” as the country of smelt and cast and pay a 200% duty.

- Check out our blog for Flexport’s guidance on CBP’s update.

- Section 232 Duties on Expanded List of Derivative Steel Products Takes Effect: As of June 23, 2025, a number of steel consumer appliances—including washing machines, refrigerators, and dishwashers—are now subject to Section 232 duties on steel.

- The expanded list of items is now subject to the 50% duty rate, which applies to the value of steel content in each product.

- Steel and aluminum from the U.K. remains exempt from the 50% duty rate, and is currently subject to a 25% tariff instead.

- The Latest on Reciprocal Tariffs:

- The 90-day country-specific reciprocal tariff pause expires on July 9, 2025—less than two weeks from now. While Treasury Secretary Scott Bessent stated earlier this month that a reciprocal tariff pause extension was “highly likely,” the Trump administration has not commented on the matter since.

- President Trump’s proposed 50% tariff on the EU remains postponed until July 9, 2025; negotiations are still in progress.

- Chinese-origin goods with a time of entry on or after May 14, 2025, will continue to face a 10% reciprocal tariff until August 11, 2025. Afterwards, if President Trump and President Xi approve and implement the U.S.-China trade deal announced on June 11, the reciprocal tariff rate on Chinese goods will remain at 10% (total effective tariff rate of 55%). If the deal is not approved by then, the reciprocal duty rate on Chinese-origin goods will revert back to 34%—at least until the deal is implemented.

- Any HTS in Annex II is exempt from reciprocal tariffs, regardless of the country of origin. As of April 16, 2025, semiconductor products are also excluded from reciprocal tariffs.

Get the latest updates and guidance on U.S. tariffs and trade on our live blog.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- Due to high demand and the rush to move volume in May and June, we are seeing a softening in bookings for traditional peak season in July and August, versus last year. On the whole, demand has not significantly declined, but the volume has been brought forward to get ahead of the tariff deadline.

- Even with the general slowdown in July bookings, overall demand is mixed based on specific shipper strategies and cargo types.

- Capacity is starting to get withdrawn for July, but not yet enough to impact the potential overcapacity situation. This week (Week 26), offered capacity on the TPEB is 4% below standard levels—a slight drop from last week (Week 25), when offered capacity exceeded standard levels by 4%.

- Following a continuous decline over the last several weeks, blank sailings on the TPEB appear to have settled at a consistent level.

- Equipment: Equipment remains sufficient across most TPEB origins, with no immediate shortages overall.

- Freight Rates:

- West Coast floating rates continue to get mitigated, and are approaching fixed levels.

- East Coast and Gulf floating rates have been mitigated quickly, and are close to fixed levels.

- For both the East Coast and West Coast, the Peak Season Surcharge (PSS) for June 15 is also being mitigated as floating market rates drop. The East Coast PSS remains higher than the West Coast PSS.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- Early July blank sailings, particularly on the Premier Alliance service, are reducing overall capacity and increasing the rate of rolled (delayed) shipments.

- Congestion at destination ports may cause further delays for ships returning in mid-July, potentially resulting in more blank sailings or port omissions.

- As the peak season intensifies, both demand and spot rates are expected to reach their highest levels by the end of July.

- Freight Rates:

- Carriers are announcing their July rates, which show significant variation. The highest GRI, from Maersk, is $4,300 per FEU. These July rates are widely anticipated to mark the peak of the spot market this year.

- The upward trend in rates has resulted from persistent space tightness and equipment shortages.

- Geopolitical Tensions:

- Middle East shipping routes continue to be impacted by a short-term risk premium due to ongoing geopolitical tensions between Iran and Israel. However, since most FEWB carriers are currently routing their services via the Cape of Good Hope (COGH), the overall impact on FEWB container shipping remains limited.

- Rising crude oil prices may prompt carriers to raise fuel surcharges, such as emergency bunker surcharges.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand:

- Yard utilization remains high at Antwerp’s MSC PSA European Terminal.

- The national strike in Belgium on June 25 has resulted in significant disruptions to maritime traffic.

- Hamburg rail closures due to construction work and summer truck restrictions may affect operations.

- Port delays persist in Antwerp, Rotterdam, Hamburg, Bremerhaven, Piraeus, Valencia, and Genoa.

- Equipment:

- Central European origin points (Austria, Slovakia, Hungary, and Eastern Germany) continue to face chassis and container shortages, which impact TAWB service capacity. Carrier haulage is recommended for these origins.

- The Ports of Lisbon and Leixoes in Portugal are facing equipment challenges, along with Mersin in Southern Turkey.

- Freight Rates:

- North Europe: Most carriers have postponed their PSS until July, or until further notice.

- West Mediterranean: Only one carrier is attempting to implement a PSS in July.

- East Mediterranean: Carriers have postponed their PSS until July.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- Capacity to the U.S. East Coast is increasing. CMA CGM is shifting multiple vessels back to the India America Express (INDAMEX) service amid the July start of traditional peak season for Indian subcontinent shippers. Multiple carriers are reporting that their ships are full and highly utilized.

- Capacity to the U.S. West Coast is more available, given the ingestion of capacity into the TPEB market and services that enable Indian subcontinent shippers to deliver cargo to the U.S. West Coast.

- Freight Rates:

- For cargo moving to the U.S. East Coast: With the traditional peak season for Indian subcontinent shippers around the corner, GRIs and PSS have been announced for the first half of July. Whether they hold depends on demand picking up from India, especially as capacity is added back into the trade after the quick rise and fall of TPEB spot rates.

- For cargo moving to the U.S. West Coast: GRIs did not stick in the market, and PSS began coming down, in line with TPEB lanes.

- Exports from Pakistan are seeing increases in cost and transit times due to additional feeder services needed to service the country in light of the India-Pakistan conflict.

Air

WEEK 24: JUNE 9 - JUNE 15, 2025

- Middle East and South Asia (MESA) Volumes Drop -13% (2Wo2W) Post-Eid and Conflict Escalation: Tonnages from MESA origins declined -13% in a two-week-on-two-week comparison. Week 24 alone saw a -9% WoW drop after a -8% WoW decline in Week 23, driven by Eid holidays (June 6–9) and the Israel-Iran conflict. South Asia was hit hardest, with traffic from Bangladesh down -43% and Pakistan -30% WoW in Week 24.

- Levant and Intra-MESA Severely Impacted by Conflict: Tonnages from Levant countries fell -21% WoW in Week 24 due to flight cancellations following Israeli attacks on Iran (starting June 13). Intra-MESA traffic plunged -26% WoW in Week 23. Together, Levant and South Asia accounted for the majority of the regional decline.

- UAE Bucks Trend with +15% WoW Surge in Week 24: The UAE saw a strong recovery with +15% WoW growth, lifting Gulf region volumes by +8%. Key gains were to West Africa (+76%), East Africa (+25%), and intra-Gulf routes (+51%), including a sharp rebound to Saudi Arabia (+107%), following Eid-related declines the previous week.

- Asia-Pacific Steady but Volatile; China-U.S. Up +6% WoW: The Asia-Pacific was the only region with a positive WoW gain in Week 24 (+2%), largely from mainland China (+3% WoW) and South Korea (+15% WoW). Ex-China tonnages to the U.S. rebounded +6% WoW after a -10% drop prior, amid tariff-related volatility. However, the Asia-Pacific’s 2Wo2W tonnages were still down -4%, and spot rates from Hong Kong to the U.S. dropped another -6% WoW.

(Source: WorldACD)

Please reach out to your account representative for details on any impacts to your shipments.

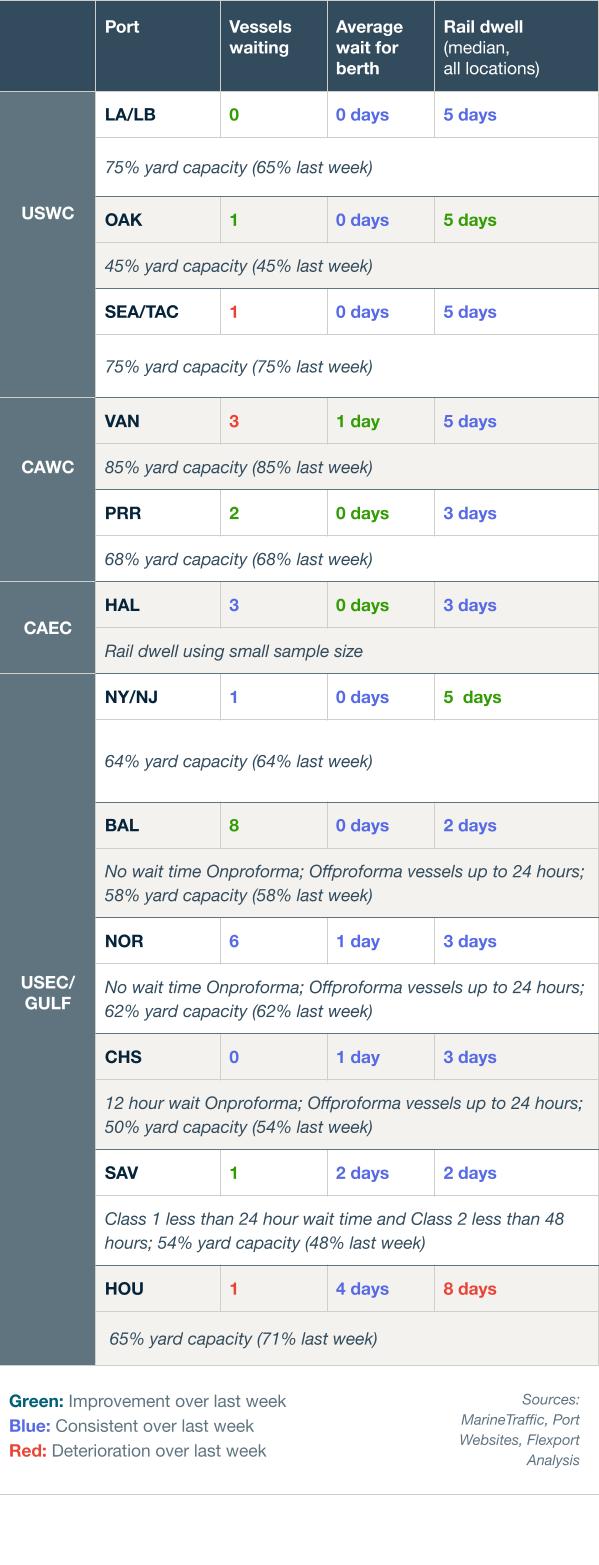

North America Vessel Dwell Times

Upcoming Webinars

North America Freight Market Update Live

Thursday, July 10 @ 9:00 am PT / 12:00 pm ET

European Freight Market Update Live

Tuesday, July 15 @ 15:00 BST / 16:00 CEST

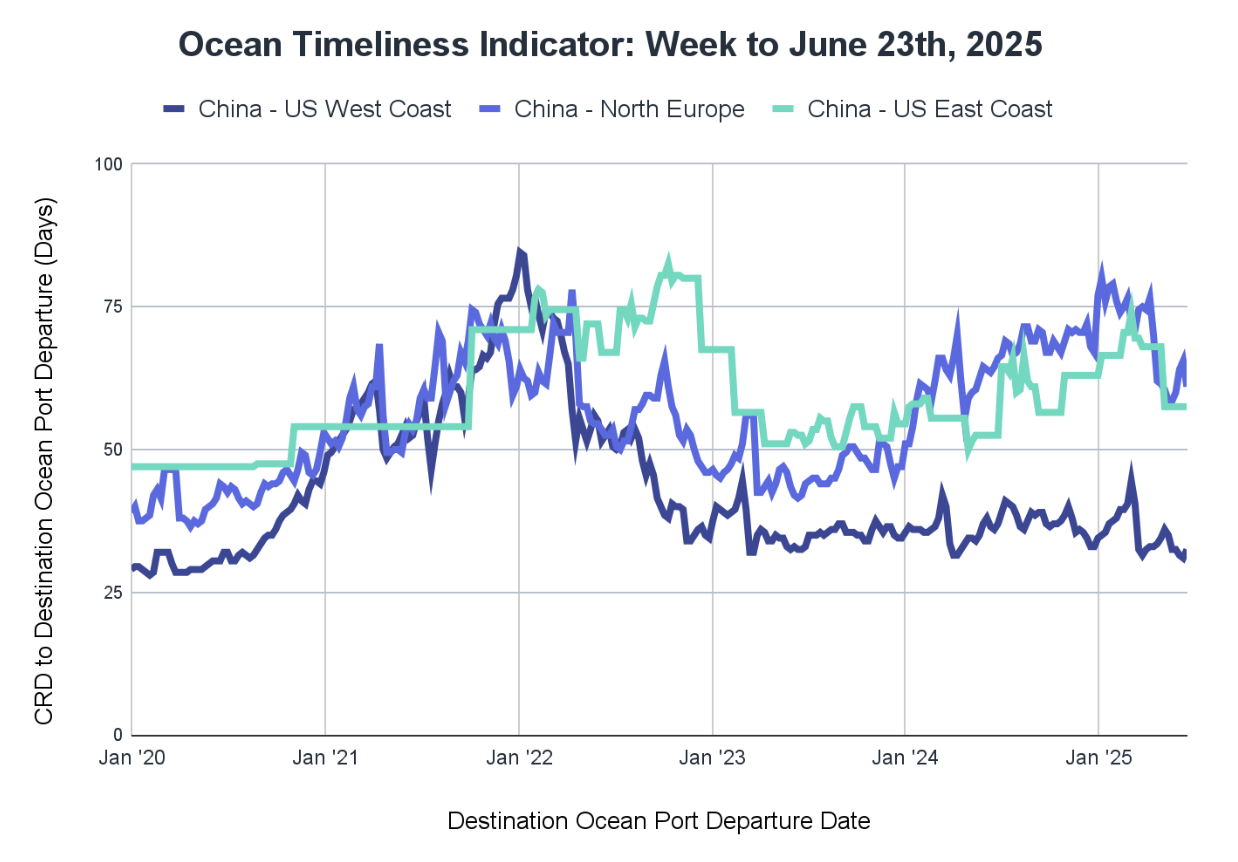

Ocean Timeliness Indicator

This week, the Flexport OTI increased for the route from China to the U.S. West Coast, and decreased for China to Northern Europe. China to the U.S. East Coast remained stable.

Week to June 23, 2025

The Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast increased from 31 days to 32.5 days. For the China to U.S. East Coast route, the OTI remained stable at 57.5 days. Meanwhile, the OTI for China to Northern Europe decreased from 65.5 days to 61 days.

About the Author

Related content

更多

![GettyImages-1354399056 (2)]()

Global Logistics Update

President Trump Suggests Possible New Tariffs; Demand for Ex-India Air Freight Skyrockets

![Warehouse GettyImages-157558600]()

Global Logistics Update

U.S. Expands Steel and Aluminum Tariffs; European Destination Ports Face Peak Season Congestion

![GettyImages-597662449 1200x800]()

Global Logistics Update

U.S.-China Tariff Truce Continues; Volcanic Eruption Disrupts North Pacific Air Routes