Global Logistics Update

U.S. and U.K. Sign Trade Deal; FEWB Faces Congestion and Ongoing Capacity Tightness

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: June 18, 2025

Trends to Watch

Talking Tariffs

President Trump Signs Executive Order on U.S.-U.K. Trade Agreement: On June 16, the White House published an executive order that will implement some parts of the U.S.-U.K. trade agreement announced on May 8. Set to take effect seven days after publication in the Federal Register, the executive order will:

- Maintain a baseline 10% IEEPA reciprocal tariff on U.K. imports

- Reduce Section 232 tariffs on U.K. auto parts from 25% to 10%

- Reduce the effective Section 232 duty rate on U.K. automobiles from 27.5% to 10%, applicable to an annual quota of 100,000 vehicles

- Eliminate IEEPA reciprocal tariffs and Section 232 steel and aluminum tariffs on U.K. products that fall under the World Trade Organization Agreement on Trade in Civil Aircraft

Per the order, the U.S. may also implement a quota of U.K. steel and aluminum imports that will be subject to most-favored-nation duty rates, contingent upon whether the U.K. meets American requirements on the security of steel and aluminum supply chains.

The U.K. is also likely to receive “significantly preferential treatment” with regard to potential upcoming Section 232 duties on pharmaceuticals, contingent upon the U.K. complying with “certain supply chain security standards.”

U.S. Customs and Border Protection (CBP) Issues Updated Guidance on Reporting Country of Smelt and Cast for Aluminum Imports: On June 13, CBP released updated instructions for reporting the country of smelt and cast for derivative aluminum imports subject to Section 232 tariffs.

- Effective June 28, 2025, aluminum imports with an unknown or indeterminable country of smelt and cast will be subject to a 200% Section 232 tariff—the same duty assessed on aluminum imports originating from Russia.

- This update restores a CBP policy instituted on March 24, 2025, concerning aluminum with an unknown country of smelt and cast. Per the March 2025 policy, which was walked back a few days later, those importers were to report Russia—and pay the associated 200% Section 232 tariff—and correct the entry via a post summary correction when able to prove that Russia was not the country of smelt and cast.

- How CBP’s June 13 announcement differs from its March 2025 policy: per CBP’s most recent guidance, importers will be required to report Russia’s Chapter 99 HTS code as well—not just Russia as the country of smelt and cast.

- For more details on CBP’s update, as well as insights into Flexport’s latest filing and reporting process, check out our blog.

U.S. Department of Commerce Expands List of Derivative Steel Products Subject to Section 232 Tariffs: On June 12, the U.S. Department of Commerce added washing machines, refrigerators, and other steel consumer appliances to its list of derivative products subject to Section 232 duties. Beginning June 23, 2025, the 50% duty rate will apply to the value of steel content in each product.

Get the latest updates and guidance on U.S. tariffs and trade on our live blog.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- Slowing bookings for July: While there hasn’t been any major drop in overall demand, bookings for July are significantly slower compared to late May and early June.

- Even with the general slowdown in July bookings due to an early peak season for some TPEB shippers, demand overall is mixed, dependent on specific shipper strategies and cargo types.

- Capacity is stabilizing at 85%-90% from the second half of June into July.

- The Pacific Southwest gateway is nearing full capacity, especially with the injection of extra loaders.

- Potential overcapacity: Increased capacity, especially to the Pacific Southwest, is resulting in potential overcapacity compared to demand, which remains relatively flat.

- Blank sailings: Looking ahead at the remainder of June, the overall downward trend in blank sailings is expected to continue, with a projected cancellation rate of 7% in Week 26 and 6% in Week 27.

- Equipment: Equipment remains sufficient across most TPEB origins, with no immediate shortages overall.

- Freight Rates:

- West Coast floating rates continue to be mitigated, and are approaching fixed levels.

- East Coast and Gulf floating rates have begun to drop in response to the overcapacity vs. demand scenario. This trend is expected to continue.

- The General Rate Increase (GRI) for June 15 has been fully withdrawn for all gateways, including the West Coast, East Coast, and Gulf, and continues to decrease.

- The Peak Season Surcharge (PSS) for June 15 is also being mitigated as floating market rates drop—especially for the West Coast, where Freight All Kinds (FAK) rates are approaching fixed levels. The East Coast PSS is also beginning to drop, but remains higher compared to the West Coast.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- Container availability remains tight due to earlier rush shipments on the Trans-Pacific trade. Some carriers are relying on empty containers from return voyages to meet export demand.

- Strikes in Belgium (June 25) and Gothenburg (June 23-24) may worsen congestion, particularly in Antwerp.

- Given low water levels in the Rhine River, barges have been stuck waiting for 56+ hours.

- In Germany, rail delays are creating container transport bottlenecks, possibly further challenging inland delivery on-time performance.

- Geopolitical impacts concerning the Strait of Hormuz: Current conflicts pose minimal direct impact on container shipping, as FEWB vessels predominantly reroute via the Cape of Good Hope and avoid the Red Sea. The primary risk concerns oil tanker markets; any blockade could result in a spike in oil prices, potentially leading to marginal increases in bunker fuel surcharges (BAF).

- Freight Rates:

- The Shanghai Containerized Freight Index (SCFI) has jumped 60% over the past six weeks.

- More GRIs are expected in July. CMA has already announced a GRI; other carriers are expected to follow in the coming days.

- Shippers are advised to book at least three weeks in advance. Carriers have already fully booked their vessels for June.

- Cargo rollovers are becoming increasingly severe, and are expected to impact vessels scheduled between late June and early July.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand: Congestion at European ports has improved.

- Antwerp currently faces the biggest challenges.

- In the Mediterranean, congestion issues persist in Piraeus, and at the main ports of Italy and Spain (Genoa, Valencia, and Algeciras).

- Equipment:

- Equipment shortages persist in parts of Central Europe, particularly in Austria, Slovakia, Switzerland, Hungary, and Southern/Eastern Germany. Carrier haulage is recommended for these origins.

- European main ports are not currently facing any major equipment shortages.

- Portuguese ports (Lisbon, Leixoes) are facing equipment issues, along with Mersin in Southern Turkey.

- Freight Rates:

- North Europe: Carriers are postponing their PSSs until July.

- West Mediterranean: One carrier is attempting to implement a PSS in the last week of June, while the rest have postponed it until July.

- East Mediterranean: Carriers have further postponed their PSSs until July, while others have postponed it until further notice.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- Capacity to the U.S. West Coast is increasingly available, related to the massive ingestion of capacity into the TPEB market and services that enable Indian subcontinent shippers to deliver cargo to the U.S. West Coast.

- Capacity to the U.S. East Coast has been reduced to below standard weekly levels. Carriers are reporting that they are running ships fully utilized on such services. There are multiple blank sailings on routes from Northwest India (NWI) to the U.S. East Coast for the month of June, reducing capacity.

- Freight Rates:

- For Indian subcontinent cargo moving to the U.S. West Coast, GRIs did not stick in the market and PSSs began coming down, in line with TPEB lanes.

- For cargo moving to the U.S. East Coast, GRIs and PSSs have been announced for the first half of July. Whether they hold will depend on demand picking up from India, or continued reduced capacity impacting the balance between supply and demand.

- Exports from Pakistan are seeing increases due to additional feeder services needed to service the country in light of the India-Pakistan conflict.

Air

WEEK 23: JUNE 2 - JUNE 8, 2025

- China to U.S. Air Cargo Drops Sharply Post-Rebound: In Week 23 (June 2-8), China/Hong Kong to U.S. tonnages fell -10% WoW and -19% YoY, with spot rates down -5% WoW and -17% YoY. The dip follows a brief May rebound tied to the U.S.-China tariff de-escalation, which indicates that the rebound likely reflects catch-up demand, not lasting recovery.

- Asia-Pacific Volumes Down Due to Holidays and Ecommerce Slowdown: China exports dropped -7% WoW, driven by weaker southern China ecommerce. Asia-Pacific volumes fell -4% WoW, led by Malaysia (-14%), Indonesia (-10%), and South Korea (-6%), due to Eid and Memorial Day.

- Global Tonnages Down -3% WoW, -2% YoY: China–U.S. weakness and global holidays drove a -3% WoW fall in worldwide volumes. Europe was down -4%, MESA -8% (including -26% intra-MESA, -17% to Africa), while North America rebounded +8% WoW post-Memorial Day.

- Rates Stable Overall, Aside from a Sharp Fall ex-HK to U.S.: Global rates averaged $2.44/kg (+1% WoW, flat YoY), spot rates $2.63/kg (+2% WoW). HK–U.S. spot rates plunged -12% WoW, hit by U.S. de minimis rule changes that have increased costs for low-value ecommerce shipments.

(Source: WorldACD)

Please reach out to your account representative for details on any impacts to your shipments.

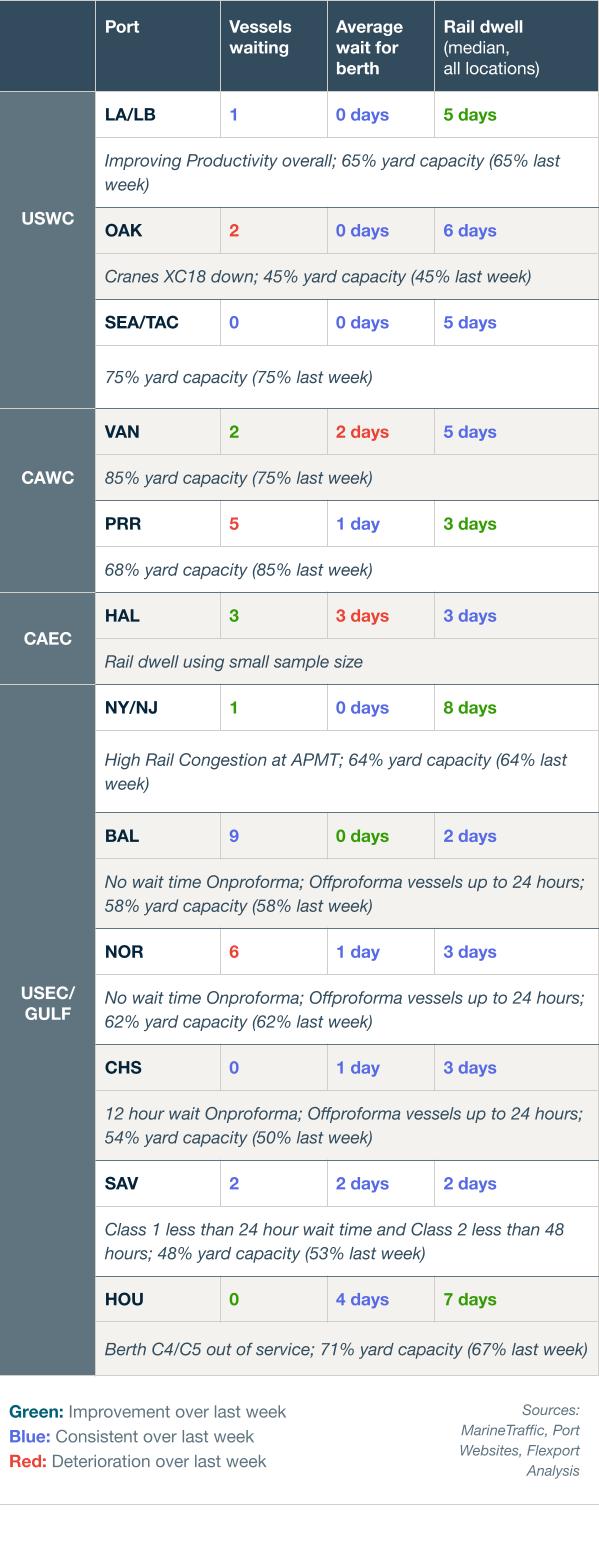

North America Vessel Dwell Times

Upcoming Webinars

Tariff Trends 2025: Expert Insights on the New U.S. Customs Landscape

Thursday, June 26 @ 8:00 am PT / 11:00 am ET / 16:00 BST / 17:00 CEST

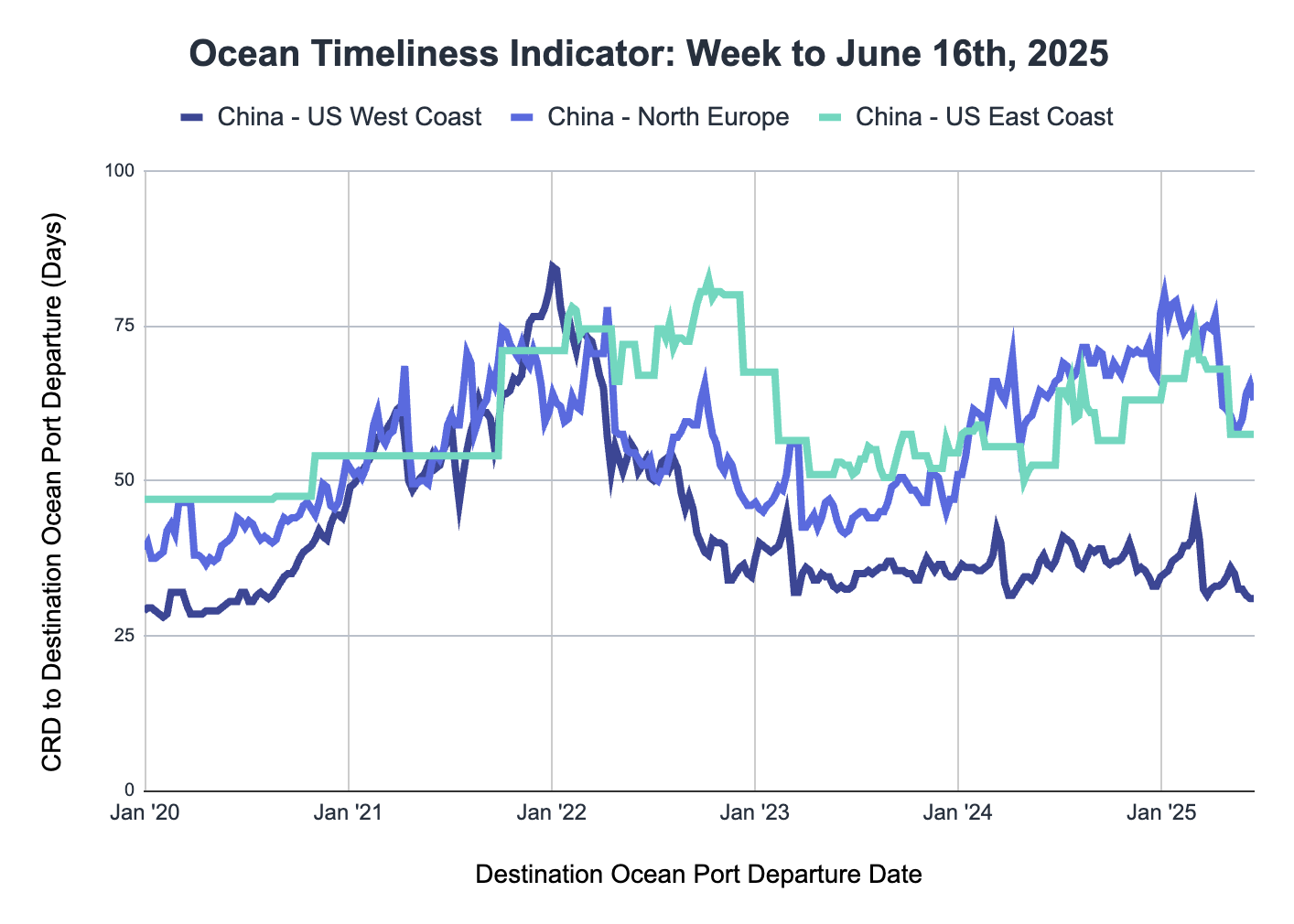

Ocean Timeliness Indicator

This week, the Flexport OTI for routes from China to the U.S. West Coast and China to the U.S. East Coast remained unchanged. It decreased for the route from China to Northern Europe.

Week to June 16, 2025

The Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast remained at 31 days. Similarly, the China to U.S. East Coast route stayed flat at 57.5 days. Meanwhile, the OTI for China to Northern Europe (Rotterdam) decreased from 65.5 days to 63 days.

About the Author

Related content

更多

![WarehouseGettyImages-535667233]()

Global Logistics Update

U.S. and Taiwan Finalize Trade Deal; FEWB Spot Rates Soften Amid Lunar New Year Lull

![Ocean Port GettyImages-1083936322 (1)]()

Global Logistics Update

EU to Vote on Modified U.S. Trade Deal; Ex-Asia Demand Tapers Off Ahead of Lunar New Year

![Air GettyImages-1343405900]()

Global Logistics Update

U.S. to Cut Tariffs on India; TPEB and FEWB Carriers Plan Upcoming Blank Sailings