Global Logistics Update

Market Update: November 8, 2017

Information about ocean and air freight rates for November 2017, with updates on capacity, delays, congestion, and trucking issues.

Market Update: November 8, 2017

Want to receive our weekly Market Update via email? Subscribe here!

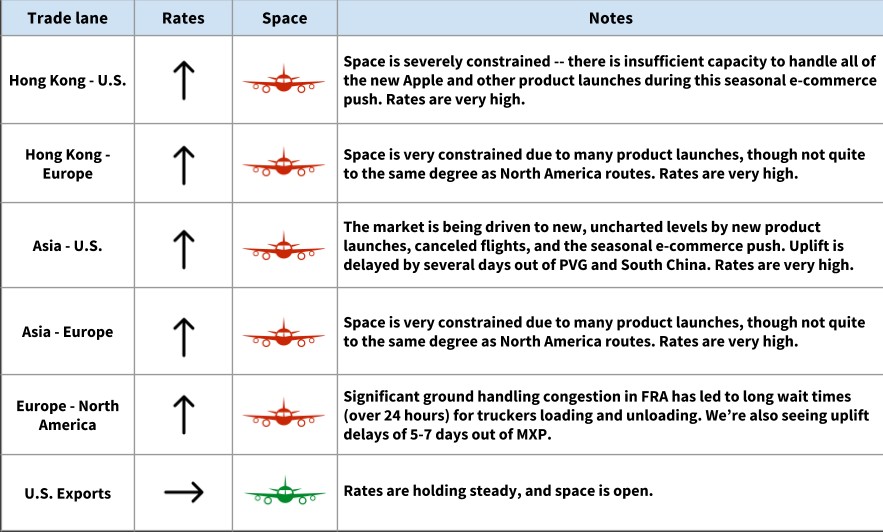

Air Freight Market Updates: Rates Are Very High, and Space Is Extremely Tight

Space constraints are worse than ever, and rates are still climbing

Capacity issues are extremely severe. This is due to a combination of product launches -- by Apple and others -- as well as a seasonal e-commerce push and canceled flights. In short, there just isn’t enough space to fit all of the cargo being shipped.

"There is nowhere to turn," one air freight forwarder told the Loadstar, in an article about this season's "perfect storm" of high rates and space constraints. “It’s a carrier’s market. Airlines are definitely becoming more selective with what they take and accept.”

In a year that has been marked by a very strong air market with consistently high rates, the current rates are exceptionally high -- and still climbing as the winter holidays approach. "Rates are going sky high – and going up every weekend," the Loadstar source commented. Read more about the state of the air market here.

Uplift delays out of Asia and Europe

Major airports in Europe are experiencing week-long delays in uplift, notably MXP (Milano Malpensa).

China gateways are also experiencing delays of 4-6 days before uplift, with the worst backlogs in South China and Hong Kong.

Severe congestion at Heathrow

Heathrow is severely congested, with long lines of trucks (and reports of trucks being turned away). If you have cargo moving in or out of Heathrow, expect lengthy delays and trucking wait fees.

Book early, and book direct flights for urgent shipments

Book your air shipments in advance -- at least 10 days before the cargo ready date, if possible.

For urgent shipments, you should also consider booking direct flights. It's more expensive, but direct flights will avoid potential delays at transshipment airports.

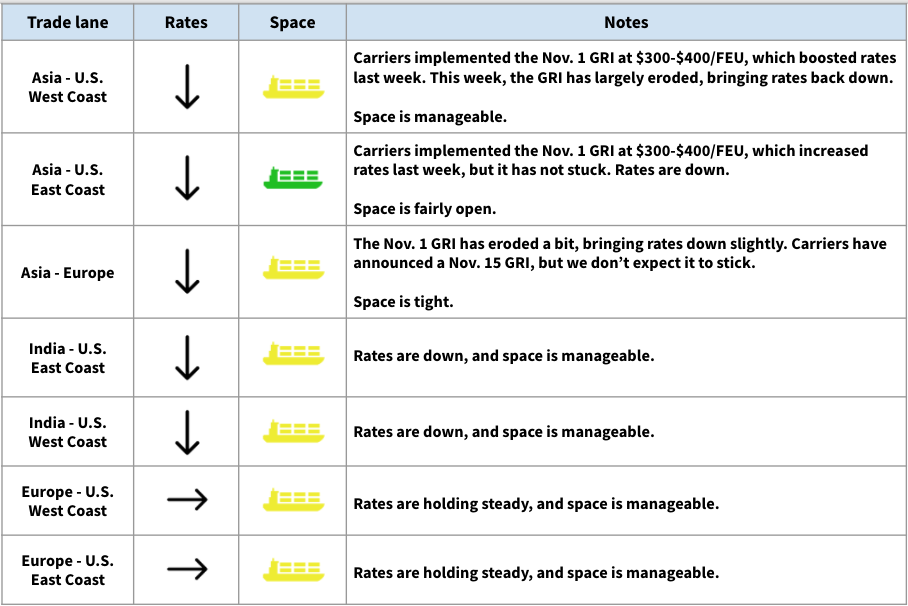

Ocean Freight Market Updates

The Nov. 1 GRI is not holding

After a brief increase due to the Nov. 1 GRI, rates are sliding back down toward previous levels.

Carriers are not yet announcing blank sailings

Unlike in years past, carriers have not yet announced blank sailings for the winter season. (They typically use blank sailings during slack season to reduce overcapacity and keep prices up.)

Rates will increase in advance of Chinese New Year

Starting in mid-December, we’ll see rates begin to go up in anticipation of Chinese New Year. This will constrain space, too. Expect more GRI announcements for December and January.

Other Freight Market Updates

Congestion and chassis shortages in Savannah, Atlanta, Chicago, Elwood/Joliet

- Savannah: Daily chassis shortages and capacity issues

- Atlanta: Because more cargo is being railed to Atlanta to avoid the Savannah issues, we’re now seeing congestion in ATL

- Chicago: Severe congestion and chassis shortage at CN in Chicago

- Elwood/Joliet: Chassis shortage at BN and UP

If your cargo is being routed through any of those ports / terminals, you may see chassis split fees and/or storage fees if your trucker needs to make an extra trip to pick up a chassis.

Delays in Seattle

The Pacific Northwest is experiencing port delays and capacity issues due to peak season -- especially SEA/TAC.

**Fuel tax increase in California **

As of November 1, California has increased its diesel tax to 36 cents per gallon (this is a 20-cent increase). We’re seeing higher fuel surcharges from trucking providers as a result.

FTL rates in California are up

The eastbound FTL market in California is very tight. Rates are up 20% or more.