Global Logistics Update

Freight Market Update: March 14, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Freight Market Update: March 14, 2024

TPM24 Takeaways

There is no better chance to learn about the state of the industry than the annual Transpacific Maritime (TPM) Conference. TPM ‘24 took place between March 3-6 at the Long Beach Convention Center. Flexport’s team was on site to chat with, and learn from, our customers and carrier partners—both current and potential. Here are our top insights for the coming year.

- Uncertainties Persist. The supply chain is getting more complex every day. The situation in the Red Sea was top of mind at TPM, as well as Panama Canal restrictions, and ILA contract negotiations. Uncertainty drives anxiety. As a global logistics platform, we can help de-risk the supply chain for our customers and give actionable, data-driven advice on how to manage your procurement decisions in 2024 and beyond.

- Diversifying means protection. In previous years, shippers and service providers would get into a meeting room and already know exactly what the rates would be. Everyone would sign the contract, and the following year, sign the same contract again. That’s no longer the case. With this market’s persistent uncertainty over the past few years, customers are starting to embrace how diversifying their carrier and forwarder portfolio can foster more agility. For example, larger customers are willing to embrace different routings to ensure disruptions don’t impact their business too strongly. Shippers are also looking for unique ways to keep their business moving, and really understanding how forwarders and brokers can create opportunities and solutions for better protection when moving supplies globally.

- Technology and visibility are the future. Customers are excited about technology and modernization. Current and potential customers had a lot of questions about integrations, and almost every shipper we spoke with is looking for real-time, accurate shipment and SKU-level visibility. Everyone is data-hungry and looking for solid solutions. Having visibility into your goods is not just critical for managing an efficient, modern supply chain; visibility helps shippers — Flexport’s customers — improve the customer experience for their own customers, too. Visibility is foundational to managing customer expectations as consumers want to know when they’ll receive their goods, and if they’re delayed, why.

- Relationships matter. Shippers are looking for partners. After the last few years and the tumultuous supply chain we’ve experienced, now more than ever people are looking for good relationships and the ability to talk to someone they trust. There are a lot of questions about the future, and customers are looking for great advice on how to navigate tumultuous waters together. Many of our customers are asking how we handled the disruptions in the past and how we thought outside of the box. It’s important to be nimble and agile with a purpose to provide efficient solutions.

The Year Ahead

After TPM, rates get locked and RFP season goes into full gear. To ensure you feel confident about forecasts for the year ahead before launching your RFPs, don’t hesitate to reach out to your Flexport account managers and our teams to discuss strategies for Fixed/Floating, and BCO/NVO volume contracts.

Trends to Watch

[Air - Global] (Data Source: WorldACD/Accenture)

- Overall Growth in Demand: The first two months of the year saw a +13% increase in worldwide air cargo demand compared to the same period last year, driven by strong performance from Middle East & South Asia (MESA) origins and recovery from the Lunar New Year (LNY) seasonal dip.

- February's Performance: Preliminary figures for February indicate an +8% year-on-year increase in air cargo tonnages, with a +4% increase when adjusting for the leap year day. This follows a +17% increase in January, showcasing a consistent upward trend despite the complications of comparing months due to LNY variances.

- Post-LNY Recovery: Three weeks after the later Lunar New Year in 2024, demand had largely rebounded from the post-LNY dip, especially in the key Asia Pacific region, mirroring patterns from 2023 but with somewhat stronger demand in 2024.

- Regional Dynamics: Strong rebounds were observed in intra-Asia Pacific traffic, up by +44% in Weeks 8 and 9 compared with Weeks 6 and 7, and significant year-on-year growth in tonnages from MESA in the same weeks (+22%), reflecting continued disruption in sea-air shipping routes due to the situation in the Red Sea.

- Global Pricing and Capacity Trends: Despite a global average rate decline of -16% compared to last year, rates from MESA are up +13%, indicating a regional anomaly. Global air cargo capacity is up by +9% over last year, with notable increases from Asia Pacific and Central & South America, highlighting an overall growth in the air cargo industry above pre-COVID levels.

- Average global rates remain above pre-COVID levels (+27% compared to February 2019).

[Ocean - FEWB]

- Asia-North Europe: The Red Sea situation continuously impacts freight market developments. Some vessels continue to reroute via the Cape of Good Hope, and some carriers are investigating the situation and re-routing back via the Suez Canal. More to follow as information becomes available.

- Demand is flat, and carriers are further adjusting rates for more fresh cargo in 2H March. Carriers are still upholding PSS/Contingency Surcharges due to rerouting vessels, however, more questions about the actual additional cost are being brought up and further adjustments are expected in April.

- Carriers are actively investigating demand & supply. We’re seeing vessels open for booking till last minute, which may reflect the oversupply situation. If soft demand continues from Week 12 onwards, we expect there could be more blank sailings announced soon.

- For historical updates on the Red Sea situation, read more in Global Ocean Carriers Halt Red Sea Transits - What to Expect.

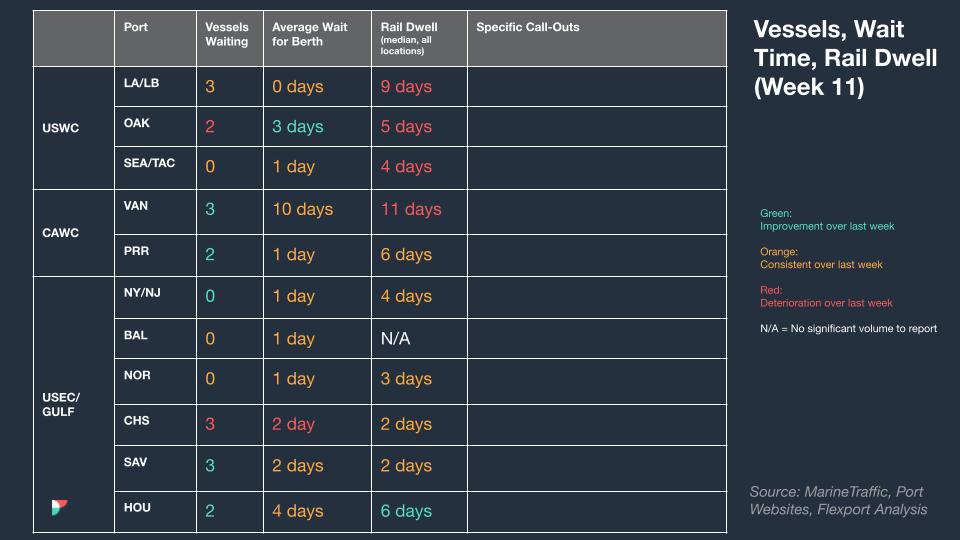

North America Vessel Dwell Times

Webinars

Freight Market Update Live | Europe

Tuesday, March 19 at 15:00 GMT / 16:00 CET

Expert Insights: Planning for the Possible Scenarios of 2024

Thursday, March 21 at 8:30 am PT / 11:30 am ET / 15:30 GMT / 16:30 CET

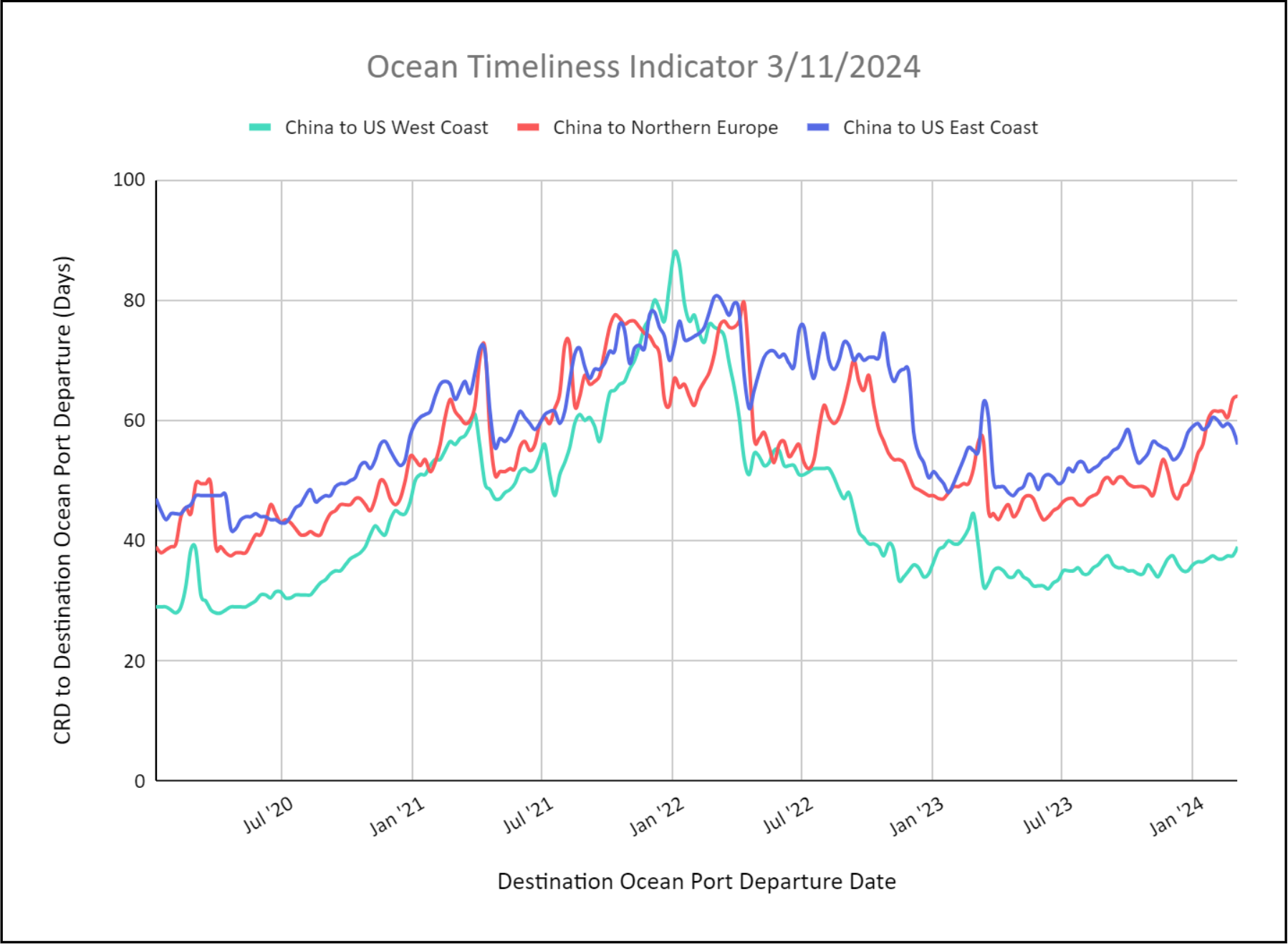

New! Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators for China to Northern Europe and China to U.S. West Coast Increased, while China to U.S. East Coast Decreased

Week to March 11, 2024

This week, the OTI for China to Northern Europe increased to 64 days due to carrier re-routings from the Suez Canal to the Cape of Good Hope. The OTI for China to the U.S. East Coast decreased slightly but remains elevated at 56 days as some carriers route westward around Cape of Good Hope while most leverage the Panama Canal despite slot restrictions. The OTI for China to the U.S. West Coast increased to 39 days as the transit time impact from the Red Sea situation is minimal.

Please direct questions about the Flexport OTI to press@flexport.com.

See full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.