Global Logistics Update

Freight Market Update: May 2, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Freight Market Update: May 2, 2024

Trends to Watch

Ocean - ISC

- Capacity from northwest India to the U.S East Coast is widely available. South and eastern India capacity to the U.S East Coast is facing slight space issues mainly driven by the first leg vessel (feeder). Once arrived in Colombo or Singapore for transhipment, mother vessel space is available. U.S West Coast capacity is much tighter than U.S East Coast due to the sharing of vessel space with other West-bound trades from South East Asia and Mainland China.

- Equipment availability has normalized from challenging levels following Red Sea related disruptions. The Indian Subcontinent is notorious for facing temporary equipment issues depending on the ocean carrier and equipment depot being used. Best practice is to continue using an “open carrier” approach and being flexible with empty equipment depots.

Ocean - FEWB

- The Red Sea situation continues to be chaotic with vessels rerouting via the Cape of Good Hope, impacting on-time performance and schedule reliability.

- With the Labor Holiday in Greater China and the blank sailing programs, demand picked up rapidly to avoid the GRI (General Rate Increase) impact. Vessels are being overbooked and rollover is expected for the first half of May.

- Due to blank sailings there are more equipment shortages reported by CMA/Evergreen/Hapag Lloyd/Yangming. Foreseeing the situation will be tough through May until carriers do the empty container reposition. It is highly recommended to pick up containers right after container yard opens or EIR (Equipment Interchange Receipt) is available to print per carrier local practice, don’t wait till last minute!

- Carriers are planning another round of GRIs in the second half of May by another $1000 per 40 foot.

Ocean - FCL U.S. Exports

- Capacity is available for base-port to base-port moves to Asia, North Europe and Mediterranean ports of discharge.

- Some inland rail locations are spotty on equipment related to global disruption of container flows. When booking to load at an inland rail point, shippers are encouraged to submit bookings 3-4 weeks in advance of CRD (cargo ready date).

Air - Global (Data Source: WorldACD/Accenture)

- Global Air Cargo Growth: There was a return to growth in global air cargo tonnages during the third week of April, mainly driven by increased flower shipments from Central and South America (CSA) in anticipation of Mother's Day, offsetting reduced demand from the Middle East and South Asia (MESA) due to Eid.

- Significant Flower Shipments: Flower shipments, primarily to North America for Mother’s Day, contributed significantly to the tonnage increase from CSA, with these shipments accounting for a substantial portion of the global tonnage growth during the period.

- Rate Stability and Yearly Comparison: The average worldwide air cargo rate remained stable at US $2.50 per kilo, maintaining a rate significantly higher than pre-COVID levels by 39% compared to April 2019, showing a robust pricing environment despite various fluctuations.

- Regional Performance Variances: While CSA showed strong week-on-week growth, other regions like MESA experienced sharp declines in air cargo tonnages, influenced by seasonal effects and specific regional challenges like weather disruptions in Dubai affecting flight operations.

Please reach out to your account representative for details on any impacts to your shipments.

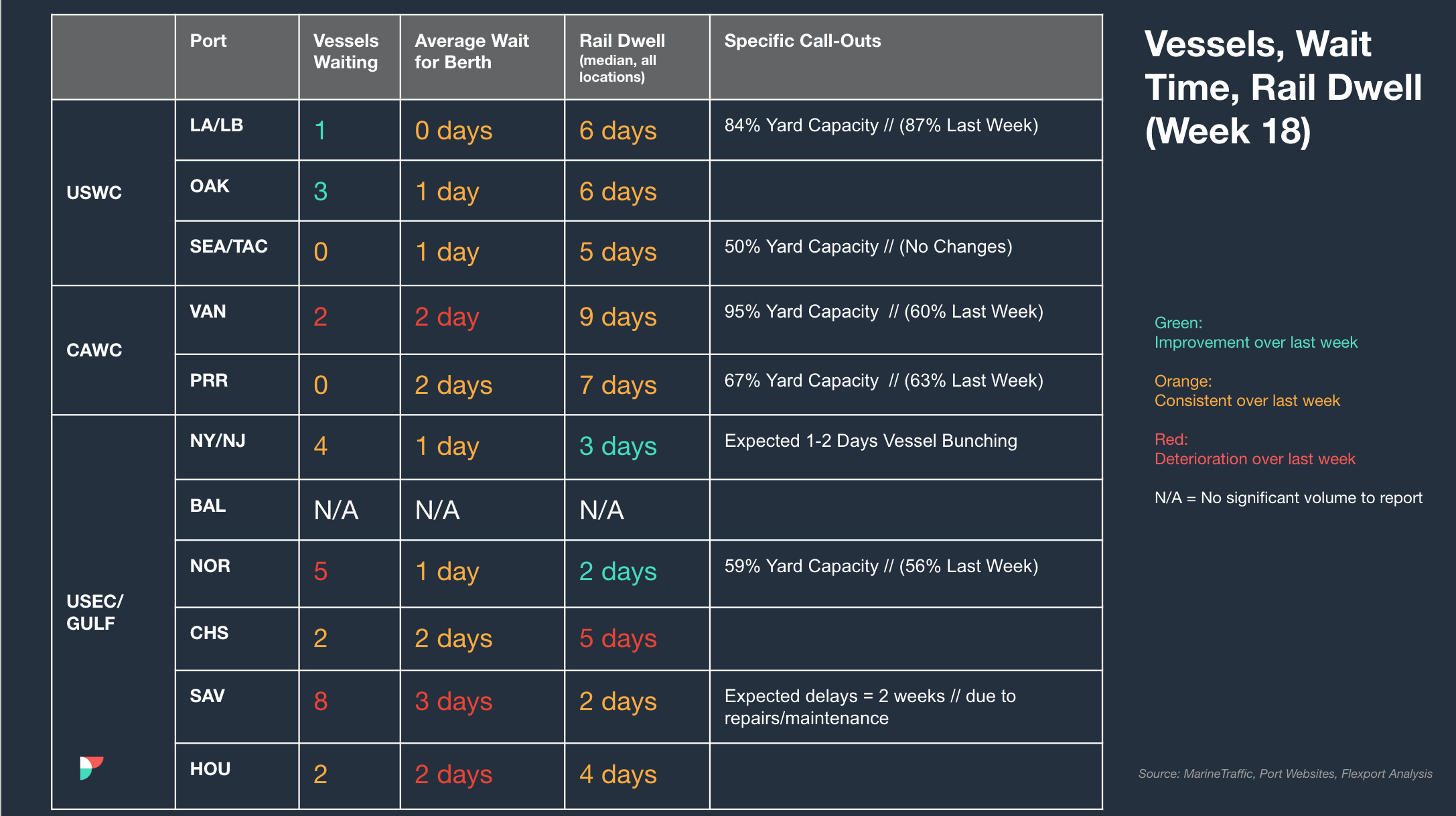

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, May 9 @ 9:00 am PT / 12:00 pm ET

Navigating Climate Insights in the Flexport Platform

Thursday, May 16 @ 16:00 CEST

European Freight Market Update Live

Thursday, May 21 @ 16:00 CEST

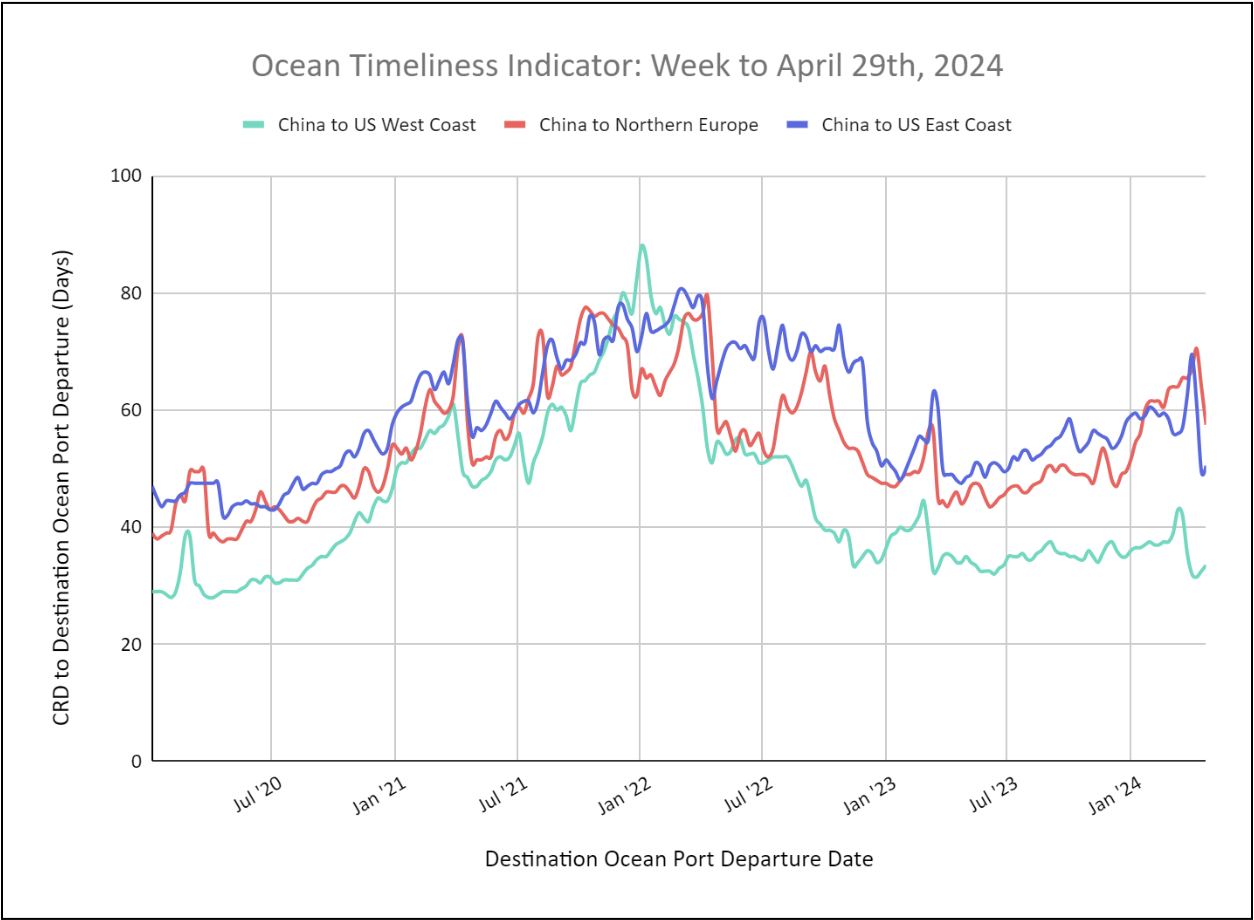

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators Decrease for China to Europe but increase for China to US West and East Coasts

Week to April 29, 2024

This week, the OTI for China to Northern Europe decreased to 58 days, after weeks of increasing transit time due to routing around the Cape of Good Hope. The OTI for China to the U.S. East Coast increased significantly to 51 days, and the OTI for China to the U.S. West Coast increased slightly to 33 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.