Global Logistics Update

Freight Market Update: July 3, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Freight Market Update: July 3, 2024

Trends to Watch

Ocean - TPEB

- Volumes remain strong, surpassing last year’s numbers on Transpacific routes. However, structurally blank sailings have occurred due to Cape of Good Hope (COGH) routings and port congestion in Asia and North America. Shipping lines are offering more premium services with expedited options, equipment, and space guarantees. Meanwhile, other carriers are reducing backlogs in Asia with extra loader (XL) space. This XL space to the Pacific Southwest (PSW) has improved the situation week over week, though the East Coast (EC) remains heavily overbooked.

- Floating rates: The General Rate Increase (GRI) for July was successfully implemented across all Transpacific Eastbound gateways, driven by peak conditions. Shipping lines adjusted rates to the EC twice as much as to the West Coast (WC) to manage high booking volumes.

- Fixed rates: Carriers have announced the new Peak Season Surcharge (PSS) for July 1, marking another increase following two successful implementation rounds.

Ocean - FEWB

- Equipment shortages and port congestion in Asia are improving but still can’t fully support current demand, with blank sailings expected in July and August.

- Demand remains strong, but slightly decreased compared to previous weeks. Floating rates have risen again for the first half of July, with a $1,500-2000 increase per 40-foot container. Customers are expected to keep pushing cargo out to avoid further delays.

- Premium options are still available for prioritizing equipment and securing earlier departure dates, reducing the risk of rolling or no equipment.

- Flexport continues to monitor the situation and advises booking early, placing bookings in smaller slots, and picking up empty containers as soon as possible. For urgent cargo with a target delivery date, we recommend using premium options as early as possible.

Ocean - TAWB

- Capacity is reducing in Europe, affecting both North and South Europe, due to the diversion of vessels to the TPEB and FEWB, and ISC to EU services, along with the merging of services by certain carriers.

- Congestion in the Mediterranean, coupled with schedule reliability issues and blank sailings, has pushed carrier utilization to 100%, leading to increased rates in July for both the West and East Mediterranean.

- Demand in North Europe remains stable, with rates holding steady. However, equipment deficits persist in certain areas of South/East Germany and the Hinterlands.

- To ensure the smoothest loading experience, we recommend booking 1-2 weeks in advance for shipments from North Europe and 2-3 weeks in advance for shipments from the Mediterranean that are loading at a coastal port.

Ocean - U.S. Exports

- Ocean rates are increasing for Q3 in corridors of the U.S. export market due to rising demand in global container markets.

- Congestion at critical transhipment hubs is reducing effective capacity for U.S. exporters.

- Navigating the ever-changing earliest return dates (ERDs) has become increasingly challenging due to current market congestion.

- To ensure the smoothest loading experience, we recommend booking 3-4 weeks in advance for shipments loading at a coastal port, and 4+ weeks in advance for shipments loading at an inland rail point.

Air - Global (Data Source: WorldACD)

- In the week of June 17-23, 2024 (week 25), global air cargo tonnage dropped by 5%, but average rates increased slightly by 1% to $2.54 per kilo, which is 10% higher than the same week last year and 43% above June 2019 pre-COVID levels.

- A combined analysis of weeks 24 and 25 shows a 3% drop in tonnage compared to the previous two weeks, with a significant 10% drop from Middle East & South Asia (MESA) origins. Rates from MESA rose by 5% and are up 57% year-on-year.

- Outbound air cargo tonnage saw double-digit drops from several predominantly Muslim countries between weeks 24 and 25, including Turkey (-69%), Saudi Arabia (-66%), Egypt (-46%), and Pakistan (-39%).

- Average spot rates from MESA to Europe in week 25 remain highly inflated compared to last year, with notable rates including $4.29/kg from Bangladesh (+165% YoY), $3.65/kg from India (+159% YoY), and $2.36/kg from Dubai (+84% YoY).

Please reach out to your account representative for details on any impacts to your shipments.

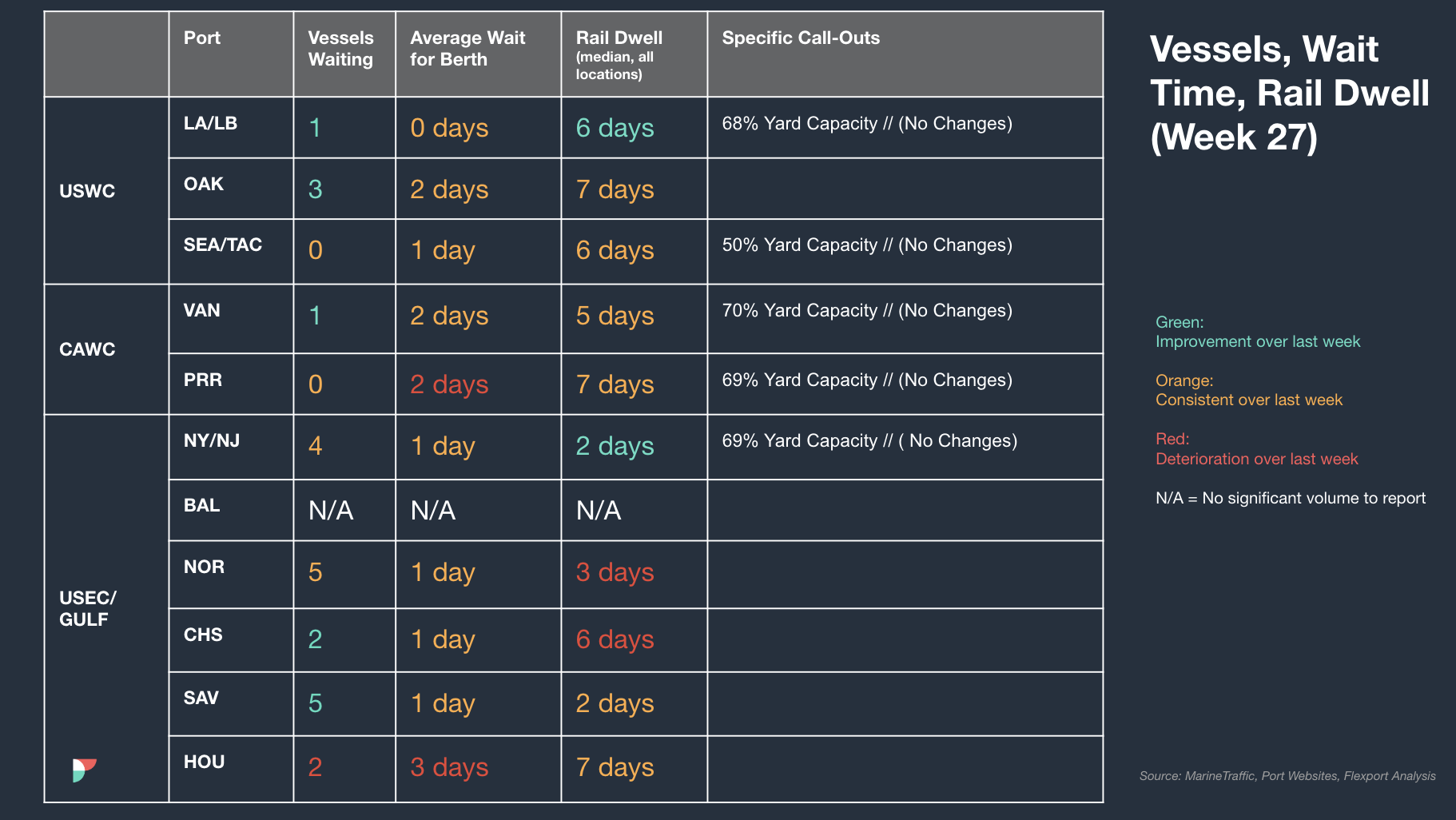

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, July 11 at 9:00 am PDT / 12:00 pm ET

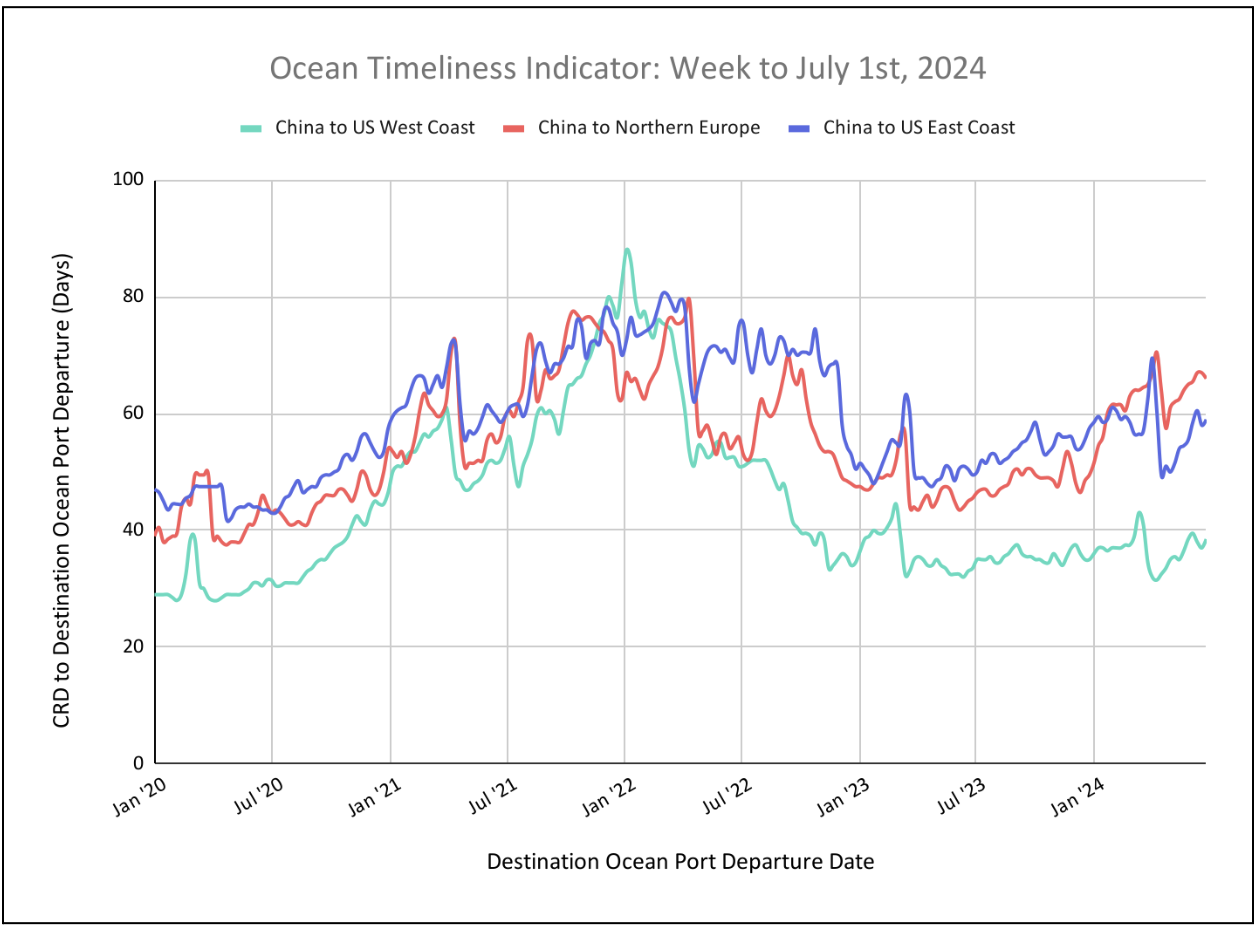

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators are exploring a new trajectory for Europe while restoring former patterns for U.S.-bound routes

Week to July 1, 2024

This week, the Ocean Timeliness Indicator for China to the U.S. East Coast corrected course with a noticeable uptick after its first decrease in 6 weeks, returning to 59 days from 58 days. In a similar upturn, OTI for China to the U.S. West Coast also increased back to 38.5 days from 37 days. It is, however, China to Northern Europe OTI’s turn this week to decrease from 67 days to 66 days, possibly due to growing port congestion in Asia.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.