Global Logistics Update

Freight Market Update: February 13, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of February 13, 2019.

Freight Market Update: February 13, 2019

Want to receive our weekly Market Update via email? Subscribe here!

⚠️Reminder Notices ⚠️

LA and NY Trucking Experiencing Congestion

We’re seeing extreme congestion at Los Angeles/Long Beach and New York ports, as a result of the influx of import volume in advance of the tariff hikes, peak season, and Chinese New Year preparations. The large import volume is causing a chassis shortage and long pickup times, so you may experience some shipment delays in the next few weeks. New York’s Newark terminal is particularly crowded, and because NY terminals are not open after hours or on weekends (unlike LA/LB), we expect the NY backlog to take longer to clear.

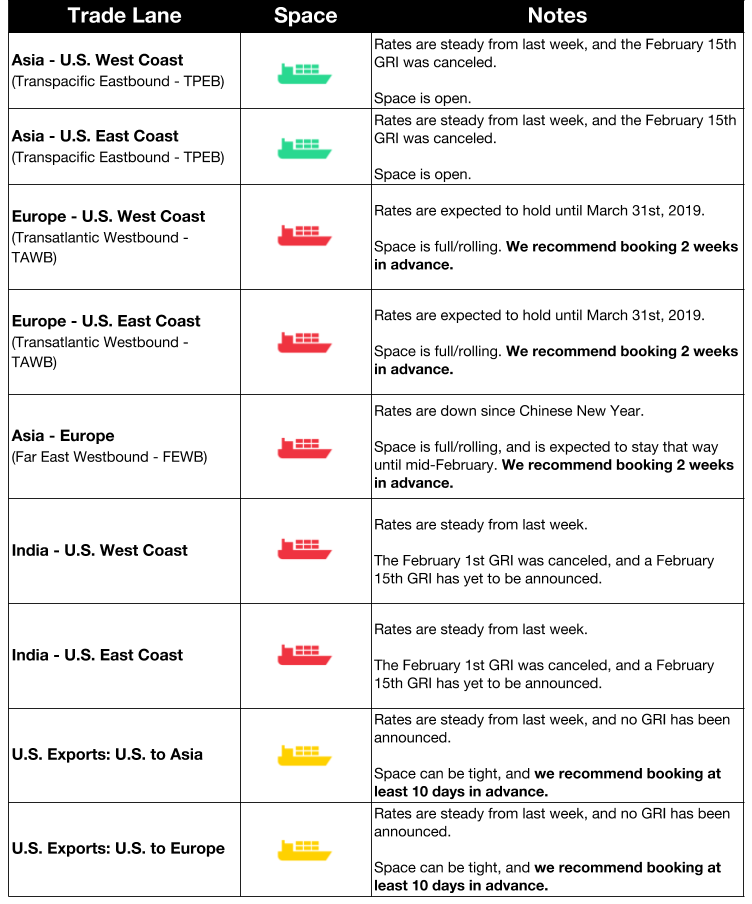

Ocean Freight Market Updates

Chinese New Year Blank Sailings Announced

A number of blank sailings have been announced around Chinese New Year. More information and a list of the affected ports and strings is available on our blog.

UK Cancels No-Deal Ferry Backup Plan

Seaborne Freight had been given a contract in December to carry trucks between Ramsgate, England and Ostend, Belgium in the event of a no-deal Brexit, as part of the government’s contingency planning. The contract was canceled this week, however, when it “became clear Seaborne would not reach its contractual requirements with the government.”

Ports Plan for Climate Change

As ocean levels rise, ports are considering the future state of their infrastructure, and starting to make changes accordingly. The Port of Virginia, for example, will be elevating their power stations above the ground and moving data servers as far away from the water as possible. However, specialists say that it’s difficult to plan infrastructure for changes that are decades out.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

No air freight market updates for February 13, 2019

Trucking Market Updates

Zim Joining Avantida Platform

Zim is joining Maersk on the Avantida platform, a digitized street turn booking service. Street turns are container round trips that reduce the amount of containers and chassis required, cutting down on congestion and emissions. The platform simplifies this service and helps to justify high fees.

ELDs Calculate Cost of Detention

The ELD mandate has provided driving data that Freightwaves used to calculate carrier opportunity cost. The amount of detention time that drivers have to sit through proved to have a significant impact on carrier capacity, rates, and driver turnover.

Amazon Advising UK Sellers to Prepare for Brexit

Amazon is advising its FBA sellers to stock up with at least four weeks worth of inventory in case the UK leaves the EU in March without a trade deal in place. Delays in trucking and customs clearance are expected in the event of a no-deal Brexit, and the resulting longer shipping times may make UK products less competitive. Sellers are advised to have additional stock imported by March 17th.

Customs and Trade Updates

Drawback Procedures for Section 301 and 232 Claims in Effect

CBP instituted fixes in ACE on February 8th so claimants could file drawback claims on Section 301 and 232 tariffs. Previously, an error would occur when submitting claims because a Unit of Measure Code (UOM) associated with the Chapter 99 tariff was required, causing confusion because a UOM was not reported on the Chapter 99 tariff entry summary. This error has been fixed and all claims that had been rejected due to the error will need to be re-submitted.

USMCA Experiences More Roadblocks Than Congress

Congressional approval was thought to be the biggest obstacle to U.S.-Mexico-Canada Agreement (USMCA) implementation, but existing laws may be what holds up its approval. The USTR put out a report stating which areas will need to be addressed and have laws re-written before the USMCA can go into effect. Some of the areas listed included: agriculture, drawback, MPF, origin rules, textiles, government procurement, safeguard tariffs, energy, and express shipments.

For a roundup of tariff-related news, subscribe to our Tariff Insider_. _