Global Logistics Update

Freight Market Update: April 1, 2020

0

Freight Market Update: April 1, 2020

How will businesses recover from COVID-19? When will factories start running again? And how can you ensure your cargo is moving when they do? Visit Flexport’s COVID-19 Trade Insights for information and analysis.

Want to receive our weekly Market Update via email? Subscribe here.

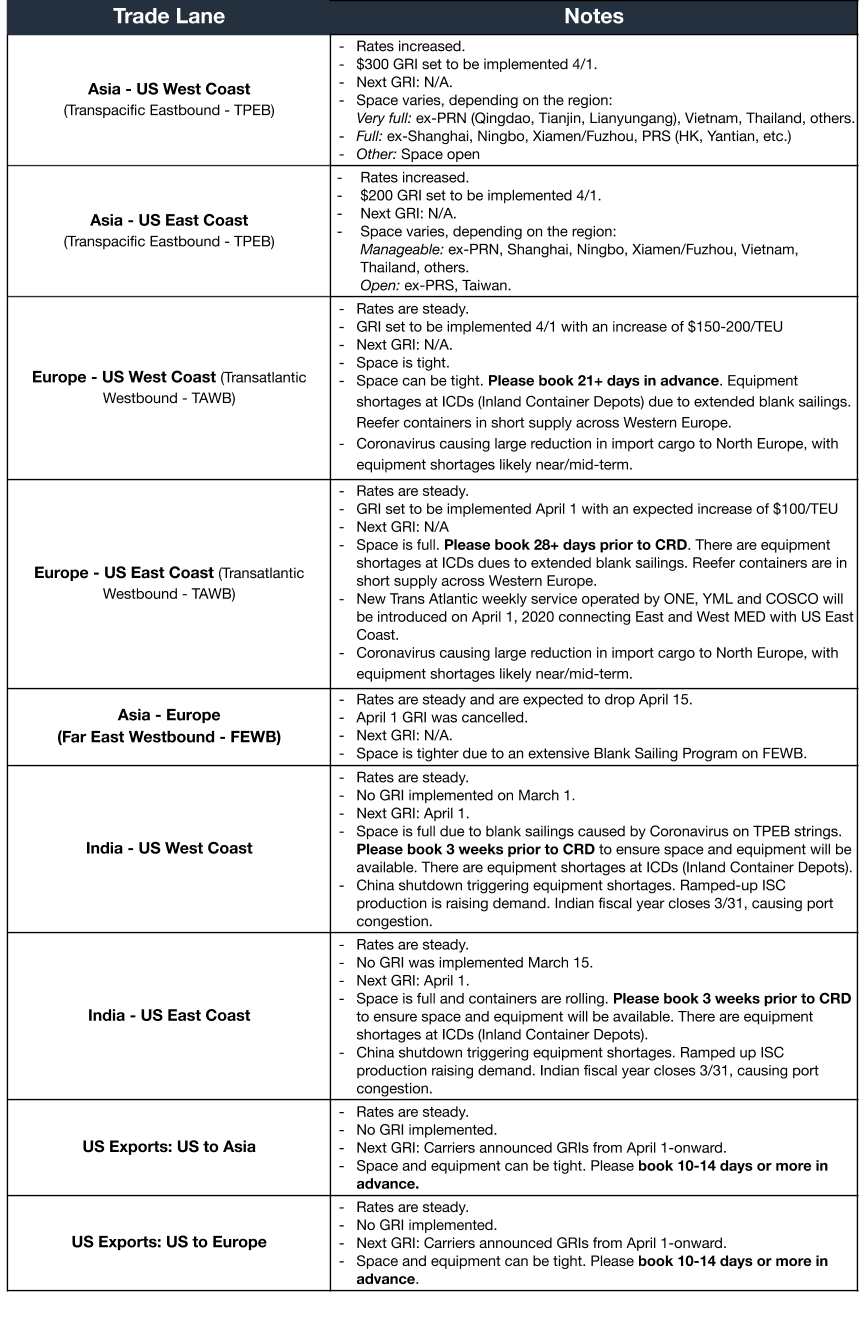

Ocean Freight Market Update

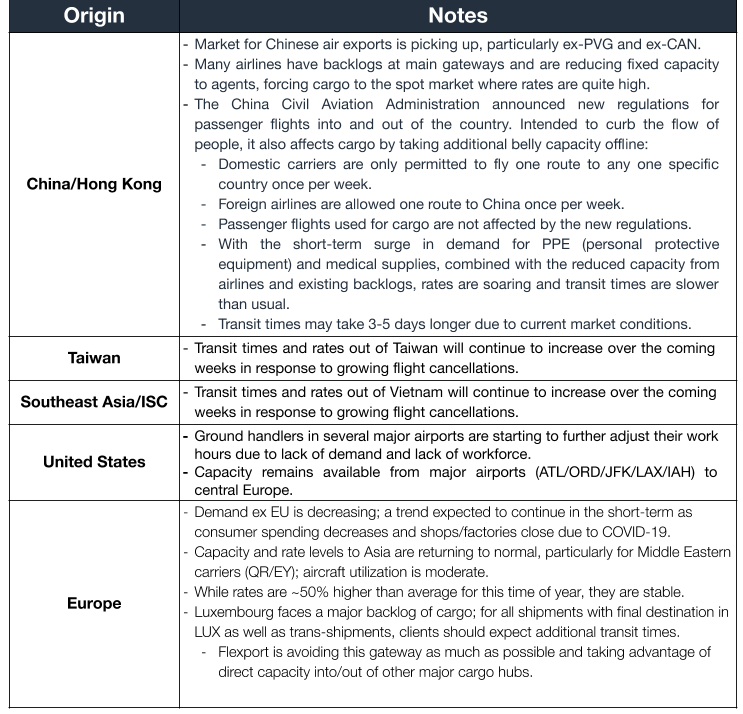

Air Freight Market Update

Freight Market News

Force Majeure Locus Expands Normally reserved for regional natural disasters, American Shipper reports that big logistics companies are declaring force majeure, reserving the right to modify part or all of its services, procedures, rates, surcharges, and other measures as needed, due to global logistics complexities caused by COVID-19. While not all forwarders are invoking the clause, its expansion could set a precedent for later global events.

Logistics Push Keeps Goods Moving While some national retailers have suspended distribution and fulfilment, the WSJ reports aggressive logistics tactics are maintaining the flow of vital consumer goods, like medical supplies and groceries, to meet demand for stockpiling quantities. Warehouses and trucking companies are taking drastic measures such as worker distancing, staggered shifts, protective gear, and temporary hourly raises.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- US stimulus bill became law as Congress passed and the President signed an enormous bill to counteract the mounting economic damage of the COVID-19 pandemic. It directs $610bn to households, $600bn to small businesses and $525bn to large businesses. It has provisions specifically directed at helping cargo and passenger airline companies.

- Weekly unemployment claims break records. As data begin to reflect the magnitude of the economic downturn, claims came in at 3.28m, obliterating the October 1982 record of 695k and exceeding expectations of 1.5m.

- Consumer sentiment across March had its lowest reading since October 2016.

- China cut interest rates by the most since 2015. It also planned an increase in its fiscal deficit, a form of stimulus.

- Market volatility shows, after dramatic drops in earlier weeks, the S&P 500 rose 10.3% last week, for its best week since 2009. The index is still down almost 25% from its high in February. The VIX volatility index remained at a very high 65.

Customs and Trade Updates

USTR Grants New Exclusions on Section 301 List 4 The USTR granted new exclusions to Section 301 List 4 tariffs. As with previous lists, the exclusions apply retroactively to the September 1, 2019 implementation date and remain in effect until September 1, 2020.

Duty Payment Deferral Still Under Discussion CBP advises a brief period of accepting requests to delay duty payments has been halted. The abrupt end is likely due to implementation issues. The Wall Street Journal reports the Trump administration discussed deferring duties for three months, but President Trump shot down the idea as "fake news.” For the few who received a duty deferral approval, reviewed on a case by case basis, a CSMS message states how to proceed.

Canada Extends Payment Timeframe CBSA announces it has extended deadlines for duties and GST payments.

29 New Subheadings to be Enforced Under Lacey Act The Animal Plant Health Inspection Service added 29 tariffs that will require Lacey Act declarations for items that are subject starting on October 1, 2020. This is a typical 6-month notice to the trade community every time new APHIS declarations are proposed. The trade community has 2 months to submit comments. Subheadings being added are under Chapters 33, 42, 44, 92, and 96. A copy of the notice is here.

For a roundup of tariff-related news, visit Tariff Insider.