Global Logistics Update

Freight Market Update: April 8, 2020

0

Freight Market Update: April 8, 2020

How will businesses recover from COVID-19? And how can you ensure your cargo is moving when they do? Visit Flexport’s COVID-19 Trade Insights for information and analysis.

Want to receive our weekly Market Update via email? Subscribe here.

Ocean Freight Market Update

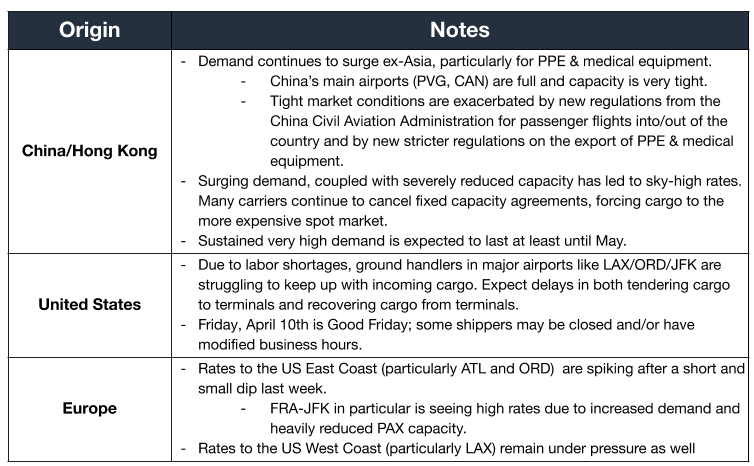

Air Freight Market Update

Freight Market News

Blank Sailings Increase The WSJ reports container shipping lines have canceled more than 160 sailings on peak-season Asia-Europe and Transpacific routes in the past week in an attempt to maintain freight rates as COVID-19 continues to destabilize supply chains.

Medical Suppliers Get Antitrust Clearance The US Department of Justice granted approval to five American medical-supply companies to combine logistical forces in order to distribute medical supplies where needed most. Freightwaves reports the companies requested the antitrust review since participating in the global Project Airbridge.

Bottlenecks Stall Food Supply Chains Prices are up for some basic food ingredients, while grain and other commodities are experiencing disruption, despite adequate supply, according to Supply Chain Dive, because of limited ocean shipping capacity, port personnel health checks, truck driver shortages, consumer stockpiling, and other COVID-19 turmoil.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- IMF stresses the magnitude of crisis as its Managing Director says the building economic crisis is “way worse” than the 2008 global financial crisis, claiming the IMF has never witnessed the world economy come to a standstill.

- Troubling preliminary data shows that, while most of the major economic data releases still cover the period before the full impact of the current pandemic measures, weekly jobless claims of 6.6m dwarfed the previous week’s record of 3.3m.

- March nonfarm payrolls fell by 701k, and the unemployment rate rose to 4.4%. These numbers did not capture the full effect of recent events. One economist’s plausible estimate put the unemployment rate at 13% and rising, the highest level since the Great Depression.

- Grim regional Fed numbers reveal the Dallas Fed general business index fell from 1.2 to -70, the lowest level since the survey started in 2004.

- Europe PMI plunges with the IHS Markit purchasing managers measure showing its biggest-ever monthly fall in March to a record-low level. Goods production fell for a 14th consecutive month.

Customs and Trade Updates

White House Will Not Implement Duty Payment Deferrals During a Bloomberg TV interview last week, Larry Kudlow, Director of the National Economic Council said the White House is not considering a 90-day deferral of tariff payments. They looked into possible "favored nation" duty relief, but ultimately felt it would be too complicated to implement.

CBP Publishes Quarterly Rates CPB posted their new quarterly rates effective from April 1, 2020 through June 31, 2020. They were unchanged from the previous quarter. Interest rates for underpayments will be 5% for both corporations and non-corporations. Interest rates for overpayments will be 4% for corporations and 5% for non-corporations.

USMCA Will Not Go Into Effect June 1 The USMCA implementation date was targeted for June 1, but it appears that July 1 will be a more likely implementation date. Canada announced that they were ready, while Mexico's senate leader tweeted that they prefer a July 1 implementation date to further clarify the rules of origin within the auto sector. Robert Lighthizer also sent a letter urging all parties to delay the June 1 start date.

For a roundup of tariff-related news, visit Tariff Insider.

Please note that the information in our publications is compiled from a variety of sources based on the information we have to date. This information is provided to our community for informational purposes only, and we do not accept any liability or responsibility for reliance on the information contained herein.