Global Logistics Update

Freight Market Update: April 18, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Freight Market Update: April 18, 2024

Trends to Watch

Ocean - FEWB

- Asia-Europe: The Red Sea situation continues to impact freight market development. Vessels continue to reroute via the Cape of Good Hope and vessel schedules continue to fluctuate. The MSC Aries vessel was seized over the weekend and Flexport is working closely with carriers if there are any further adjustments on the vessel deployment for Asia/Indian Subcontinent to Europe.

- After the Day 8 product reshuffle of Ocean Alliance and THE Alliance blank sailings, market capacity dropped by 10-13% in the first half of May. Vessel space is getting tighter with the Chinese Labor Holiday approaching, particularly from Greater China.

- Carriers are still implementing GRIs (General Rate Increase) to keep rates from dropping further. Maersk and CMA have a current rate level of $3800-4000 per 40 foot. Flexport is monitoring other liners’ approach to GRIs.

Air - Global (Data Source: WorldACD/Accenture)

- Global Rate Increase: Worldwide air cargo rates rose by over 2% in the first week of April, reaching $2.54 per kilo, nearly matching last year's levels and significantly above pre-COVID rates (+41% from April 2019). This upward trend continues despite a decline in tonnages due to global holiday periods like Easter, Ramadan, and Qingming Festival.

- MESA-Europe Spot Rates: There was a significant surge in spot rates from the Middle East & South Asia (MESA) to Europe, notably from India and Bangladesh. Rates from these origins more than doubled compared to last year, with India-Europe reaching $4.13/kg (+160%) and Bangladesh-Europe at $4.59/kg (+179%).

- Impact of Jet Fuel Prices and Container Shipping Disruptions: Increasing jet fuel prices (+4% WoW) and ongoing container shipping disruptions, especially in the Red Sea, are influencing air cargo rates. These factors, combined with strong cross-border e-commerce demand, continue to boost rates from Asia Pacific and MESA regions.

- Comparative Rate Trends: On a two-week basis, global rates increased by 4%, despite a drop in tonnages from Asia Pacific, MESA, and other regions. Significant fluctuations included a 9% global tonnage drop and flat rates from other origin regions like Africa, Europe, and North and South America.

- Regional Analysis: Year-on-year, MESA was the only region with a notable rate increase (+39%) due to strong demand (+11%) and moderate capacity growth (+6%). Elsewhere, rates generally fell, with Europe experiencing the most significant drop (-22%) despite global rates nearing last year's peak levels.

Please reach out to your account representative for details on any impacts to your shipments.

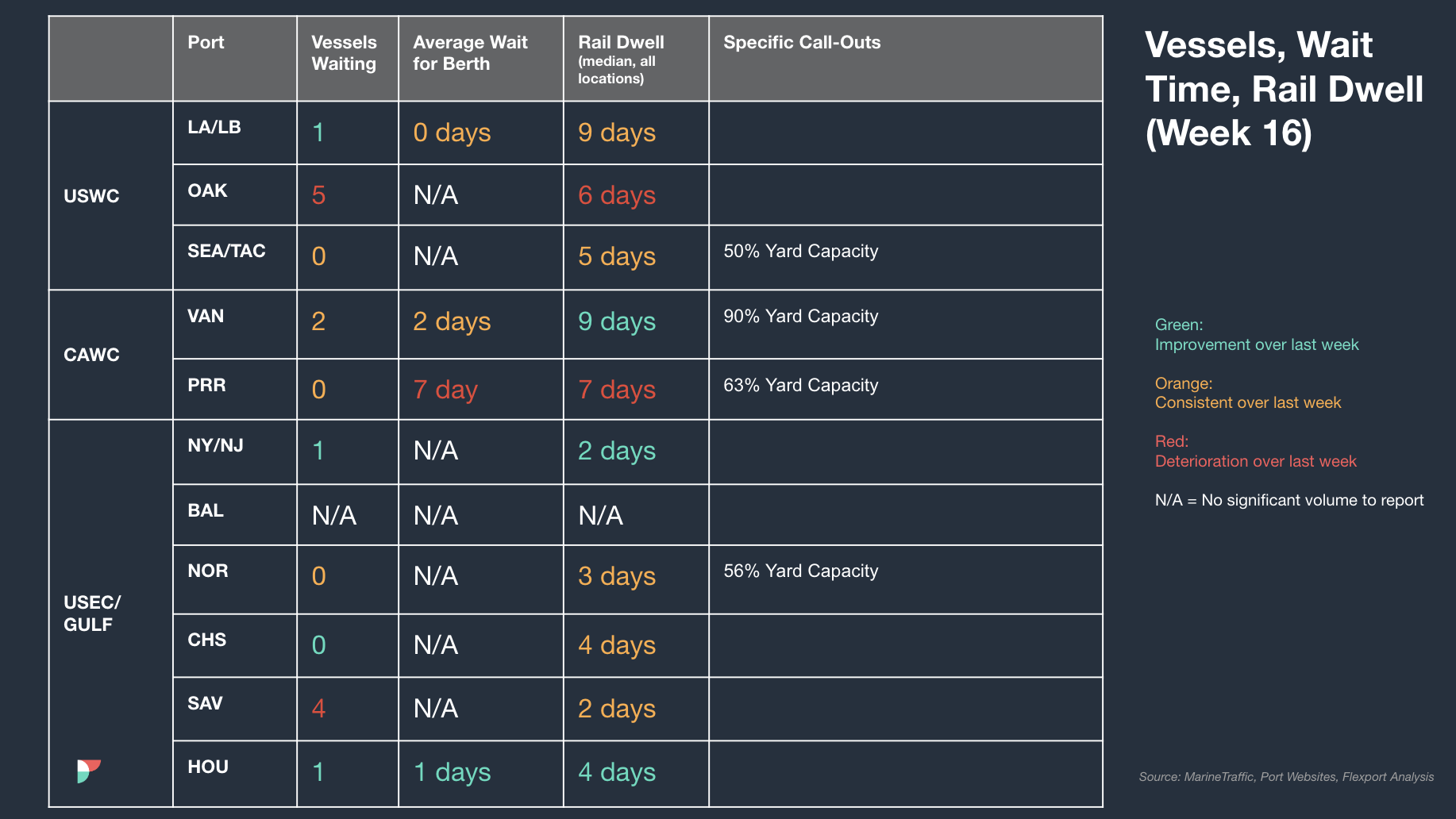

North America Vessel Dwell Times

Webinars

Decarbonizing Maritime Transportation in the Supply Chain

Monday, April 22 at 14:00 BST / 15:00 CEST

Europe Freight Market Update Live

Tuesday, April 23 at 15:00 BST / 16:00 CEST

North America Freight Market Update Live

Thursday, May 9 @ 9:00 am PT / 12:00 pm ET

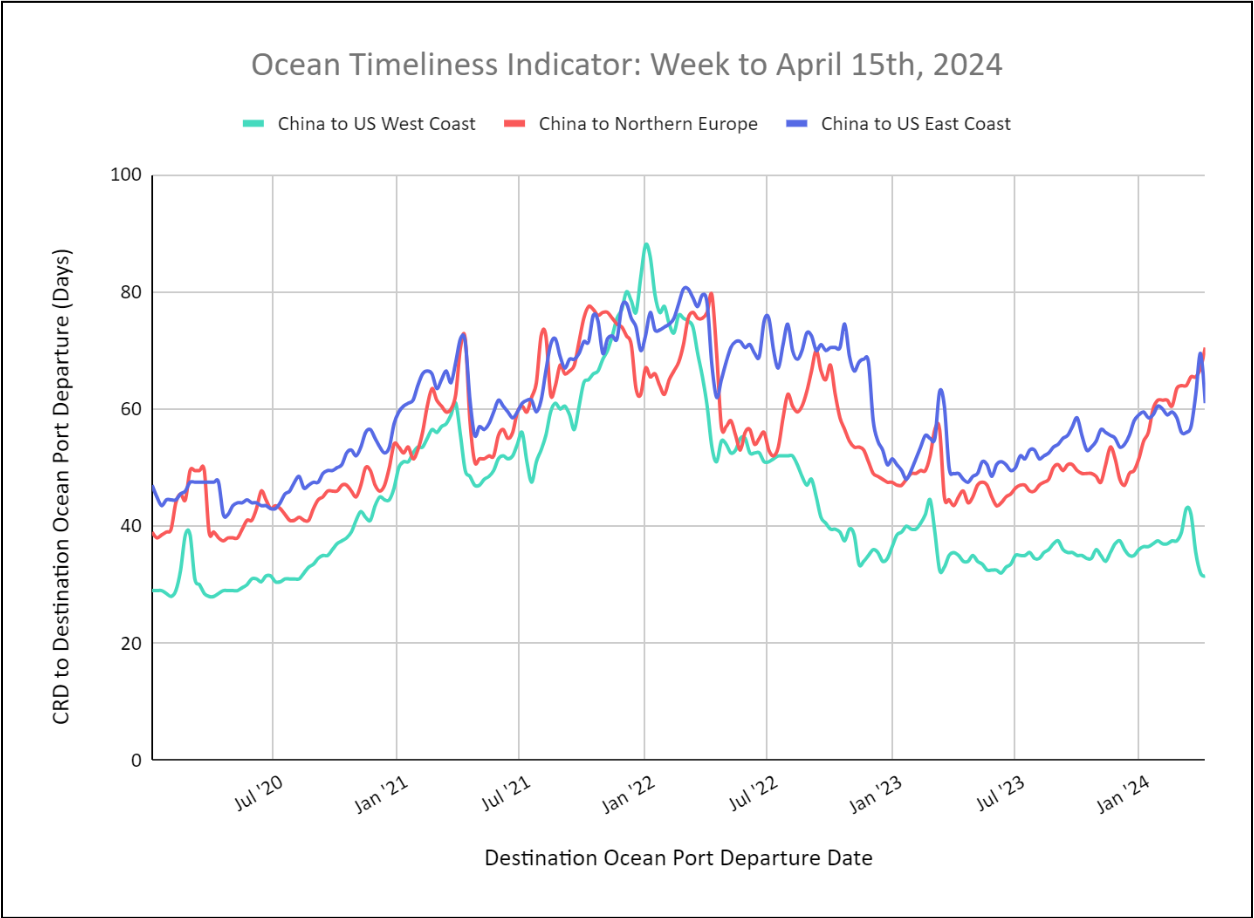

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators Decline for China to U.S. West Coast, Rise for China to U.S. East Coast and China to Europe

Week to April 25, 2024

This week, the OTI for China to Northern Europe continued to increase to 70 days, the highest since 2022, due to continued re-routings from the Suez Canal around the Cape of Good Hope. The OTI for China to the U.S. East Coast also decreased towards the new normal of 61 days as some carriers route westward around Cape of Good Hope. Most have decided to use the Panama Canal despite continued slot restrictions. We do not expect the Baltimore situation to impact the China to East Coast OTI overall. The OTI for China to the US West Coast remained steady at 32 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.