Global Logistics Update

Freight Market Update: April 24, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of April 24, 2019.

Freight Market Update: April 24, 2019

Want to receive our weekly Market Update via email? Subscribe here!

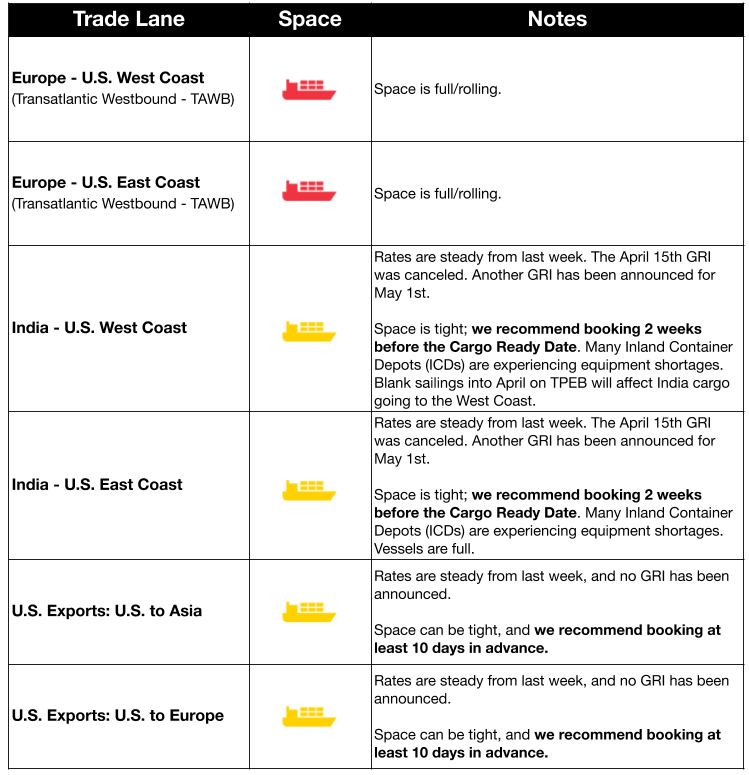

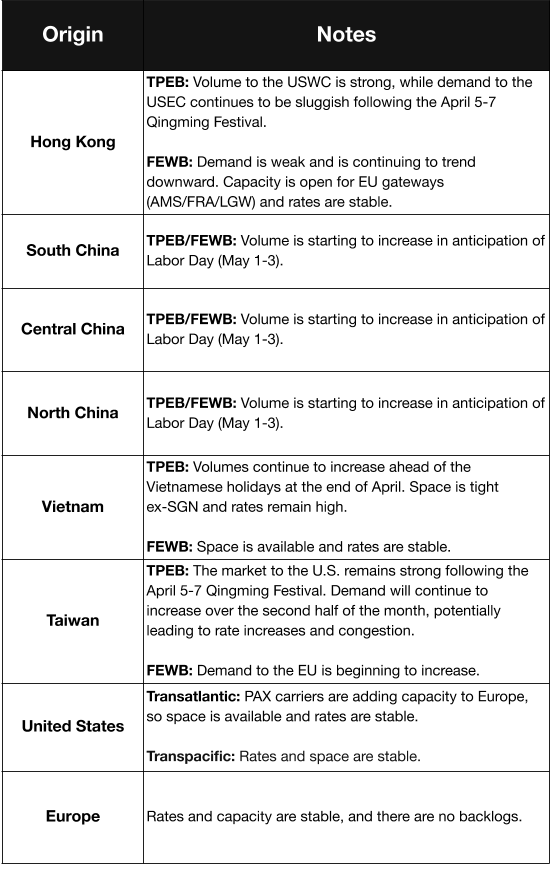

Ocean Freight Market Updates

**Earth Day Spotlight: Shipping’s Impact on Climate Change **

If shipping were a country, it would be the sixth-largest polluter in the world. We’re seeing its effects on climate change throughout the industry: the Panama Canal is especially dry this season and forcing vessel weight restrictions, and the increasing severity of typhoon season has been forcing extended closures at origin ports.

Flexport recognizes the impact of shipping on climate change, and is committing to offset all shipping-related carbon emissions of every disaster relief shipment we procure and manage in honor of this year’s Earth Day. Read more about our carbon-neutral initiative on our blog.

Weight Restrictions on Panama Canal Shipments

The Panama Canal restricts the draft (how deep the hull goes into the water) of vessels based on the amount of water available in Gatun Lake, which varies based on rainfall, amount of vessels and other factors. The current draft restriction is for no more than 44’ from a maximum of 49’. Ships must be lighter to meet the draft requirement, so they need to carry less cargo/ballast/fuel or offload cargo to the Panama Canal Railway.

The draft adjustments are estimated to have cost the canal $15M so far in 2019, because vessels must carry less cargo, and customers have been seeking out alternative services.

Carriers Form Digital Container Shipping Association

Maersk, Hapag-Lloyd, MSC and Ocean Network Express (ONE) have received regulatory approval from the Federal Maritime Commission (FMC) to form the Digital Container Association. The association plans to create “open source tools to speed up digitization in the industry,” to increase shipment visibility and the ability to track freight across carriers.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

Air Freight Market Updates

United’s Capacity Lowered Due to Boeing MAX Jets

United Airlines’ capacity growth is lower than originally forecasted since their 14 MAX jets were grounded following two deadly crashes involving the Boeing model. The 14 grounded jets represent only 1.4% of United’s total capacity, but executives have said that they can only continue using spare aircraft as replacements for “so long before challenges and costs mount.”

Delta Air Lines to Add Capacity

Delta Air Lines plans to add to overall capacity by 3-4% in 2019, with plans to launch additional services to Europe from Boston and New York. Domestic growth will diminish, however, to compensate for the additional capacity.

Jet Airways Suspends Operations

Jet Airways operations were completely grounded last week after emergency cash was not made immediately available. The airline was operating 600 flights a day a few months ago until funding fell through. Rivals are being temporarily given its landing slots and aircraft while Jet Airways hopes for a new buyer soon.

Trucking Market Updates

Convoy Launches Drop-and-Hook Program Nationwide

Convoy, a digital freight broker, has expanded its drop-and-hook (also known as drop-and-pick) program nationwide. The program will allow drop-and-hooks to be arranged through its application, utilizing a Convoy trailer pool. The application reduces waste and allows truckers to spend more time on the road and less time waiting on live loads.

**EU Parliament Approves New Emission Standards **

Manufacturers based in the EU will need to cut CO₂ emissions for new trucks and lorries by 15% by 2025 and by 30% by 2030. This new legislation will reduce emissions by 30% and will apply to the UK, even if/when it exits the European Union.

Drayage Capacity Not Suited for 2019 Market

Driver wait times have decreased across the nation after the trade war frontloading rush, but the drayage market is still underprepared for what’s ahead. Vessel sizes and container volumes are increasing and without planning for the need for drayage growth, ports are likely to become more congested with a worsened driver shortage.

Customs and Trade Updates

ITRAC Data Added to ACE

CBP will migrate Importer Trade Activity (ITRAC) data to the Automated Commercial Environment (ACE) reporting section of the portal in an effort to enhance available data in ACE. Previously, if an importer wasn’t an Importer Self-Assessment (ISA) certified member, they needed to submit an application and pay $250 to be sent a CD that compiled quarterly ITRAC data on their account. This new ACE capability replaces that process, although it won’t be completely transitioned out until the winter of 2019.

Novice Importer to Owe $300K in Penalties and Unpaid ADD

The Court of International Trade (CIT) ruled against an importer whose first shipment in 2003 failed to declare their product (stainless steel flanges) under the correct anti-dumping duty (ADD) order. The court stated that “even small, unsophisticated, first-time importers should understand that knowingly submitting false statements to CBP is illegal.” The case cited the company’s changing arguments that the items were not subject to ADD, then that the products were returned U.S. goods, then that the goods had been eligible for GSP duty-free treatment. The importer now owes $146,368.64 in unpaid duties, and $141,984.98 in penalties.

WCO to Approve New E-Commerce Standards

The World Customs Organization (WCO) is on the verge of approving new standards dealing with cross-border e-commerce standards. The proposed June framework has been reviewed, and the WCO is developing the ways in which these changes can be implemented. While no decisions have been finalized, and none are expected until at least June 2019, the WCO wants a document that guides and standardizes the challenges of the e-commerce landscape.

For a roundup of tariff-related news, read our Tariff Insider_. _