Global Logistics Update

Freight Market Update: July 11, 2018

Ocean, trucking, and air freight rates and trends for the week of July, 2018.

Freight Market Update: July 11, 2018

Want to receive our weekly Market Update via email? Subscribe here!

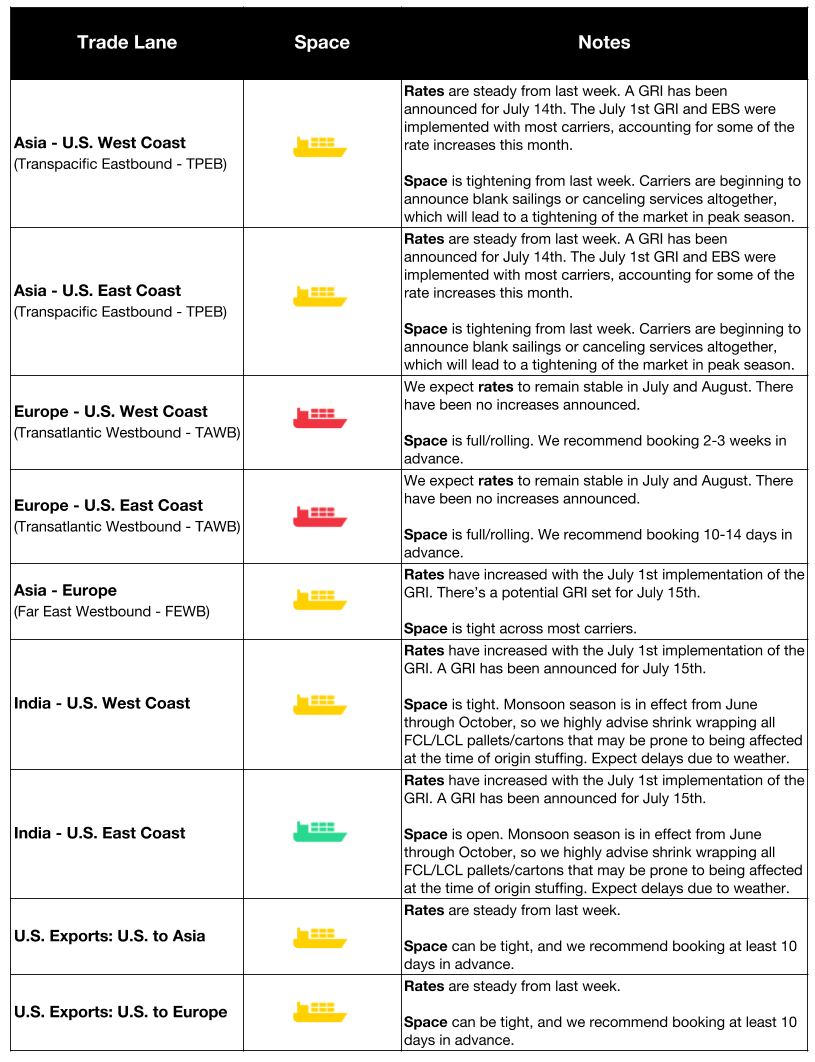

Ocean Freight Market Updates

Trans Pacific Carriers Announce Emergency Bunker Surcharges for July

The rising price of oil, which is set by the Brent Crude Oil price, has led many carriers to raise their prices. OPEC oil cuts are expected to continue through the end of 2018, with U.S. sanctions against Iran also expected to contribute to rising oil prices.

A number of carriers have announced an Emergency Bunker Surcharge (EBS), which will begin on July 1st.

Related blog post: What you need to know about the Emergency Bunker Surcharges

**Typhoon Maria Hits Taiwan and China **

Typhoon Maria has made landfall, and is affecting a number of people. Hundreds of thousands of people have been evacuated, major roadways have been destroyed, and a number of schools have closed until further notice.

Please note that shipments will be delayed due to the typhoon. We will continue to be in contact with our clients regarding any existing or upcoming shipments that may be affected.

U.S. Threatens Additional Tariffs on $200 Billion Worth of Chinese Goods

The trade dispute escalated on Tuesday, as the Trump administration said it would levy tariffs on an additional $200 billion worth of goods. These tariffs will go into effect if Beijing does not change its trade practices. The new round of tariffs would increase prices for a number of American retailers, affecting consumer goods such as electronics, tools, and housewares.

Rising Retail Demand Drives Shipments to U.S. Ports

Concern among large manufacturers (in anticipation of changes to trade policies), paired with growing retail demand, has led to an increase in cargo volume at U.S. seaports. The National Retail Federation reports that in the first half of the year, retail imports to U.S. ports should reach 10.2 million 20-foot equivalent units (TEUs), which is an increase of 3.8% year-over-year.

A Record $1.5 Trillion Was Spent on Shipping Costs in 2017

U.S. companies are spending a record amount on transportation and warehousing due to increasing demand and prices for logistics services. According to the Council of Supply Chain Management Professionals’ annual State of Logistics report, costs for nearly all aspects of logistics have increased.

Businesses should expect for additional costs in the year ahead, as rising interest rates, higher fuel prices, and impending tariffs will add to total expenses.

**Container Lines Worry About Repercussions of Sulphur Cap **

The International Maritime Organization (IMO) decided to implement a 0.50% sulphur cap on marine fuel, effective January 1, 2020. The move to cut sulphur oxide emissions has many container lines worried, as the decision translates to an estimated extra cost of $50bn.

To comply with the IMO’s decision, vessels will have to either equip themselves with exhaust gas cleaning systems (known as scrubbers) or burn a compliant bunker fuel. Ocean carriers worry that they won’t be able to recover the additional costs from shippers.

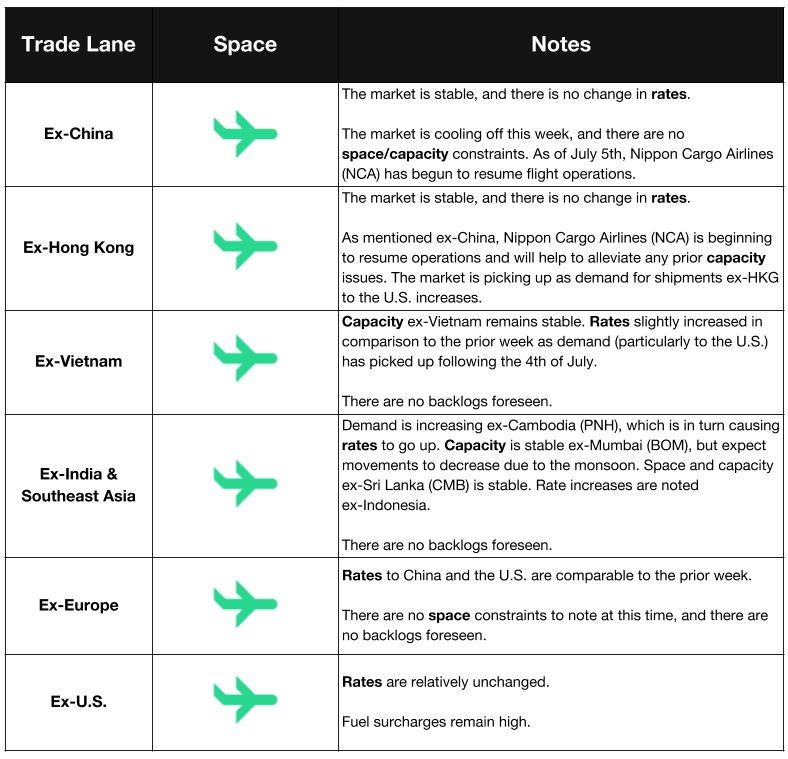

Air Freight Market Updates

**ELD Mandate Negatively Impacts Air Cargo **

The electronic logging device (ELD) mandate’s repercussions move far beyond the road, as air cargo providers are citing negative consequences. Higher trucking rates, delays, and even modal switches are some of the negative consequences for air cargo.

Related: The Electronic Logging Device (ELD) Mandate -- What You Need to Know

**Forwarders & Shippers Prepare for Low Air Capacity **

The 2017 capacity constraints for air freight aren’t forgotten in the minds of shippers and forwarders. In response to last year’s shortages and higher-than-usual rates, shippers are looking for guaranteed space throughout the year for their products, and some are looking for their own planes. Forwarders are chartering more flights to guarantee space, and reserving planes for select shippers.

The Loadstar reports that demand growth is at 4-5%, and that April, which is usually the beginning of slack season, was stronger than expected.

Related blog post: Investing in Service, Flexport to Charter its Own Aircraft

Trucking Market Updates

Updated PierPass OffPeak System to Start in Fourth Quarter

On June 26th, members of the West Coast MTO Agreement (WCMTOA) announced that the program for providing extended gate hours (PierPass 2.0) has a planned start for the fourth quarter of 2018. A Q&A on the revised OffPeak program is available here.

U.S. Drayage Market is Up

Drayage demand in the U.S., which has been strong in 2018, has seen a spike over the last two weeks. Demand is high for freight shipping as well, with volume up 7.1% on a year-over-year basis.

There are a number of theories regarding the cause of increased drayage demand, but the JOC reports that no one knows exactly why.

LA-LB Terminals Agree to Restructure PierPass Program

Agreeing to restructure the 13-year-old PierPass program, Los Angeles-Long Beach marine terminal operators will reduce the traffic mitigation fee to $31.52 per TEU, a 55% reduction.

Assuming the Federal Maritime Commission approves the restructuring, the new pricing will take effect in August 2018.