Global Logistics Update

Market Update: June 2017

Recent news and updates related to the ocean and air freight market for the month of June 2017.

Market Update: June 2017

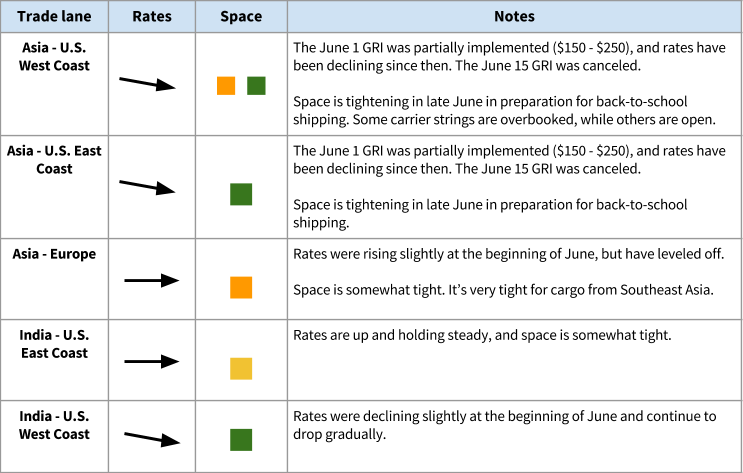

Ocean Rates for June 2017

Peak season is coming

Peak season will kick off in July, which means that PSS may be applicable starting July 15.

Space will tighten for Asia - US

Space from Asia to the U.S. is expected to tighten beginning in late June or early July for back-to-school shipping.

Equipment shortages at China base ports

We’re seeing scarce equipment at China base ports, especially Shanghai, Ningbo, and Shenzhen. We suggest booking and picking up empty containers as early as possible to maximize container availability.

Ramadan will impact cargo from South Asia

Ramadan began on May 27. We’ll see blank sailings, delays, and congestion at many South Asian ports, due to reduced working hours and public holidays.

NOR: A good alternative when space is tight

This time of year, we see a lot of reefers (refrigerated containers) bringing fresh produce from U.S. markets to Asia -- but there isn’t nearly as much produce for them to ship from Asia back to the U.S. This means that carriers are searching for products to fill up those empty reefer containers back to the U.S. (otherwise, it’s wasted space for them). Ask us if non-operating reefers (NORs) are a good fit for you!

Hapag-Lloyd - UASC merger is now complete

Hapag-Lloyd and UASC have completed their merger. We don’t expect this to impact rates or capacity (no capacity is being removed), and each will continue to act as their own line. For now, it will mainly serve to reduce costs for the newly joint company, allowing for increased efficiency. '

Congestion continues in Shanghai

Congestion continues at the Port of Shanghai, caused in part by the April 1 ocean alliance reshuffle, and also by bad weather. Moving into summer, the weather should improve, and we expect congestion to ease as well.

Air Market Updates

Air freight capacity ex-Asia continues to be tight, with year-over-year demand growth expected to continue in the double digits for Q2, following a 15% increase in March and a strong acceleration in May.

Tight capacity continues to be driven by three main factors:

- The ocean alliance shift in April (and the associated new shipping schedules and ship re-positioning) has led to a shortage of ocean capacity, therefore boosting air freight volume

- Increased retail spending online (e-commerce), the result of healthier economic backdrops and higher consumer confidence, is driving business-to-consumer delivery demand

- Project shipments by a few select tech companies have compounded capacity constraints ex-China

Prices are still high and show no signs of dropping

Slack season is usually April-June, but we have experienced a sustained peak that began after Chinese New Year at the end of January; we expect this to continue and for rates to remain high for the rest of Q2.

At this point, there are no indications the market will ease up. Specifically, we've seen two Taiwanese carriers announce significant rate increases of 10-15%. Also, carriers are beginning to implement separate fuel surcharges - a change from all-in rates - to account for fluctuations in fuel costs.

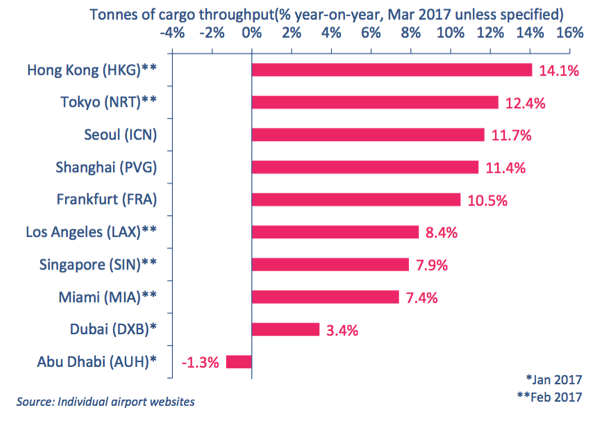

This graph shows the increase in cargo throughput at major airports:

© International Air Transport Association, 2015 . Cargo Chartbook Q1 2017. All Rights Reserved. Available on IATA Economics page_. _

Flexport LCL Updates

Flexport's in-house LCL consolidation service is now operating on 60 lanes into the US, Canada, and the UK out of major China base ports and Taiwan. View the full list of lanes here.

If you move LCL from Shanghai to Los Angeles, ask your Flexport team about our premium Matson service, with 10-day port-to-port transit time. This service guarantees vessel discharge within 1 day of arrival at port, and we're able to pick it up for deconsolidation immediately.

Other Freight Market News

FTL delays for International Roadcheck

International Roadcheck is scheduled to take place June 6-8. It’s a three-day targeted enforcement program for commercial motor vehicles, and will result in thousands of inspections of motor carriers, commercial trucks, and drivers.International Roadcheck may lead to delays and/or increased costs during this time period, for a few reasons:

- Some FTL carriers and drivers choose not to operate during the week of International Roadcheck. This constrains overall capacity.

- Non-compliant drivers and vehicles taken out of service will cause reduced capacity and delays.

- All drivers must wait in lines (which are sometimes long) until they are inspected. The inspection itself takes about an hour.

Congestion in Seattle

At the beginning of June, we’re seeing congestion at some Seattle-Tacoma port terminals, due to an increase in new business from the ocean alliance reshuffle. You may see delays as a result of long trucking wait times.