Global Logistics Update

Freight Market Update: June 28, 2018

Ocean, trucking, and air freight rates and trends for the week of June 28, 2018.

Freight Market Update: June 28, 2018

Want to receive our weekly Market Update via email? Subscribe here!

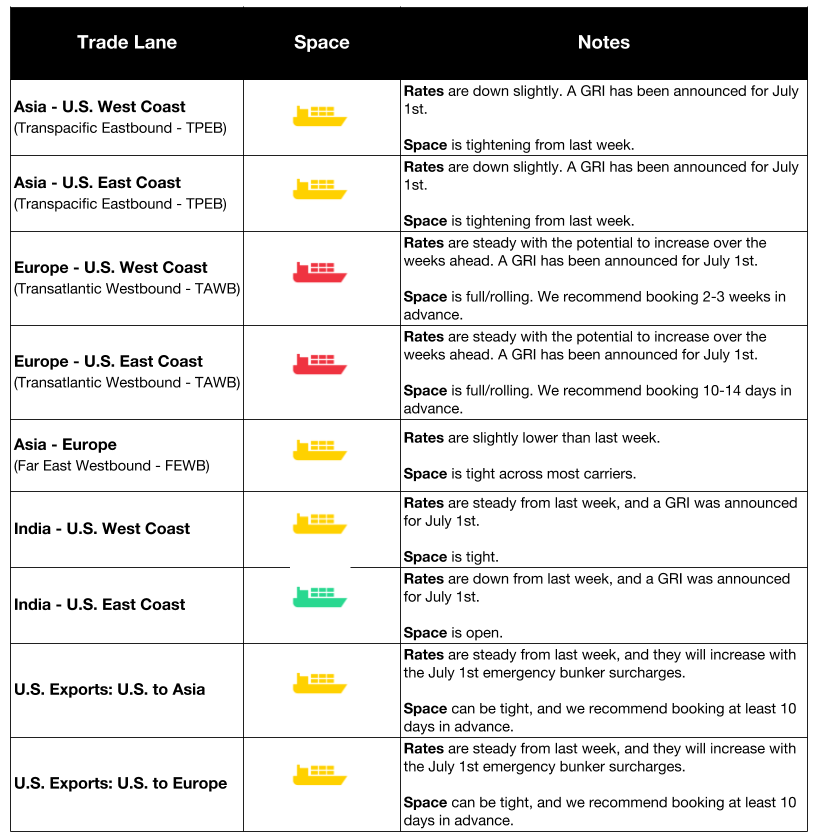

Ocean Freight Market Updates

**Temporary Port Closures Scheduled **

All West Coast ports in the U.S. will be closed on 7/4 and 7/5; all other inland and ocean ports will be closed on 7/4. Most US carriers, including cartage and airport operations, will be closed in observance of independence day as well.

Rising Retail Demand Drives Shipments to U.S. Ports

Concern among large manufacturers (in anticipation of changes to trade policies), paired with growing retail demand, has led to an increase in cargo volume at U.S. seaports. The National Retail Federation reports that in the first half of the year, retail imports to U.S. ports should reach 10.2 million 20-foot equivalent units (TEUs), which is an increase of 3.8% year-over-year.

EU Responds to U.S. Tariffs With Rebalancing Measures

Responding to President Trump’s duties on steel and aluminum imports, the EU will start imposing retaliatory tariffs on U.S. goods on Friday. These rebalancing measures will immediately target a list of products worth €2.8 billion and will come into effect on June 22nd, increasing the total worth to €6.4 billion

In response to the EU countermeasures, President Trump threatened to impose duties on European cars. As of 2016, the U.S. accounted for approximately 25% of all EU auto exports.

A Record $1.5 Trillion Was Spent on Shipping Costs in 2017

U.S. companies are spending a record amount on transportation and warehousing due to increasing demand and prices for logistics services. According to the Council of Supply Chain Management Professionals’ annual State of Logistics report, costs for nearly all aspects of logistics have increased.

Businesses should expect for additional costs in the year ahead, as rising interest rates, higher fuel prices, and impending tariffs will add to total expenses.

**Container Lines Worry About Repercussions of Sulphur Cap **

The International Maritime Organization (IMO) decided to implement a 0.50% sulphur cap on marine fuel, effective January 1, 2020. The move to cut sulphur oxide emissions has many container lines worried, as the decision translates to an estimated extra cost of $50bn.

To comply with the IMO’s decision, vessels will have to either equip themselves with exhaust gas cleaning systems (known as scrubbers) or burn a compliant bunker fuel. Ocean carriers worry that they won’t be able to recover the additional costs from shippers.

Maersk to Add Trans-Atlantic Loop

Beginning July 2nd, Maersk Line will launch a new trans-Atlantic service. This will connect four ports in the Mediterranean with two in Canada. Aided by two new trade deals, the Comprehensive Economic and Trade Agreement (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific partnership (CPTPP), Maersk believes maritime container volume will grow by 7% in 2018.

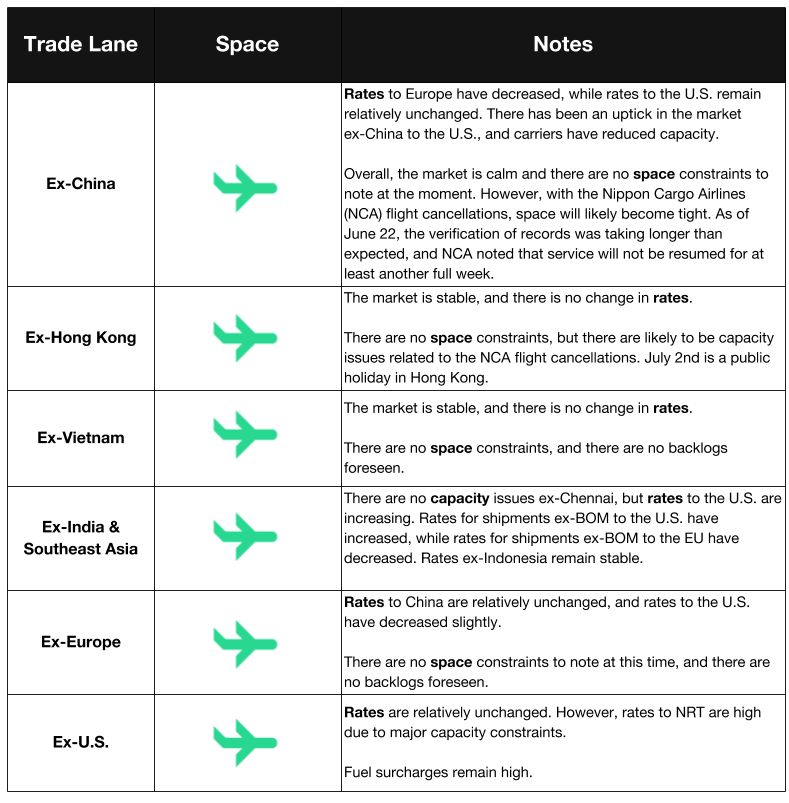

Air Freight Market Updates

**Japanese Airline Nippon Cargo Airlines (NCA) Suspends All Operations **

Eleven NCA 747 freighters were grounded on Saturday (June 16th) after government inspectors uncovered “inappropriate” maintenance records at its Narita hub. Inspections are currently underway, and NCA said the suspension will be in place for at least a week. The maintenance record in question concerns “lubricating oil supply to the aircraft parts at Narita airport on 3 April,” reports The Loadstar_. _

Please note that space will likely be tight as a result of the suspension.

**ELD Mandate Negatively Impacts Air Cargo **

The electronic logging device (ELD) mandate’s repercussions move far beyond the road, as air cargo providers are citing negative consequences. Higher trucking rates, delays, and even modal switches are some of the negative consequences for air cargo.

Related: The Electronic Logging Device (ELD) Mandate -- What You Need to Know

**Forwarders & Shippers Prepare for Low Air Capacity **

The 2017 capacity constraints for air freight aren’t forgotten in the minds of shippers and forwarders. In response to last year’s shortages and higher-than-usual rates, shippers are looking for guaranteed space throughout the year for their products, and some are looking for their own planes. Forwarders are chartering more flights to guarantee space, and reserving planes for select shippers.

The Loadstar reports that demand growth is at 4-5%, and that April, which is usually the beginning of slack season, was stronger than expected.

Related blog post: Investing in Service, Flexport to Charter its Own Aircraft

Trucking Market Updates

Updated PierPass OffPeak System to Start in Fourth Quarter

On June 26th, members of the West Coast MTO Agreement (WCMTOA) announced that the program for providing extended gate hours (PierPass 2.0) has a planned start for the fourth quarter of 2018. A Q&A on the revised OffPeak program is available here.

U.S. Drayage Market is Up

Drayage demand in the U.S., which has been strong in 2018, has seen a spike over the last two weeks. Demand is high for freight shipping as well, with volume up 7.1% on a year-over-year basis.

There are a number of theories regarding the cause of increased drayage demand, but the JOC reports that no one knows exactly why.

LA-LB Terminals Agree to Restructure PierPass Program

Agreeing to restructure the 13-year-old PierPass program, Los Angeles-Long Beach marine terminal operators will reduce the traffic mitigation fee to $31.52 per TEU, a 55% reduction.

Assuming the Federal Maritime Commission approves the restructuring, the new pricing will take effect in August 2018.