Global Logistics Update

Freight Market Update: March 25, 2020

0

Freight Market Update: March 25, 2020

How will businesses recover from COVID-19? When will factories start running again? And how can you ensure your cargo is moving when they do? Visit Flexport’s COVID-19 Trade Insights for information and analysis.

Want to receive our weekly Market Update via email? Subscribe here.

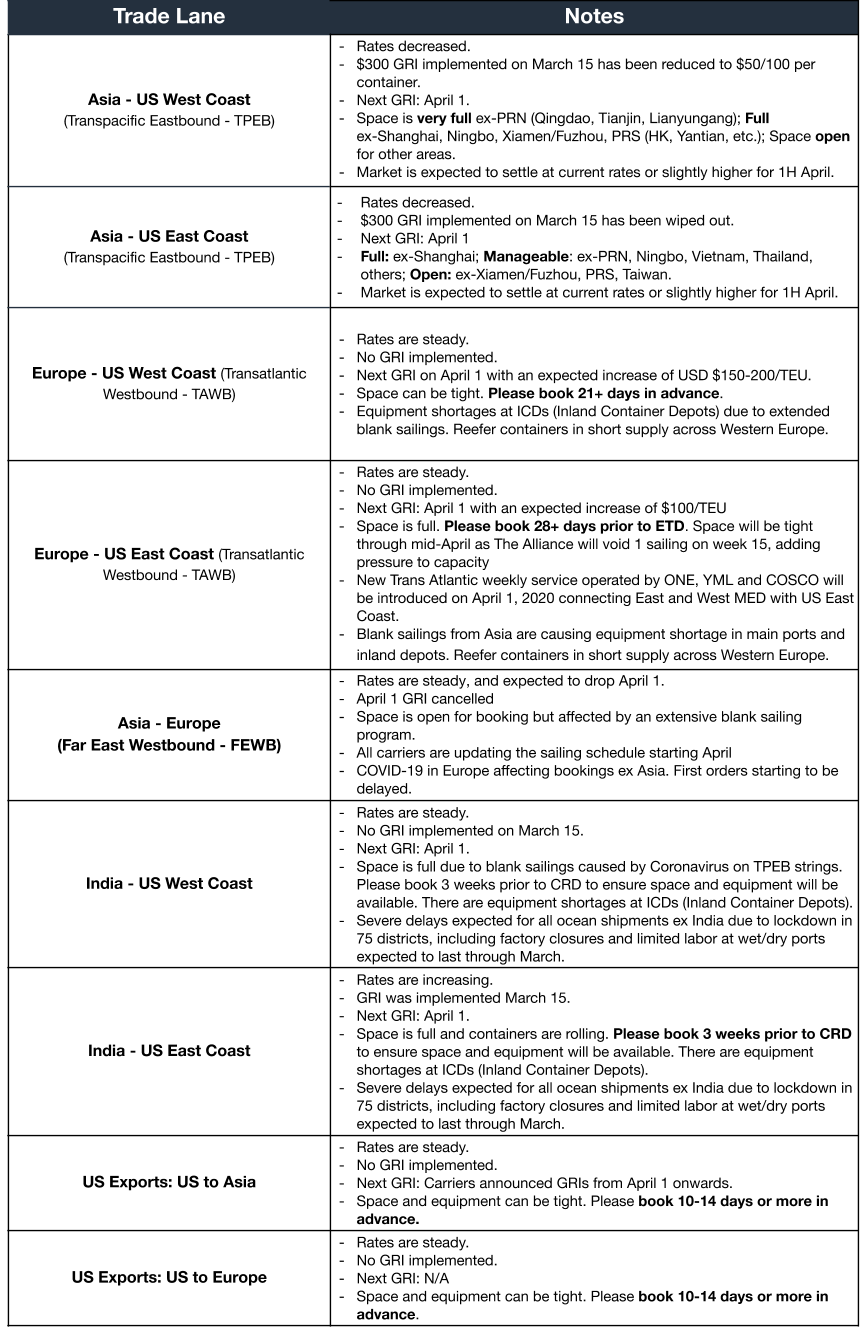

Ocean Freight Market Update

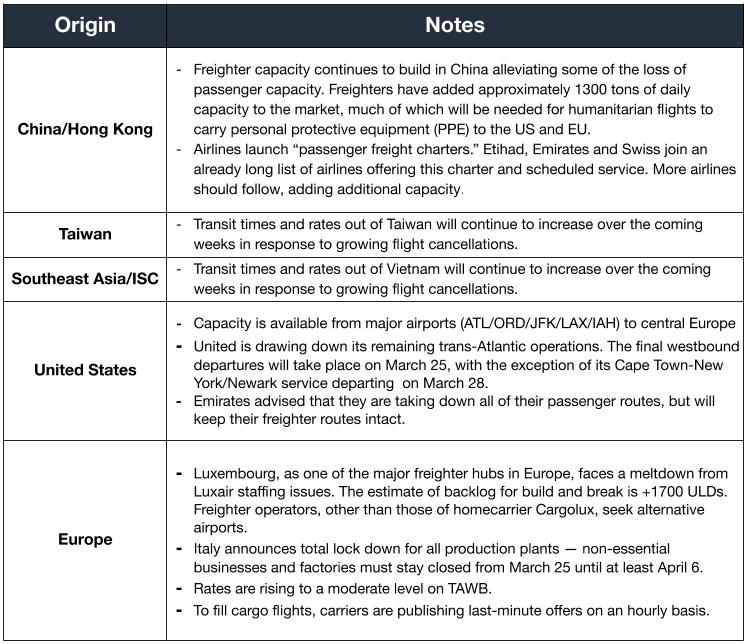

Air Freight Market Update

Freight Market News

Port Pile-Ups May Move West As China awakens from its economic standstill, US and European ports struggle with worker quarantines, container shortages, and terminal closures caused by COVID-19 that could leave cargo piled up in Western ports in a few weeks. According to WSJ, some experts see the past few months’ experience sharpening logistics strategies, while one shipowner’s COO calls it “a roll of the dice.”

DOH Lists Essential Transport Workers A recent memo from the Department of Homeland Security’s Cybersecurity & Infrastructure Security Agency (CISA) identifies essential transportation and logistics workers. American Shipper reports the memo is meant to guide local governments as states continue to issue stay-at-home orders.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- US stock markets dropped sharply last week as the health and economic repercussions of the novel Coronavirus outbreak sank in. In the US, the S&P 500 had its worst week since the 2008 financial crisis, falling 15%.

- Other global indices fell as well, though not as sharply. In Asia, the Nikkei was down 5.0% for the week, the Hang Seng down 5.1%. In Europe, the DAX and the FTSE 100 were down 3.3%.

- The WTI oil price had its largest weekly fall since 1981.

March numbers drop with the New York and Philadelphia Feds releasing gloomy survey data from early March surveys, both well below expectations. The NY Fed survey of general business conditions showed the worst figure since March 2009. The Philadelphia survey of manufacturing was the weakest since July 2012. - Weekly jobless claims last week rose dramatically to 281,000. Preliminary numbers from just 15 states show almost 630,000 claims for the next week.

- GDP forecasts are dark and fuzzy, according to a WSJ survey of 34 economists last week with Q2 US estimates ranging from -4% to -10%. JP Morgan came in with a -14% estimate. Then, Friday, Goldman Sachs predicted -24%. The range of forecasts is itself remarkable and reflects the lack of any clear analogous case on which to base a model. These forecasts also generally call for a substantial recovery in Q3 and Q4.

- A $2 trillion Senate stimulus bill failed a procedural vote on Sunday night, but as of Wednesday, quick passage was expected.

Customs and Trade Updates

USTR Grants Exclusions to List 3 The USTR issued 177 new product exclusions to Section 301 List 3. The exclusions apply retroactively to the September 24th, 2018 implementation date. The list covered one full 10-digit HTS and 176 specifically prepared product descriptions. These granted exclusions will remain in place until August 7th, 2020. The notice also makes a request for comments on any tariff/product tied to the COVID-19 outbreak response.

Customs COVID-19 Updates

CBP Determining on Duty Deferral Program

NCBFAA and other industry members suggested last week that CBP allow extensions for payments of duties and fees. On Friday, CBP posted a CSMS message stating that they are "accepting requests for duty payment extensions." Currently, the only payments that can be granted extensions are the ones made directly from the importer and their own ACH account. Parties interested in delaying their duty payments can reach out to Randy Mitchell (randy.mitchell@cbp.dhs.gov). CBP is reviewing the possible options on the table and hopes to give the trade community an update soon with additional announcements.

Bond Insufficiencies

CBP posted a CSMS message stating that they will grant 10-day extensions for insufficient bonds to tie out the termination and replacement of the bond for any that were set for termination by March 31, but no later than April 15.

Border Closures US, MX, CA

US, Canada, and Mexico instituted border closures to restrict movement between the countries. The closures only restrict travelers and not international commerce.

WCO Classification Reference Guide

The World Customs Organization provided a document to help the trade community with HTS numbers associated with COVID-19 medical supplies.

For a roundup of tariff-related news, visit Tariff Insider.