Global Logistics Update

Freight Market Update: March 6, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of March 6, 2019.

Freight Market Update: March 6, 2019

⚠️Reminder Notices ⚠️

LA and NY Trucking Still Experiencing Congestion

Congestion at the ports of Los Angeles/Long Beach has eased up some after Chinese New Year, but delays are still longer than usual. New York and New Jersey ports are still heavily congested.

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. Quay side operations have improved, but a shortage of haulage capacity restricts movement.

Haulage capacity in Germany and the Benelux also remains a challenge, impacted by low water in the river Rhine, reducing intake of barges and increasing moves via rail and truck.

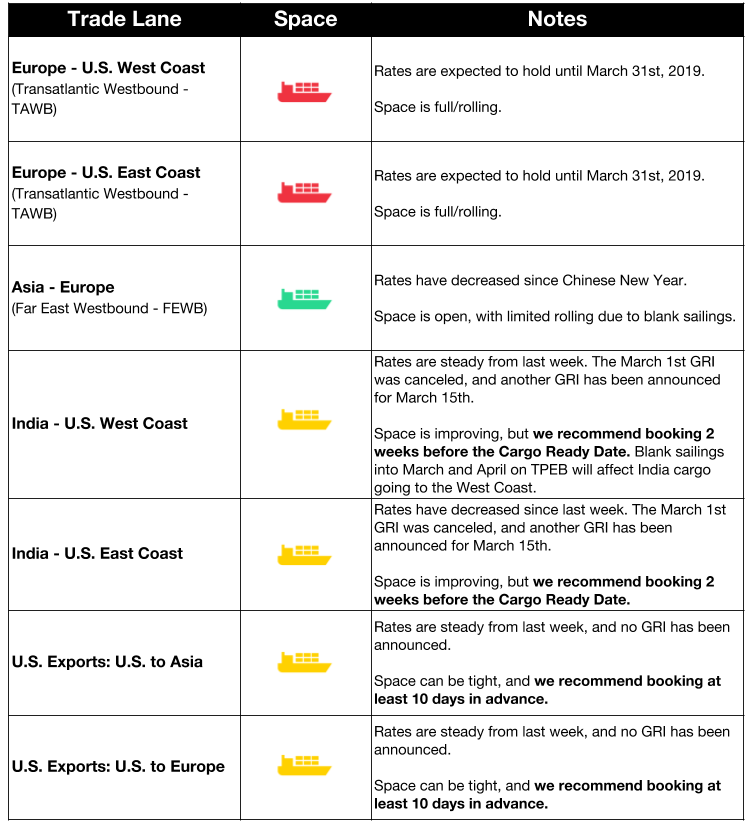

Ocean Freight Market Updates

Port Tampa Bay Added to Pacific Express 3 Rotation

The Florida port has been added to CMA CGM’s Pacific Express 3 rotation. The addition makes Tampa the fourth stop on the Gulf Coast, before the string continues on to Miami and Jaxport. The port addition allows Central Florida shippers to avoid high long-haul trucking costs.

**Container Imports Exceeding Exports **

More empty containers are being exported back to Asia than ever before, bringing empty containers up to a record 25.6% of all movements. The trade war has been cited as the cause for the increase in deadheading, as shippers imported goods into the U.S. ahead of the tariff hike, but U.S. exports “remained stagnant.”

FMC Completes Fee Investigation

The Federal Maritime Commission (FMC) concluded their year-long investigation into detention and demurrage and found them to be “just and reasonable.” The final report, expected in September, will provide standardization recommendations.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result. Ocean carriers are expected to need much higher bunker surcharges to offset the cost of the regulations.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

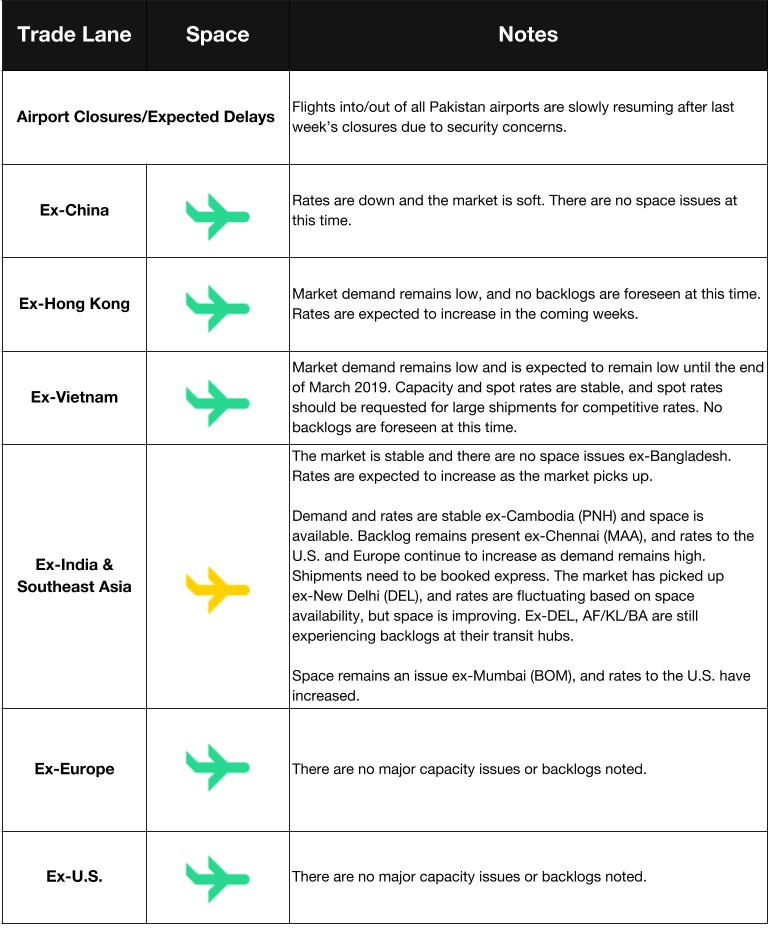

Air Freight Market Updates

Boeing Prepares for Brexit

Boeing is placing spare airplane parts around the UK and the world in preparation for a no-deal Brexit. Ken Shaw, head of supply chain management, said that in light of the UK’s uncertain trade future, “we are having to be more purposeful so we are redistributing inventory.”

Pakistan Flights Returning

Pakistan had closed its air space following tensions with India, causing Emirate and Qatar Airways to suspend flights beginning on February 27. Flights that fly between Pakistan and India had been forced to a temporarily reroute, but flights are slowly resuming.

Trucking Market Updates

**Port of Dover Optimistic on Brexit Delays **

A new report says that Dover’s operations would be able to continue as normal even if dwell times and Calais port times increased by 50%. Dover’s port capacity is able to handle the additional 50%, although the port would need to maintain their current vehicle check-in efficiency.

Amazon Advising UK Sellers to Prepare for Brexit

Amazon is advising its FBA sellers to stock up with at least four weeks worth of inventory in case the UK leaves the EU in March without a trade deal in place. Delays in trucking and customs clearance are expected in the event of a no-deal Brexit, and the resulting longer shipping times may make UK products less competitive. Sellers are advised to have additional stock imported by March 17th.

Customs and Trade Updates

India and Turkey Designations Terminated from GSP

In a March 4th press release, U.S. Trade Representative Robert Lighthizer announced that India and Turkey will be removed as beneficiary countries in the Generalized System of Preferences (GSP) trade program. The release stated that India failed a compliance check, and implemented a wide array of trade barriers that negatively affected U.S. commerce. Turkey was removed because the country had economically developed to the point where it should no longer benefit from preferential market access. These changes will take effect 60 days after Congress and the governments of India and Turkey are officially notified.

Nearly 1,000 Exclusions from Section 301 Granted

The office of the U.S. Trade Representative (USTR) released a document that shows that 985 exclusions have been granted, out of more than 10,000 requests, from the first tranche of section 301 goods. The granted exclusions are retroactive to the July 26, 2018 implementation date, and apply to all importers that brought in goods under those tariffs. 21 tariffs were granted exclusions.

**2019 Trade Agenda Released **

The USTR has released a 373-page document and put out a press release that outlines their 2019 agenda. The Trump Administration release covers a wide array of topics, with focus on modernizing policies to help aid U.S. growth. The release determined that many of the free trade programs currently in place put the U.S. at a disadvantage, and put emphasis on trade agreements and the ratification of the USMCA. China and the issues that led to the current trade war were also heavily addressed.

For a roundup of tariff-related news, read to our Tariff Insider_. _