Global Logistics Update

Freight Market Update: May 29, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of Month Date, Year.

Freight Market Update: May 29, 2019

Want to receive our weekly Market Update via email? Subscribe here!

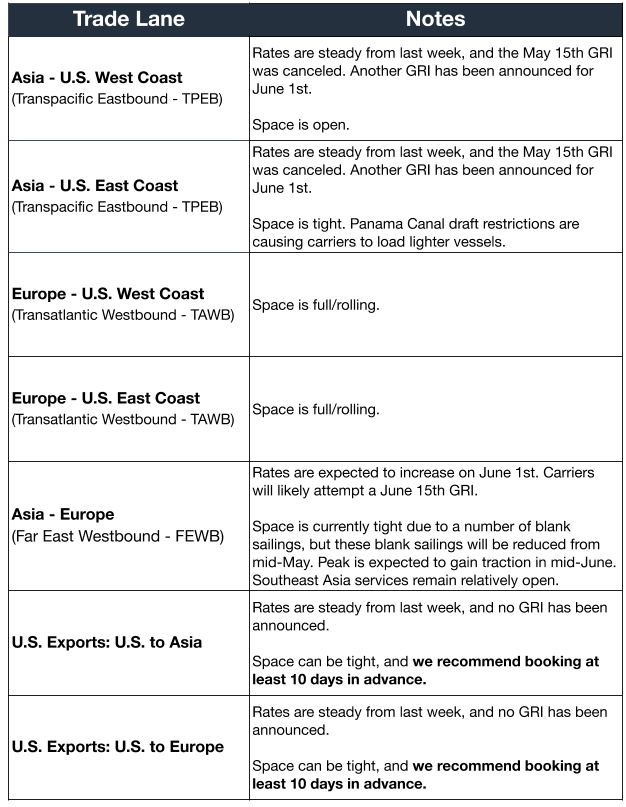

Ocean Freight Market Updates

BCMEA Lockout at All British Columbia Ports

The British Columbia Maritime Employers Association (BCMEA) has formally announced a lockout of longshore employees across all of British Columbia, including ports and terminals in Vancouver, Vancouver Island, Prince Rupert and Stewart. Stay tuned for updates on the situation and how it will affect operations on our blog.

Hari Raya Holiday Season May Cause May and June Delays

The Muslim holiday will likely cause shipping delays in Indonesia, Malaysia, Singapore, and other observing countries as those celebrating take time away from work. Your operations team will keep you informed of any delays to your shipments.

Weight Restrictions on Panama Canal Shipments

The Panama Canal restricts the draft (how deep the hull goes into the water) of vessels based on the amount of water available in Gatun Lake, which varies based on rainfall, amount of vessels and other factors. Ships must be lighter to meet the draft requirement, so they need to carry less cargo/ballast/fuel or offload cargo to the Panama Canal Railway.

The Panama Canal Authority has postponed the further reduction to allowable vessel draft for the Neopanamax locks and Panamax locks from May 28, 2019 to June 12, 2019 due to increased rainfall. The long drought has cut capacity through the canal by almost one-fifth and boosted rates for shipments headed to the U.S. East Coast.

CMA CGM Purchases 50,000 Container Trackers

CMA CGM has ordered 50,000 container trackers this year, after investing in the production company, Traxens, back in 2012. The trackers are attached to containers, and can provide data on “the container’s position, both at sea and on land, the intensity of any shocks that may occur, the opening and closing of doors, and external temperature variations.” The purchase announcement comes a year after MSC said it would begin outfitting 50,000 containers with smart technology in the next few years.

Lack of Tariff Front-Loading May Boost Falling Rates

More transpacific sailings were canceled this week and rates continue to fall, but carriers are hopeful of an uptick coming soon. Import volumes had soared at the end of 2018 as importers front-loaded shipments in advance of the anticipated January tariff hike, but advance notice wasn't given for the most recently announced tariffs. Carriers say that the stockpiles imported into the U.S. before the tariffs are likely now running low and will force importers to start bringing in more goods despite tariffs.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

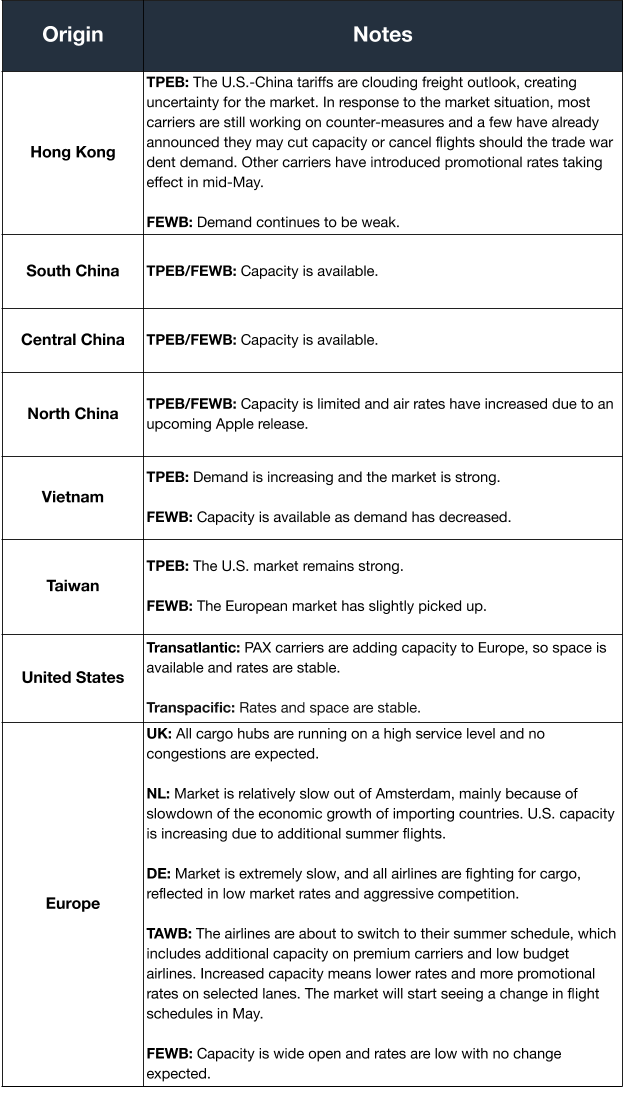

Air Freight Market Updates

Pilots Protest Amazon Air Suppliers

Pilots protested last week outside of Amazon’s annual shareholder meeting in Seattle, claiming that the carriers who fly for Amazon -- ABX, Atlas Air and Southern Air -- were ignoring safety concerns. According to Atlas Air pilot and Airline Professionals Association (APA) spokesperson Robert Kirchner, “Atlas pilots are overworked, underpaid and disrespected [and] our planes are not adequately staffed or maintained.” Amazon has threatened to change carriers if a negotiation can’t be reached.

Huawei Ban Worsens Soft Air Market

“Semi-conductors have long been a bellwether for the air cargo industry,” according to The Loadstar, and now that Huawei is banned from purchasing U.S.-made parts, the air freight market is expected to feel the effects of dipping sales. Demand remains low across the market, especially between Asia and Europe.

Trucking Market Updates

Mirrorless Trucks Entering Testing Phase

Two technology companies, Stoneridge and Bosch, are testing out camera systems on trucks that could replace external mirrors. Stoneridge says that its mirrorless system offers a 25% greater field of view compared to conventional mirrors, and that it could help reduce driver fatigue. Other companies are developing similar systems and according to Freightwaves, it “could replace mirrors in the very near future.”

International Roadcheck Coming June 4-6, 2019

The Commercial Vehicle Safety Alliance’s (CVSA) International Roadcheck will take place June 4-6th, 2019. International Roadcheck is an annual three-day event in which CVSA inspectors examine as many trucks as possible, looking for anything that doesn’t meet their safety standards for motor carriers, vehicles or drivers.

International Roadcheck may lead to delays and/or increased costs, for a few reasons:

- Some FTL carriers and drivers choose not to operate during the week of International Roadcheck, constraining overall capacity.

- Non-compliant drivers and vehicles taken out of service will cause reduced capacity and delays.

- All drivers must wait in lines (which are sometimes long) until they are inspected. The inspection itself takes about an hour.

FMCSA Asking for Public Comments on Lower Driving Age

The Federal Motor Carrier Safety Administration (FMCSA) is asking for public comment on training, qualification and safety concerns regarding a pilot program that would allow 18-20 year-olds to drive commercial motor vehicles in interstate commerce. The program would create more jobs in the industry and address the nationwide truck driver shortage. So far 75% of received comments are against the program. The public comment period is open until July 15, 2019.

Customs and Trade Updates

Section 301 Tariffs Exclusion Process Update

The USTR has posted a notice that the exclusion process for the third tranche of tariffs will open “on or around June 30.” The window to file for exclusions will likely open that day for the 10% tariffs imposed on September 21, 2018 and revised to a 25% tariff on May 10, 2019. Many are expected the official notice to have similar parameters to that of the first two tranches.

**Footwear Retailers and Distributors Fighting Fourth Tranche **

Footwear retailers and distributors sent a letter to President Trump imploring him to remove the footwear HTS numbers from the possible list 4 of Section 301 tariffs. Over 150 shoe manufacturers and retailers signed the letter. They argued that the increased tariffs would add $7B in additional costs to consumers every year, and that existing tariffs were already high. Raising them further would cause the industry harm because it takes years to move sourcing to another country. The Sports & Fitness Industry Association is also putting together a petition, and other countries are expected to follow suit.

COAC Blockchain Recommendations

The Commercial Customs Operations Advisory Committee (COAC) has released a document that hopes to push CBP to implement global data standards and protocols with blockchain that’s consistent with World Customs Organization (WCO) principles. They urged that these standards and protocols be designed to encourage the greatest amount of technology adopters, as blockchain remains a priority in modernizing trade.

For a roundup of tariff-related news and the latest on the new fourth tranche, read our Tariff Insider.