Global Logistics Update

Freight Market Update: November 14, 2018

Ocean, trucking, and air freight rates and trends for the week of November 14, 2018

Freight Market Update: November 14, 2018

Want to receive our weekly Market Update via email? Subscribe here!

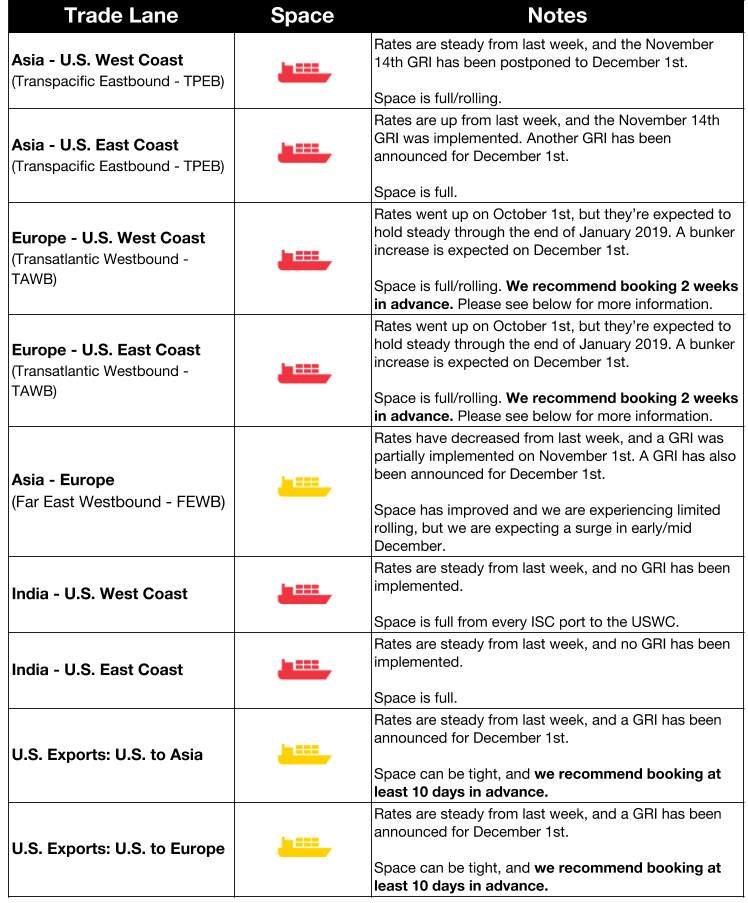

Ocean Freight Market Updates

Hapag-Lloyd Forecasts Continued Growth Through 2018

Peak season’s high transport volumes are helping the carrier recover from the industry slump in recent years caused by an oversupply of vessels. Hapag-Lloyd expects volume to remain high and freight rates to continue to recover through the rest of 2018.

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. The tight congestion is expected to continue through late January when Chinese New Year cargo will arrive.

Maersk is planning on transferring its UK port of calling from Felixstowe to London Gateway on 2M’s AE7/Condor service at the end of November in an attempt to relieve pressure on the UK’s haulage situation.

Rail and road capacity are also limited in Germany due to a surge in volume.

LA-LB PierPass Flat Fee Confirmed for November 19th

The West Coast Marine Terminal Operators Agreement (WCMTOA) has confirmed the implementation of the PierPass 2.0 extended gates program in Los Angeles-Long Beach on November 19th. The Traffic Mitigation Fee (TMF) rate will be $31.52 per 20-foot container, and $63.04 for all other container sizes.

Amazon Confirms HQ2 Locations

Amazon has confirmed New York City and Arlington, Virginia as Amazon’s HQ2. An immediate impact isn’t expected for either city, but industry experts will be keeping an eye on the transportation and housing markets.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions to 0.5% from 3.5%.

Whether they upgrade their vessels or their fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

Beginning on March 1, 2020, IMO is banning vessels from carrying high-sulfur fuel (fuel with a sulfur content higher than 0.5%) unless the vessel has a scrubber to clean the fuel.

Carriers are still debating on which method will be preferred.

Asia shippers have already begun purchasing and testing low sulfur bunker fuel in preparation for the 2020 regulations.

U.K. Warehousing Shortage in Advance of Brexit

Similar to how U.S. import volume is up in anticipation of 2019 tariffs, U.K. warehouses are seeing a surge in demand in anticipation of continuing Brexit negotiations. With the short-term and long-term effects to trade practices still unknown, buyers are importing goods and storing them in the U.K. to avoid potential delays later. Primark, manufacturer of Twinings tea and Patak’s sauces, is one of these companies planning to stockpile goods in anticipation of Brexit.

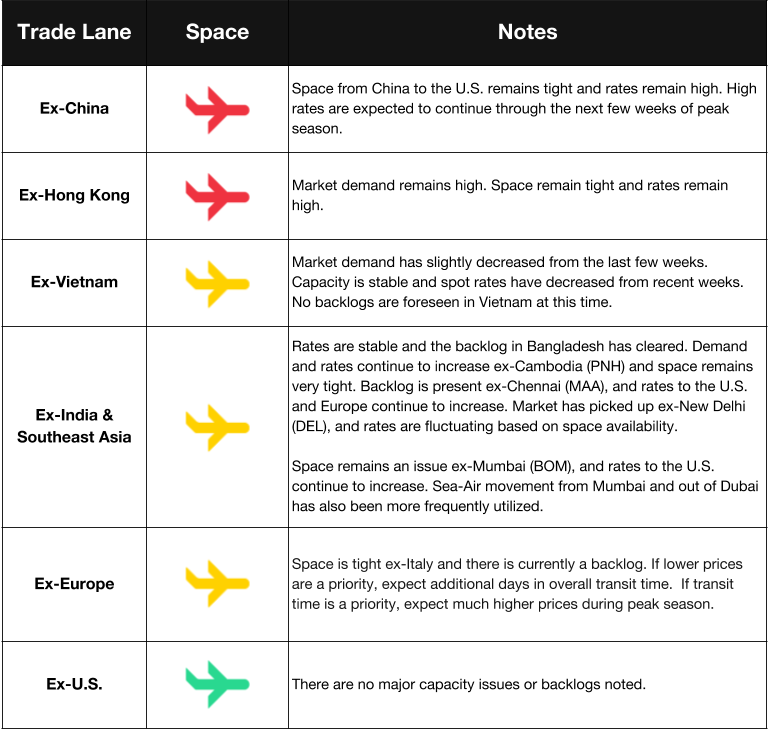

Air Freight Market Updates

‘Sniffer Dog’ Companies Able to Screen U.S. Air Cargo

Private companies and individuals will soon be able to bring in sniffer dogs to screen air cargo in the U.S. In total, 12 organizations have been given approval to certify third-party canine teams who will screen air cargo for aircraft operators, foreign air carriers, and other parties operating with TSA approval.

High Fuel Costs Hurting Small Air Carriers

The Wall Street Journal reports that more than 20 carriers around the world have gone out of business this year, most of whom were smaller European airlines. Rising costs are being blamed, although experts are expecting to see a few more smaller carriers fall off despite recent lower fuel prices as the industry moves into off-season.

Air Market Supply Outpaces Demand

The air market continues to experience slow growth as we continue through 2018. The industry is boosted by ecommerce, but slow supplier transit times are eliminating the need for an high-cost, high-speed mode option like air.

Trucking Market Updates

Progress for Autonomous Trucks

Startup WaveSense is commercializing ground-penetrating radar that can be used to determine environmental conditions below the road surface to help create reliable maps. This is a step toward an autonomous trucking industry, but other problems still need to be solved, like how driverless trucks would exit a highway for the final consumer destination, and how trucks would receive updated maps.

DB Schenker is also launching an autonomous truck pilot.

Additional Factories Help Mitigate Trucking Costs

Some manufacturers are building factories closer to their consumers to reduce trucking costs and transit times. This move could be risky, as more factories means more supply that may not meet demand, but lower costs and the ability to avoid Chinese tariffs may make it a good investment.

UK Trucking Faces Number of Critical Issues

The Road Haulage Association (RHA) warns that ignoring the current trucking problems will lead to disaster for the market in the future. A shortage of truck drivers, high costs to train new and younger drivers, and constricting regulatory practices are stifling the UK trucking market and will lead to a “catastrophic cocktail of disaster” if not addressed. Trucking currently needs to be booked 15 days in advance.

Haulage Reported as Most Vulnerable Freight Mode

Haulage is more vulnerable to theft than other modes of transport, and in-transit hijackings are the number-one threat to trucking around the world. Thefts in the U.S. and Canada tend to happen at unsecure cargo trucks at unsecure locations, but hijacking remains rare. In South America, Africa, and the Middle East, on the other hand, hijackings account for over 50% of truck theft.

EPA Cracking Down on Emissions Violations

California passed a state law in 2008 designed to phase in over time that requires diesel trucks and buses that operate in California to be upgraded to reduce their emissions. Two interstate trucking companies were fined hundreds of thousands of dollars last week for not installing filters that would prevent pollutants from contaminating the air.

The Trump administration is also pushing for pollution limits on commercial trucks.