Global Logistics Update

Freight Market Update: October 31, 2018

Ocean, trucking, and air freight rates and trends for the week of October 31, 2018

Freight Market Update: October 31, 2018

Want to receive our weekly Market Update via email? Subscribe here!

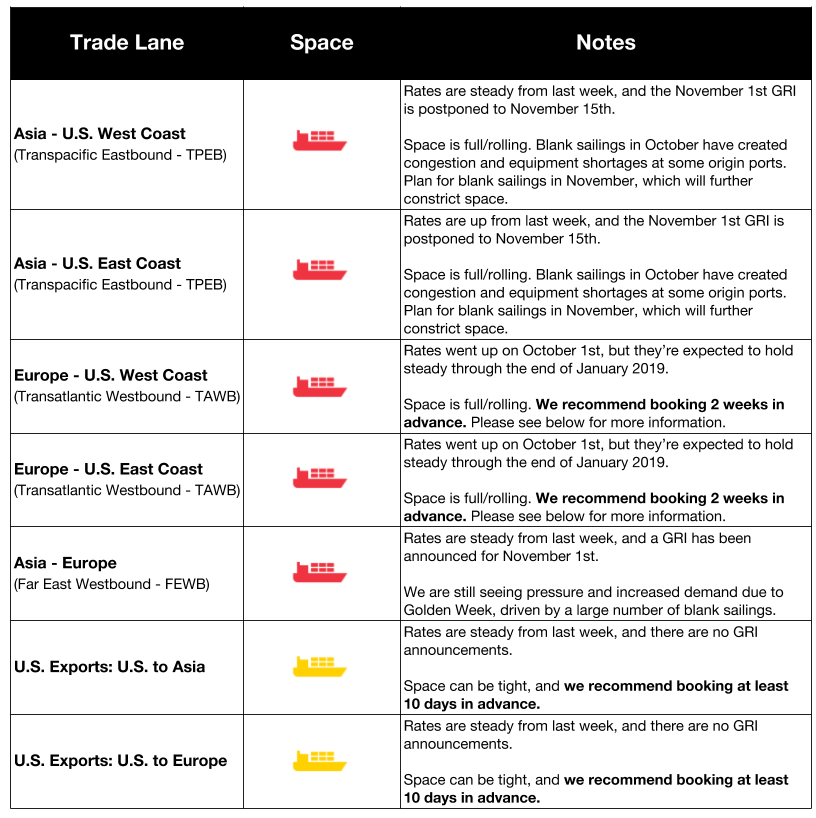

Ocean Freight Market Updates

Transatlantic Westbound Lane Experiencing Tight Capacity

UK ports are very congested, which is causing a decline in port productivity and tight trucking capacity. Trucking needs to be booked 15 days in advance currently. Trucking/intermodal capacity is very tight in North Europe due to a surge in volumes.

Services are full 14 days out. Book in advance to secure space and minimize risk of rolling.

Impact of New IMO ECA Regulations

The International Maritime Organization has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions to 0.5% from 3.5%.

Whether they upgrade their vessels or their fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

The practice of slow-steaming, reducing vessel speed to conserve fuel, may become mandatory to achieve the IMO’s long-term emissions reduction goals. Enforced speed limits would reduce capacity as transit times are increased.

Beginning on March 1, 2020, IMO is banning vessels from carrying high-sulfur fuel (fuel with a sulfur content higher than 0.5%) unless the vessel has a scrubber to clean the fuel.

LA-LB PierPass Flat Fee to Begin in November

On Monday, the West Coast Marine Terminal Operators Agreement (WCMTOA) announced that it would implement the PierPass 2.0 extended gates program in Los Angeles-Long Beach on November 19th. This will pass if the Federal Maritime Commission (FMC) doesn’t block the revised extended-gates program.

Eastbound trans-Pacific Spot Rates Expected to Remain High

As shippers prepare for the impending 25% tariffs scheduled to take effect on January 1st, and the holiday season rush continues, vessel space is expected to remain tight. While peak-season for holiday shipping typically ends in November, spot rates are also expected to remain high through the end of the year.

OOCL to Introduce Bunker Surcharge

In an attempt to cover the “surge in operating cost” of meeting IMO sulfur cap regulations by January 2020, OOCL will introduce a bunker recovery charge. The floating bunker formula will use factors including type of fuel, ship capacity, and fuel prices.

Hapag-Lloyd Gets Ahead of IMO 2020 with Marine Fuel Recovery (MFR) Mechanism

As the IMO 2020 start date of January 1, 2020, approaches, Hapag-Lloyd is preparing customers with a new Marine Fuel Recovery mechanism. The mechanism, which will replace all existing fuel-related charges, will be gradually implemented from January 1, 2019, and aims to bring transparency to the calculation of costs.

According to a statement from Hapag-Lloyd, the mechanism, “takes into account various parameters, such as the vessel consumption per day, fuel type & price (specific for HSFO, LSFO 0.5% and LSFO 0.1%), sea and port days, and carried TEU.”

U.S. Businesses Consider Moving out of China

As a result of the trade war between the U.S. and China, U.S. importers are considering moving their manufacturing business out of China. U.S. companies are facing increasing competition from businesses in other nations and are eager to adjust their supply model before they lose market share.

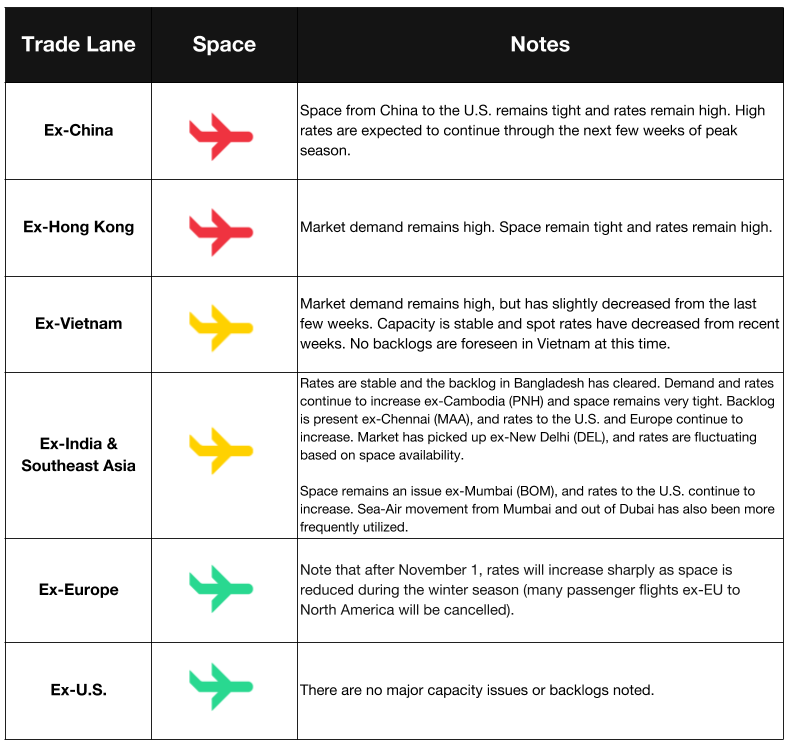

Air Freight Market Updates

Tight Market Continues in Peak

Air freight capacity is continuing to tighten and rates are continuing to rise as we push further into peak season. Because e-commerce draws out the amount of time consumers have to purchase goods, a break in the market is not expected between the December holidays and Chinese New Year.

Trucking Market Updates

Rising Costs Passed to End Consumer

Rising trucking costs are being passed off to the end consumers as retail companies are forced to raise product prices to compensate for freight costs. We may see those trucking rates stabilize in the coming months.

Rail Market Remains Strong

Despite rising diesel fuel prices, North American rail freight was able to grow and remain profitable during the first three quarters of 2018, and expects to continue that trajectory into 2019. This is unlike the ocean industry, which struggled to pass rising costs off to clients.