Global Logistics Update

Global Logistics Update: January 23, 2025

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: January 23, 2025

Trends to Watch

Customs Update

- On January 17, 2025, U.S. Customs and Border Protection (CBP) announced a Notice of Proposed Rulemaking (NPRM) to restrict certain products from qualifying for the de minimis low-value shipment exemption.

- According to CBP, the proposed rule would disqualify merchandise subject to specific trade and national security actions, including Section 232, 201, and 301 tariffs, from duty-free treatment. Shipments claiming the exemption would also need to provide the 10-digit Harmonized Tariff Schedule of the United States (HTSUS) classification.

- This NPRM is the second following the Biden Administration’s September 13 announcement. The public has 60 days to comment on the proposal.

- For assistance, contact customsbd@flexport.com.

Tariffs Watch

- We’re closely monitoring the tariff updates following President Donald Trump’s inauguration on Monday. So far, he has announced plans to implement 10% tariffs on Chinese goods and 25% tariffs on goods from Mexico and Canada, effective February 1.

- In the meantime, the President also announced a 60-day freeze on new regulations, which could delay recent rulemaking tied to de minimis shipments.

- Visit our blog to stay up-to-date.

Ocean - TPEB

- Rates: Shipping lines have reduced short-term rates to both coasts to stimulate demand ahead of Lunar New Year. FAK rates remain higher than NAC rates, plus peak season surcharges (PSSs). Further PSS adjustments are likely to occur only by mid-February.

- Blank sailing: Carriers have planned blank sailings for the CNY period and network adjustments. Available capacity is expected to decline starting in Week 5 and remain limited until Week 8, after which a significant increase is anticipated.

- Space: Due to the Pre-Chinese-New-Year (CNY) rush, space remains constrained, particularly on fixed allocations. However, some strings still have open space, especially to the West Coast and, to a lesser extent, the East Coast.

- Equipment: No significant equipment issues have been reported at origin.

Ocean - FEWB

- Lunar New Year and alliance restructuring: The Lunar New Year and the restructuring of shipping alliances will take place in the first half of the month, providing carriers with an opportunity to efficiently allocate existing capacity. Both capacity and freight rates are expected to transition smoothly, with the market remaining relatively oversupplied.

- Capacity and market competition: There has been no significant change in the overall capacity of the new alliances. However, a new wave of market share competition is anticipated to resume after work restarts following the holiday period.

- Israel-Gaza ceasefire impact: The Israel-Gaza ceasefire agreement, effective January 19, 2025, has not yet led carriers to make decisions about resuming affected routes. In the short term, this is unlikely to cause a drop in freight rates.

- Regional trade observations Europe: The European economy remains sluggish.Tariff impact: Recent U.S. tariff increases on Chinese goods may stimulate export demand from China to Europe and other regions, potentially boosting trade. FEWB trade: A modest increase in FEWB trade might occur after the Lunar New Year.

- Market outlook: Taking these factors into account, the market is expected to remain generally stable. Unless there is a sudden surge in cargo volumes, FEWB rates are likely to continue their gradual downward trend.

Ocean - TAWB

- Capacity: Carrier capacity is starting to open up following the tentative agreement between the ILA and USMX. Space is now available for shipments from North Europe to the U.S. East Coast. However, capacity from South Europe remains tight.

- Blank sailings persist due to service restructuring and the phase-in of new services.

- Equipment challenges continue in Central Europe, particularly in Austria, Switzerland, Hungary, Slovakia, the Czech Republic, and South Germany.

Air - Global Mon 06 Jan - Sun 12 Jan 2025 (Week 2):

- Global Air Cargo Price Trends: Global air cargo spot prices remain significantly elevated, up over +20% compared to the previous year, despite a typical seasonal dip in early January 2025. Rates particularly from Asia Pacific and MESA regions contribute to maintaining this higher level.

- Asia Pacific Route Analysis: Spot rates for Asia Pacific to the USA dropped by -5% week-on-week in early January 2025, and tonnage fell sharply initially but rebounded. However, spot rates remain substantially higher year-on-year, with a noted decrease from China to the USA.

- Asia Pacific to Europe Shifts: Tonnage and spot rates from Asia Pacific to Europe sharply decreased in early 2025 after high numbers in late 2024. There was a slight rebound, with spot rates significantly higher compared to the same period last year, highlighted by rising rates from key countries like South Korea, Hong Kong, and Japan.

- MESA Origin Rate Dynamics: MESA-origin air cargo rates have been declining as disruptions to ocean freight supply chains impacted 2024's elevated levels. Despite recent falls, rates remain significantly higher year-on-year. Political and security concerns, such as threats affecting the Red Sea, continue to influence shipping and air cargo dynamics in the region.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

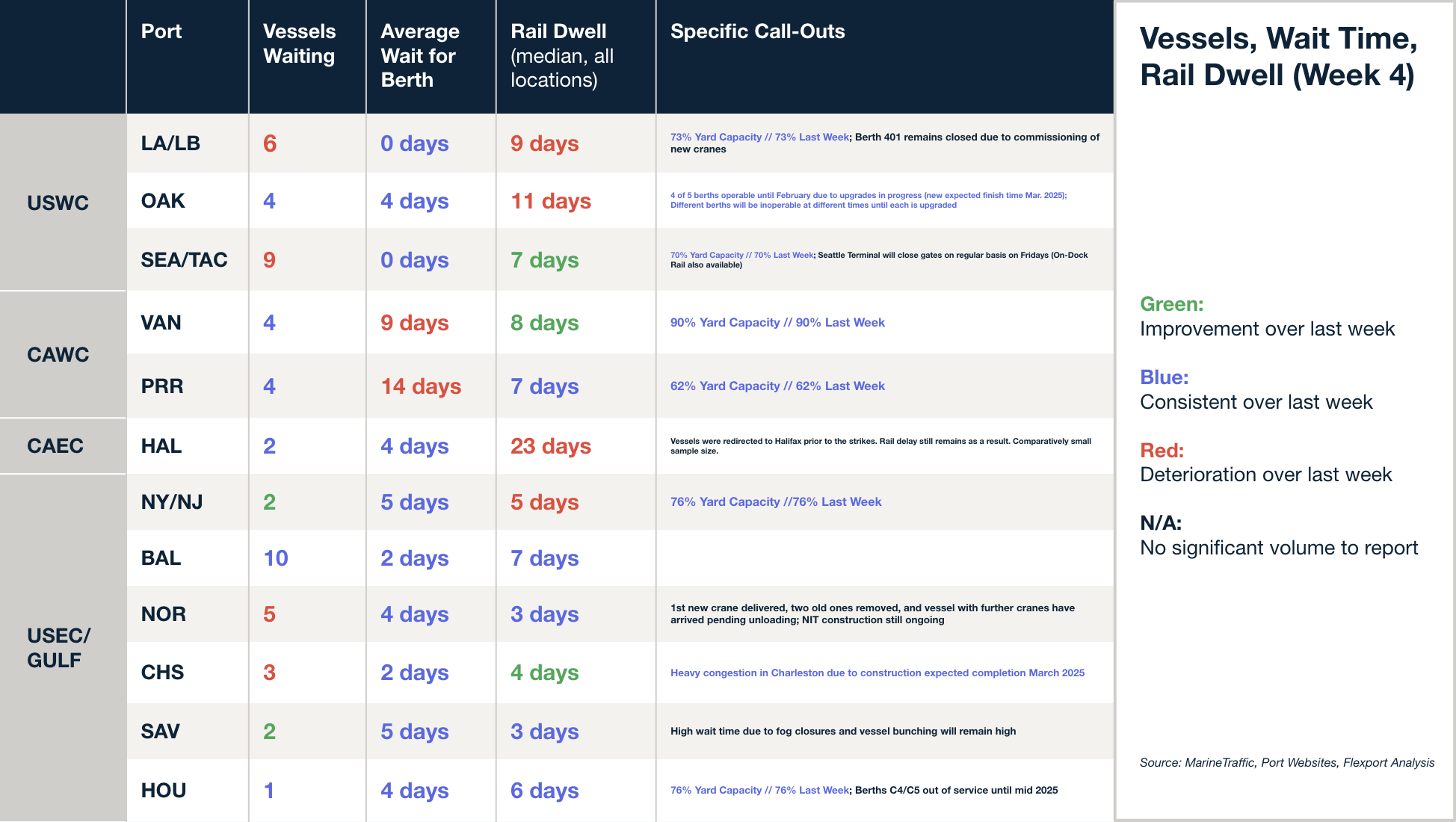

North America Vessel Dwell Times

Upcoming Webinars

The Ripple Effect of U.S. Tariffs: What Global Companies Need to Know

Thursday, February 6 @ 8:00am PT / 11:00am ET / 16:00 GMT / 17:00 CET

European Freight Market Update Live

Tuesday, February 11 @ 15:00 GMT / 16:00 CET

North America Freight Market Update Live

Thursday, February 13 @ 9:00 am PT / 12:00 pm ET

This Week in News

ECSA-US spot rates weaken rapidly after hitting record high in Q4

Spot rates on the East Coast South America-to-U.S. lane have dropped sharply this month after reaching record highs in Q4 2024. Rates fell from $5,800 per FEU in November to $4,300 per FEU by January 21, due to reduced demand and less full vessels. Despite this, trade remains strong, with Brazilian exports to the U.S. hitting a record $40.3 billion in 2024. Experts expect Brazil-U.S. trade to stay robust in 2025, though global uncertainties remain.

CBP’s proposed rule nixes de minimis treatment for array of imports

U.S. Customs and Border Protection (CBP) has proposed rule changes to eliminate de minimis treatment for low-cost imports subject to Section 201, 232, and 301 tariffs, meaning goods under $800 would no longer be exempt from import duties. This change aims to protect domestic industries, particularly textiles and manufacturing. Shipments claiming the exemption would also need to provide tariff classification numbers. The proposal could increase costs for U.S. consumers due to higher tariffs. Importers may consolidate shipments to avoid exceeding the $800 threshold. Public comments are open until March 24.

How businesses are preparing for the tariffs Trump has promised to impose

As companies brace for potential tariffs under President Donald Trump, Ryan Petersen, CEO of Flexport, joined PBS to discuss how uncertainty surrounding tariffs has prompted businesses to take action. Petersen emphasized the unpredictability of tariff rates, but suggested that moving goods early is a sensible strategy—as is creative tariff engineering.

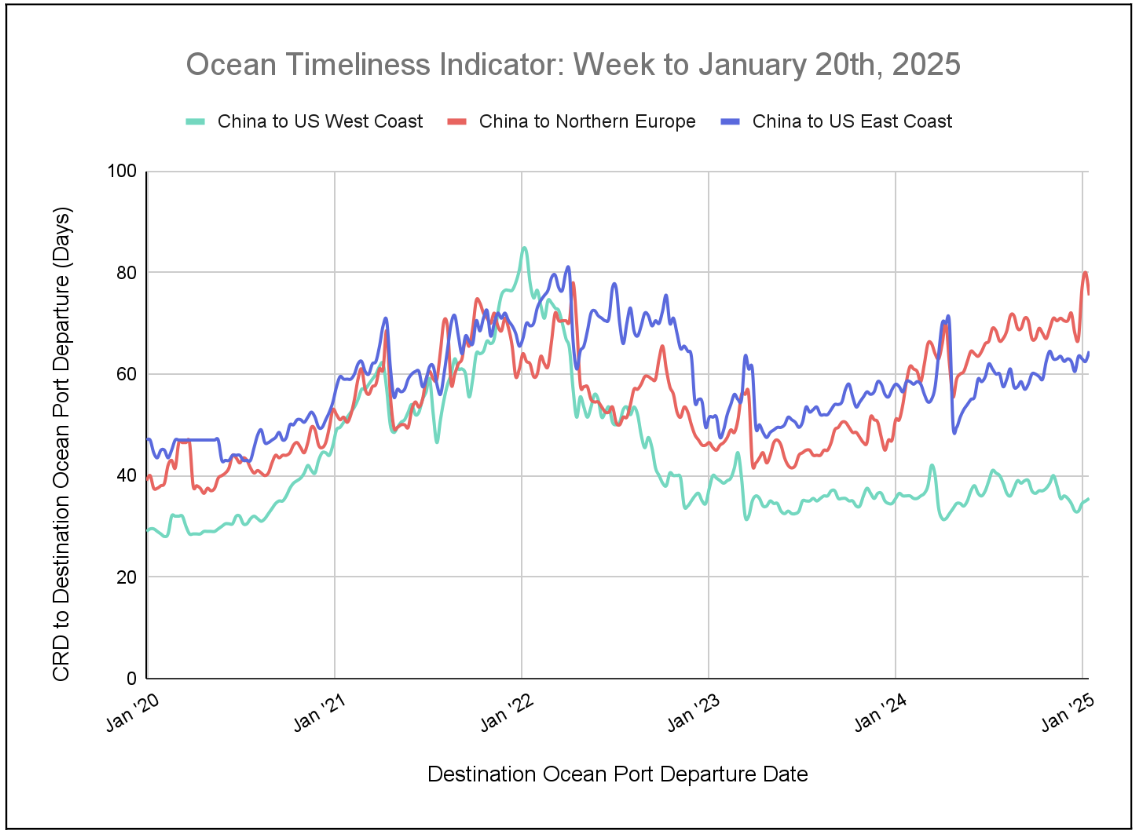

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI for China to North Europe has finalized its ascension cycle and is now decreasing, while China to the U.S. East Coast and China to the U.S. West Coast see an uptick.

Week to January 20, 2025

This week, the Ocean Timeliness Indicator (OTI) for China to North Europe has finalized its ascension cycle and is now decreasing, having initially risen sharply from 68 to 80 days and then decreasing to 75.5 days. Meanwhile, China to the U.S. East Coast and China to the U.S. West Coast are both on the rise, moving from 62.5 to 64.5 days and from 35 to 35.5 days, respectively.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.