畅想货运无阻的美好图景, Flexport 飞协博平台助您达成无限可能。从创建采购订单直至货物最终交付,赋予您与您的合作伙伴以及供应商前所未有的可视化和控制力。

轻松无忧 全面跟踪

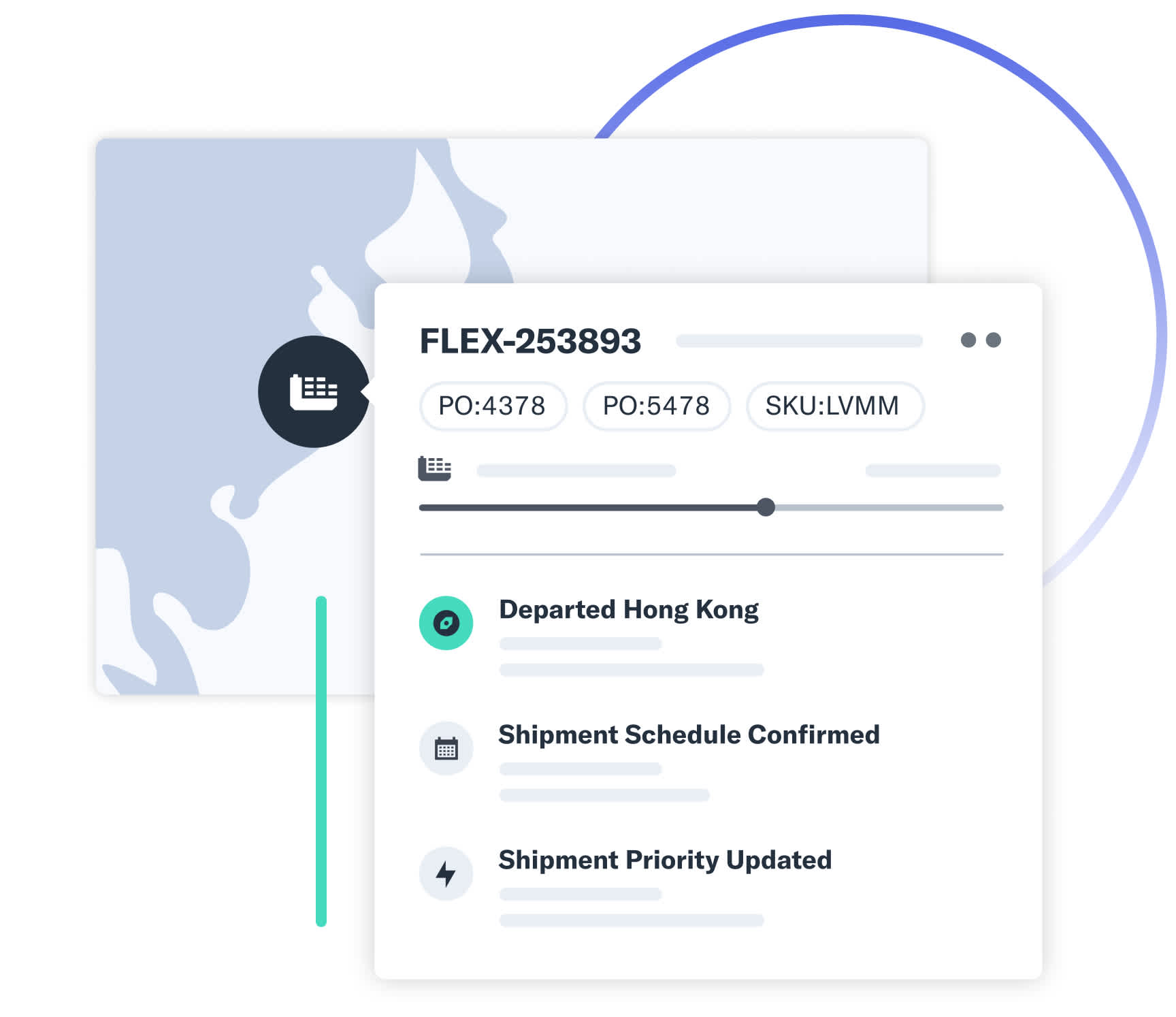

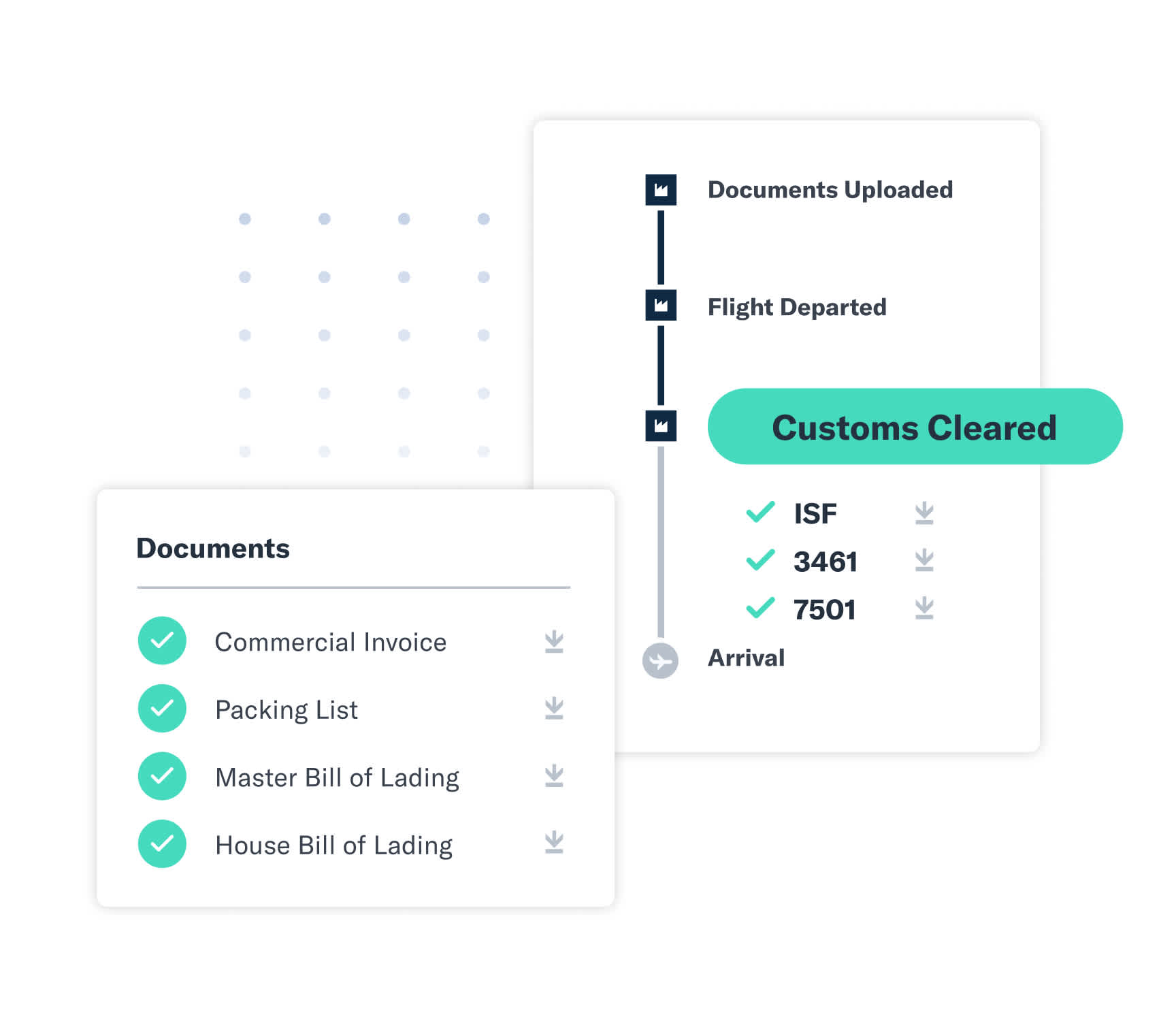

跨越海陆空跟踪货物。全面获悉节点更新、异常预警、到岸成本和库存影响,数据一目了然。

流程更顺畅。工作更精简。

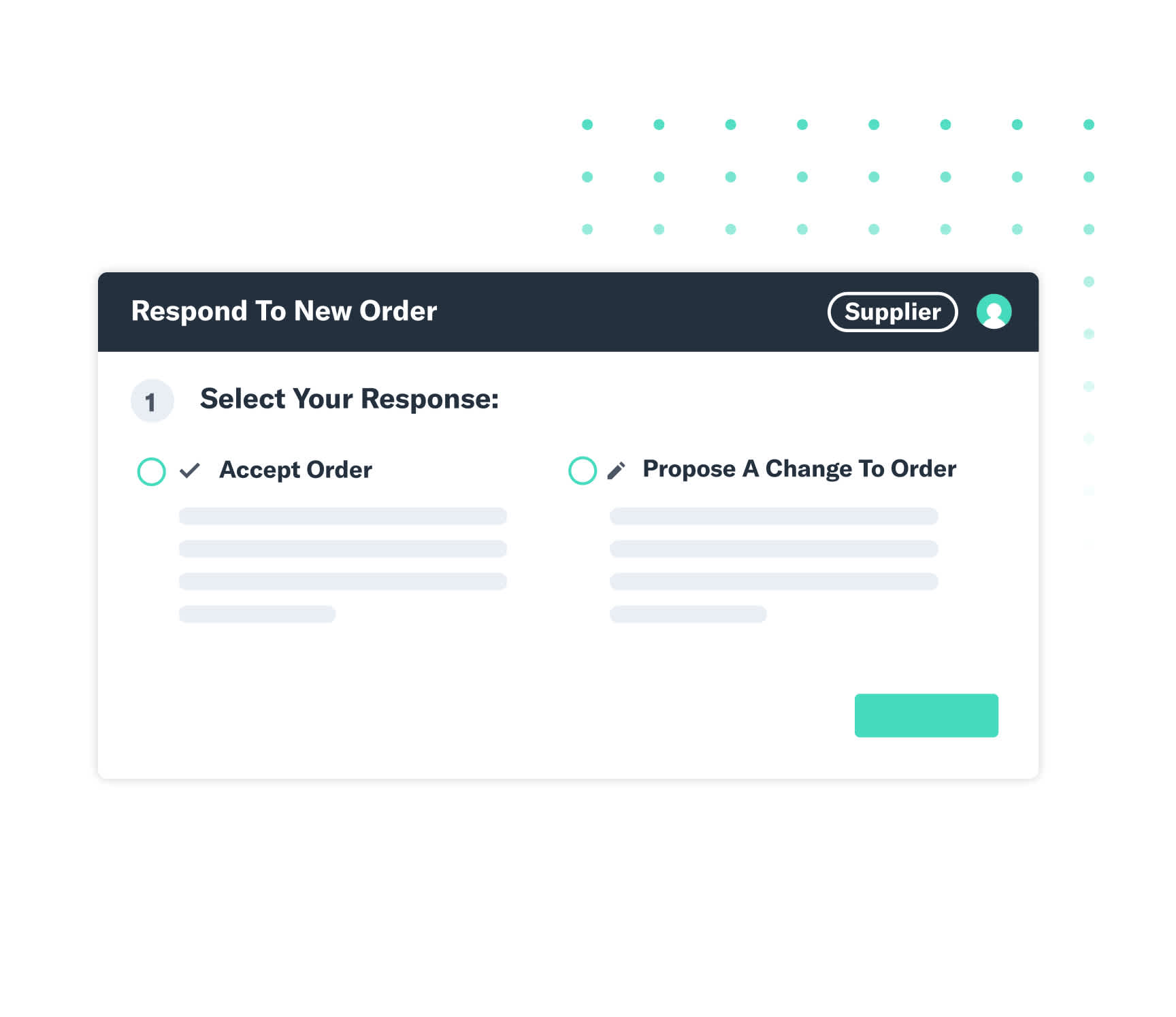

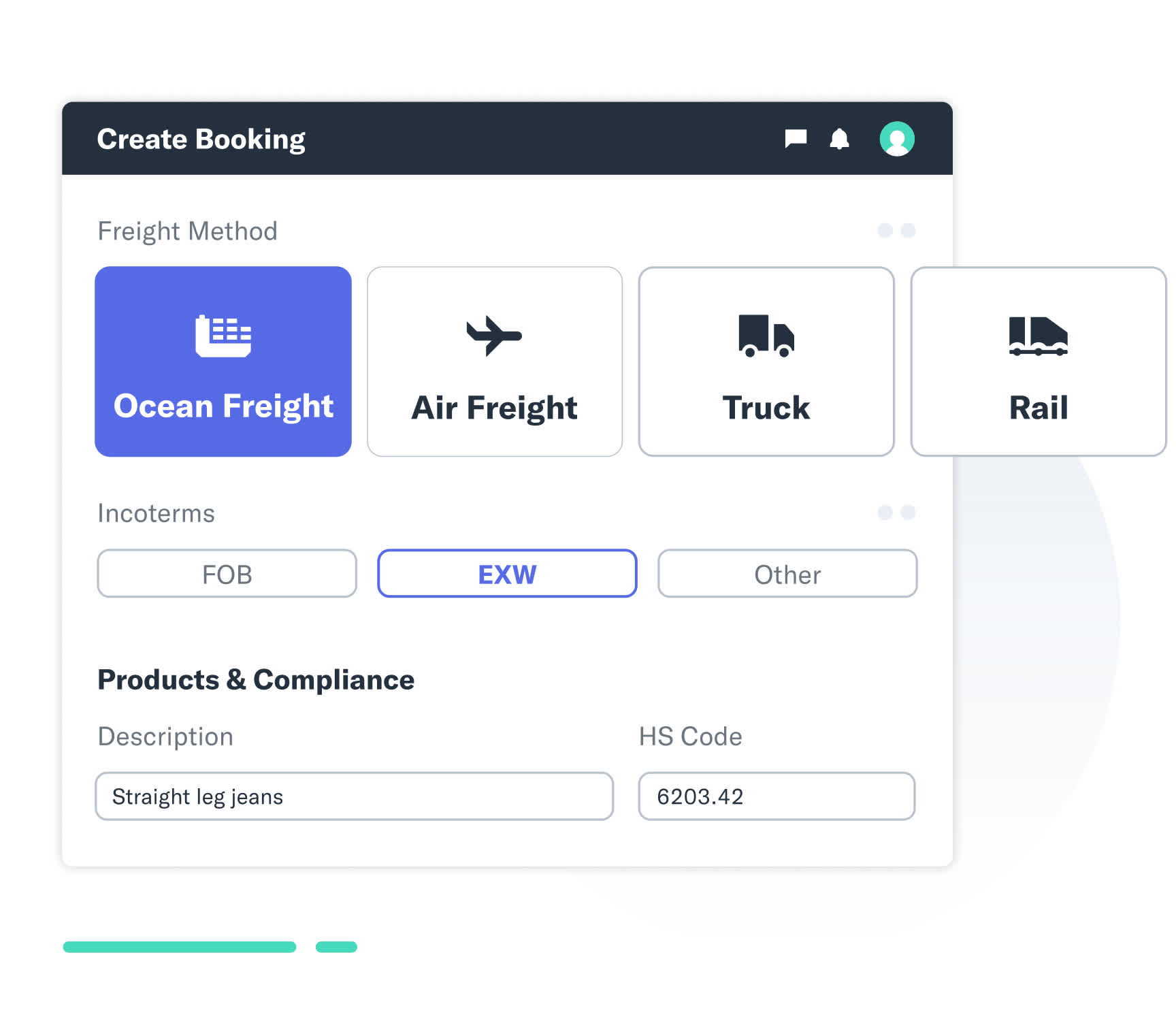

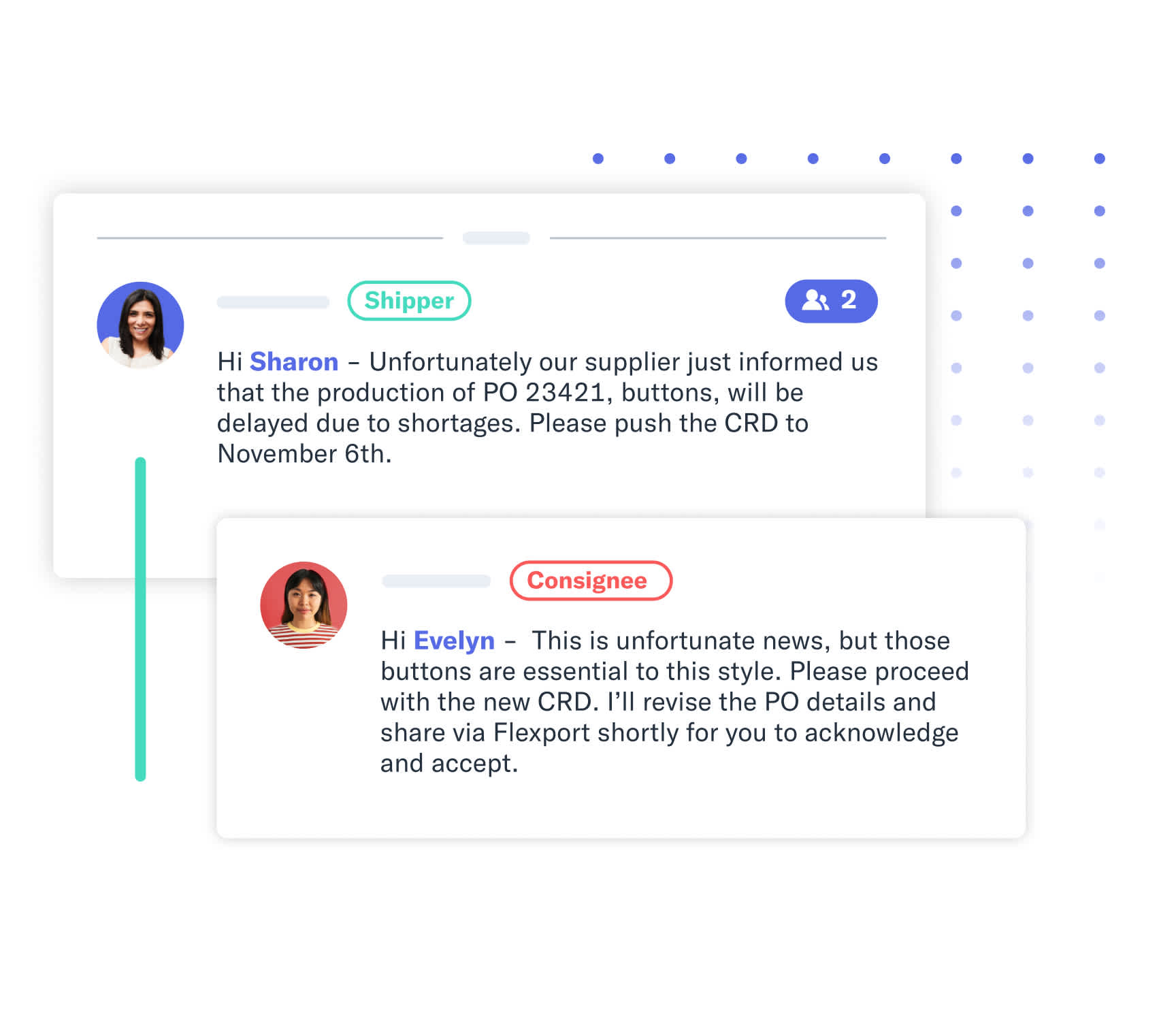

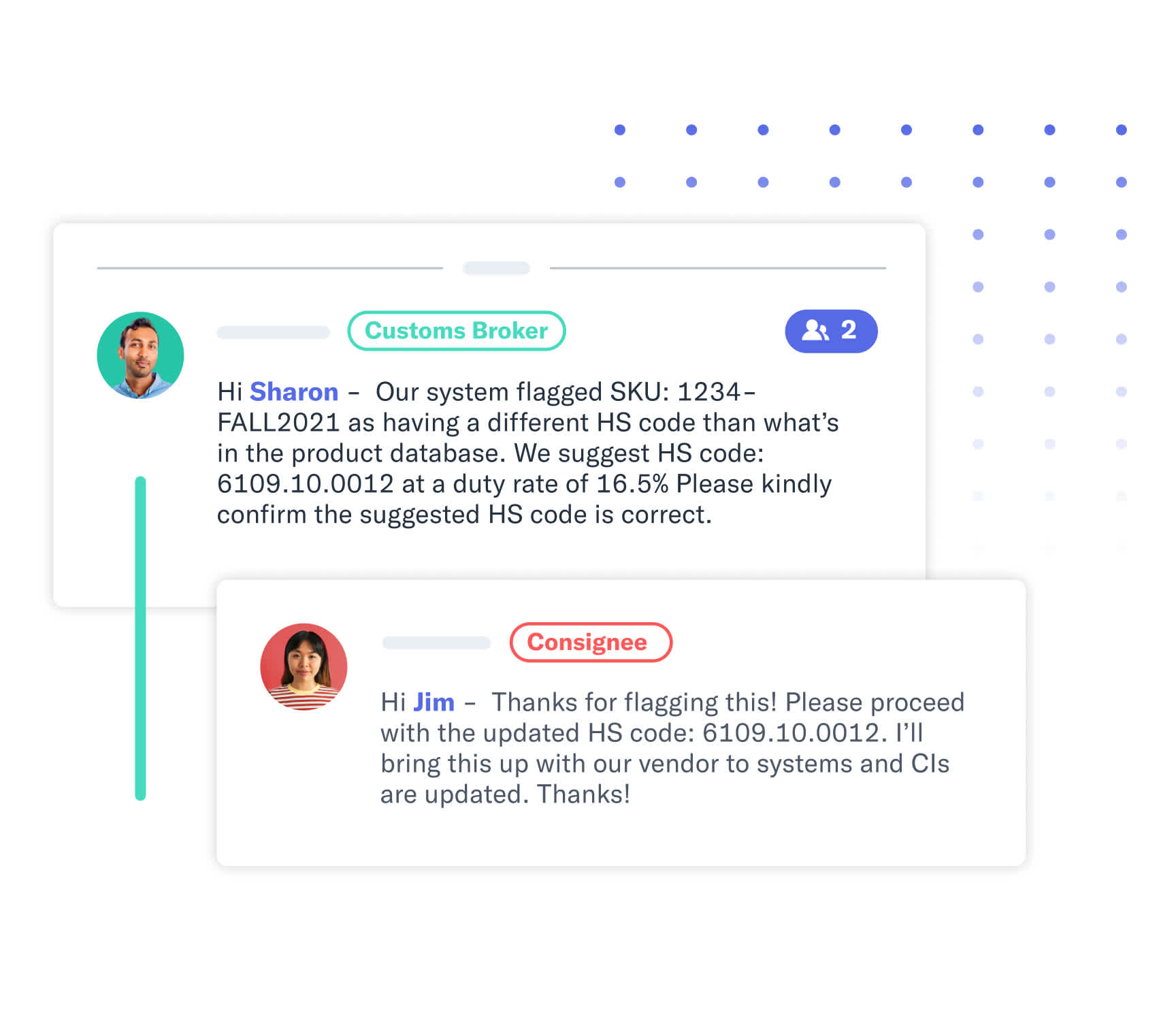

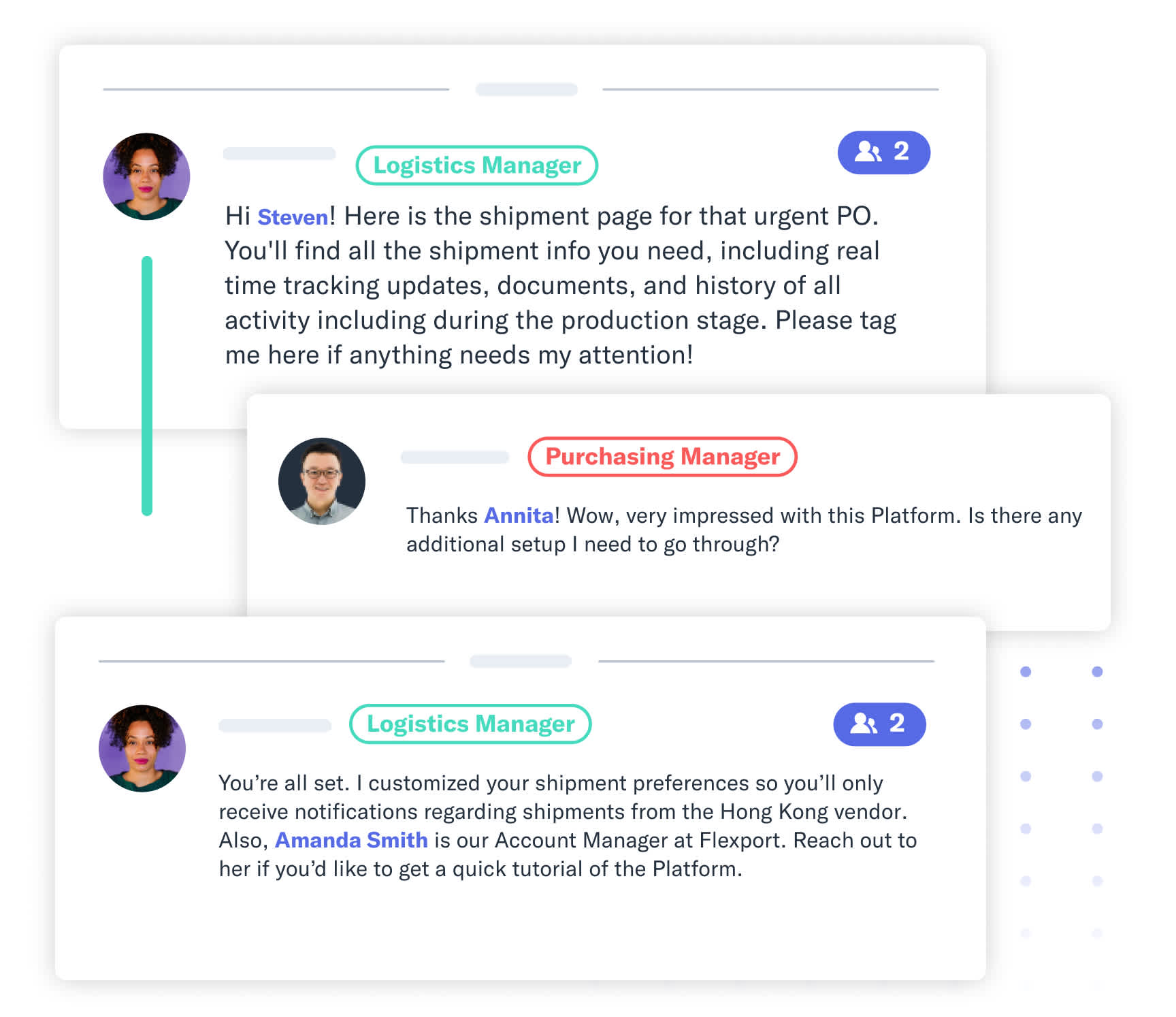

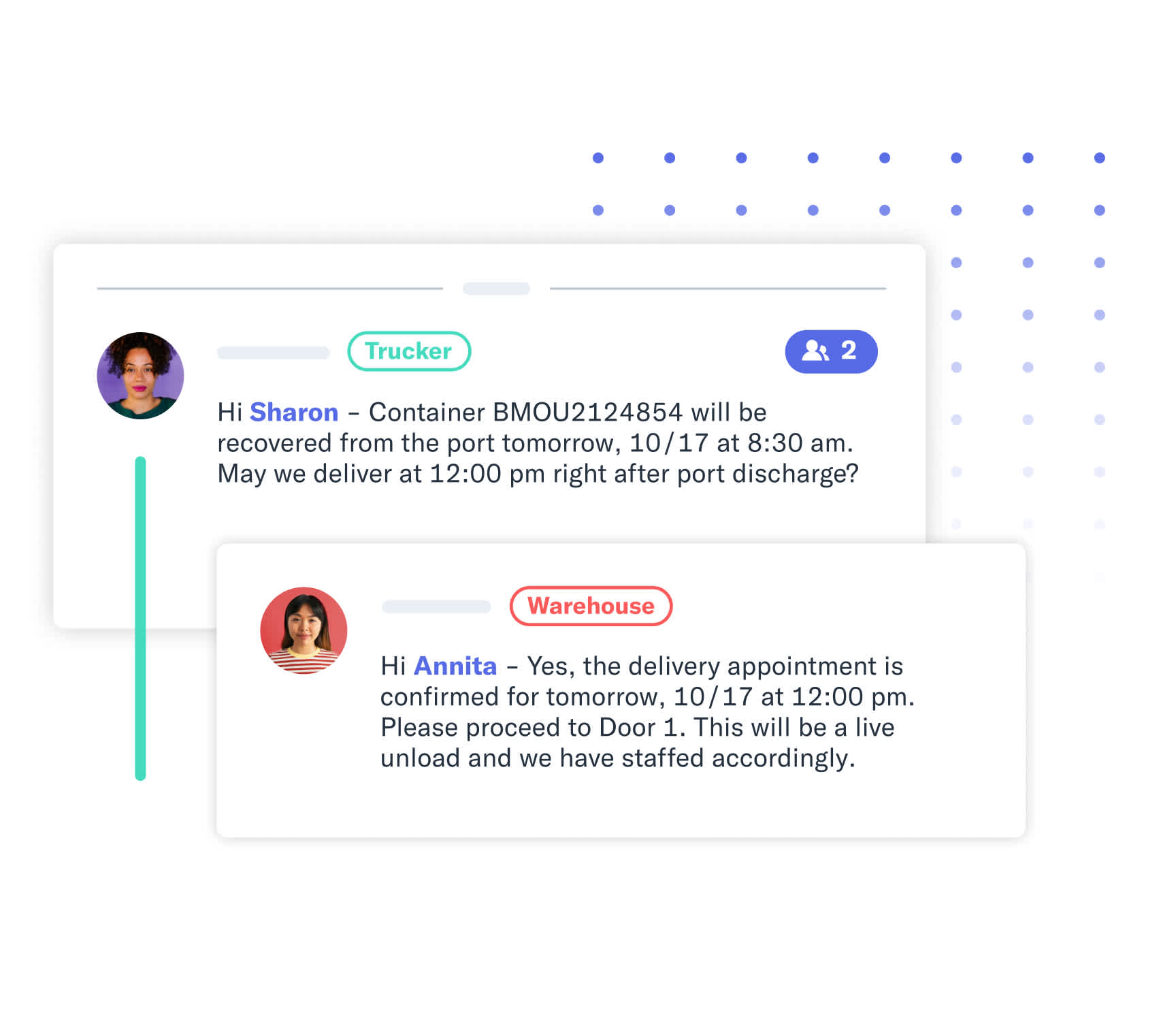

实时协作。获取来自供应商的订单。跟踪库存动态。仓库沟通等信息。Flexport 飞协博平台加快供应链中各环节的工作流程。

平台数据助您作出更好的决策

Flexport 飞协博平台拥有强大的数据构建、存储和保护能力,让您的货物运输时间、到岸成本和集装箱利用率等指标尽在掌握。

加入 Flexport 飞协博上的数千个领先品牌

91%

91% 的 Flexport 飞协博客户都认为,Flexport 飞协博平台让他们能与供应商、合作伙伴及其团队明确、快速地沟通与合作。* 了解医疗科技公司 Qardio 如何通过 Flexport 飞协博将数据置于其业务的核心。

4 小时

相比其他货运代理,我们目前的客户使用 Flexport 飞协博可以,平均每周节省 4 小时。* *基于 2020 年 TechValidate 对 200 多家 Flexport 飞协博现有客户的调查。

55 名用户

平均而言,Flexport 飞协博客户会邀请其公司大约 55 名用户加入该平台,这些用户覆盖供应链、客户支持、财务和销售等业务领域。

集成

集成 API 的数据 释放您的货运潜力

有效利用我们不断增长的公共 API 集合。从采购订单到开发票的整个流程,集成实现了完整的数据可见性自动化,为客户节省大量时间,减少失误,优化货运决策。

让您的数字化流程更进一步

Control Tower

A unified platform to manage all your logistics service providers and suppliers.