Global Logistics Update

U.S. Announces August 1 Reciprocal Duty Rates; Demand Remains Steady Across Most Trade Lanes

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: July 10, 2025

Trends to Watch

Talking Tariffs

- President Trump Postpones End Date for Country-Specific Reciprocal Tariff Pause: On July 7, President Trump published an executive order postponing the end of the country-specific reciprocal tariff pause from July 9 to August 1. All U.S. trade partners will remain subject to existing reciprocal tariffs until August 1, with the exception of China, whose 10% reciprocal duty rate expires on August 12.

- President Trump Announces Upcoming Reciprocal Duty Rates for Select Trade Partners: In a series of tariff letters posted on Truth Social, President Trump laid out his proposed reciprocal duty rates for 22 nations, with more announcements expected to come. All proposed duties are expected to take effect on August 1, pending official confirmation via executive order or Federal Register notice.

- According to the tariff letters, if any of the involved nations increases its tariffs on the U.S., the U.S. will increase its reciprocal tariff rate on that nation by an identical amount.

- The letters also state that any goods transshipped to evade a higher tariff will be subject to that higher tariff.

- For a full list of the Trump administration’s proposed reciprocal tariffs, check out our live blog.

- FDA-Regulated De Minimis Imports Now Subject to FDA Review: On July 9, U.S. Customs and Border Protection (CBP) published a CSMS stating that all de minimis imports subject to FDA regulation must now undergo FDA review, effective immediately.

- Previously, many low-value shipments subject to FDA requirements were exempt from FDA review.

- With this update, FDA-regulated de minimis shipments must now include their Partner Government Agency (PGA) data.

- The de minimis exemption will expire for all countries on July 1, 2027, per the “Big Beautiful Bill” signed into law last week.

- Other Potential Tariffs on the Horizon:

- On July 2, President Trump announced he would impose a 20% reciprocal tariff on Vietnam, along with a 40% tariff on goods transshipped through Vietnam.

- In a July 6 Truth Social post and at a July 8 Cabinet meeting, President Trump announced plans to levy a 10% tariff on imports from BRICS—an intergovernmental group that includes Brazil, Russia, India, China, and several other nations. The 10% duty would be levied on top of any other applicable tariffs.

- On July 8, President Trump also indicated that he plans to impose pharmaceutical tariffs as high as 200%—but before doing so, he intends to give pharmaceutical manufacturers at least a year to relocate their operations to the United States.

- On July 9, President Trump announced that a 50% tariff on copper imports will take effect on August 1, now that the Commerce Department’s national security investigation into copper has concluded.

Get the latest updates and guidance on U.S. tariffs and trade on our live blog.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- Projections for July demand remain largely flat, with no significant uptick in volume. This indicates a potential softening of the demand surges seen in late Q2, which were partially driven by the temporary U.S.-China tariff agreement and shippers rushing to place orders ahead of potential tariff increases.

- Overall capacity remains at 84%-91%, indicating oversupply relative to current demand. Overcapacity is likely contributing to the downward pressure on floating rates, particularly for the U.S. West Coast.

- Blank sailings are still ad hoc, without any consistent patterns or major service suspensions. This suggests that carriers are managing capacity more flexibly now, rather than through large-scale reductions.

- Equipment: Equipment availability across most TPEB origins is sufficient, with no immediate shortages reported.

- Freight Rates:

- Floating rates for the U.S. West Coast are continuing to decrease, and are at or even below fixed contract levels. This decline, along with reduced demand pressure, is supported by the full removal of the July 1 Peak Season Surcharge (PSS) for the West Coast.

- Floating rates for the East Coast and Gulf regions have been mitigated, but remain above fixed contract levels. The PSS for the East Coast has been mitigated, but remains in place.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- Shipping capacity in Week 29 has seen significant overall reductions, considerably impacting recent bookings.

- The reduction in available space has led to increases in container rollovers. In response, carriers are controlling space by releasing containers in limited windows, further disrupting shipment efficiency.

- The buildup of rolled cargo, which has accumulated since late June, is expected to be gradually cleared over the next two to three weeks.

- Overall demand remains steady.

- Equipment:

- Container supply is relatively stable for MSC and Gemini Cooperation, but inventory at Ocean Alliance and Premier Alliance depots is tight.

- Shippers are strongly advised to follow Equipment Interchange Receipt (EIR) open times and process container pick-up as early as possible.

- Missing EIR/documentation windows may result in further sailing delays.

- Freight Rates:

- This week, Shanghai Containerized Freight Index (SCFI) rates have increased slightly, but have risen more slowly compared to the previous week. The index is up $76/TEU, indicating slower upward momentum.

- Market expectations indicate that freight rates will largely hold at early July levels until the end of the month. Most sailings are already fully booked through the end of July.

- Carriers remain cautious on further rate moves for August, as substantial early August volumes have yet to be booked. Booking volumes in late July will be a key factor in determining rate trends for early August.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand:

- PSA Antwerp and key Northern European ports (Hamburg, Bremerhaven) are experiencing high congestion. Delays are also ongoing in major Mediterranean ports.

- Demand is stable, with strong activity from Germany, Benelux, and Spain.

- Equipment:

- Shortages persist in Austria, Slovakia, Hungary, and Eastern Germany.

- Imbalances in Lisbon and Mersin are primarily affecting 40’ containers.

- Freight Rates:

- North Europe: To maintain volumes, carriers are not implementing a July PSS.

- West Mediterranean: All carriers have extended rates through September.

- East Mediterranean: Carriers are delaying July PSSs.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- Capacity to the U.S. East Coast has increased, with July kicking off the traditional peak season for Indian subcontinent shipping.

- Capacity to the U.S. West Coast is again available, given the sharp increase in capacity in the TPEB market and services that enable Indian subcontinent shippers to deliver cargo to the U.S. West Coast.

- Freight Rates:

- For cargo moving to the U.S. East Coast: General Rate Increases (GRIs) and PSSs have been announced for the first half of July, but those increases have not been implemented. There appears to be a lack of underpinning demand to support the increases, especially considering the capacity reinjected into the Indian subcontinent to U.S. East Coast trade. Heading into the rest of July, the market appears soft.

- For cargo moving to the U.S. West Coast: GRIs did not stick in the market and PSSs have come down, in line with TPEB lanes.

- Exports from Pakistan continue to see elevated cost and transit times due to additional feeder services needed to service the country in light of the India-Pakistan conflict.

Air

WEEK 26: JUNE 23 - JUNE 29, 2025

- Global Air Cargo Rates Rose +2% MoM in June: Despite the month-on-month rise, global air cargo rates remained -1% below June 2024, driven by continued volatility in trade lanes due to evolving U.S. tariff policies.

- Tonnages from China to the U.S. Dropped -15% Since March: Meanwhile, China–Europe volumes rose +15% YoY, with shippers shifting flows to Europe and other markets to avoid tariff exposure and the end of the de minimis exemption.

- Worldwide Chargeable Weight in Q2 2025 Increased +4% YoY and QoQ: This marks stronger growth than the +3% seen in prior years, despite a -4% dip in June tonnages compared to May.

- Asia–U.S. Spot Rate Share Jumped to 73–75% in May–June: Contract rates reached $5.28/kg—13% higher than spot rates—highlighting mismatched capacity and rapidly shifting market conditions.

(Source: WorldACD)

Please reach out to your account representative for details on any impacts to your shipments.

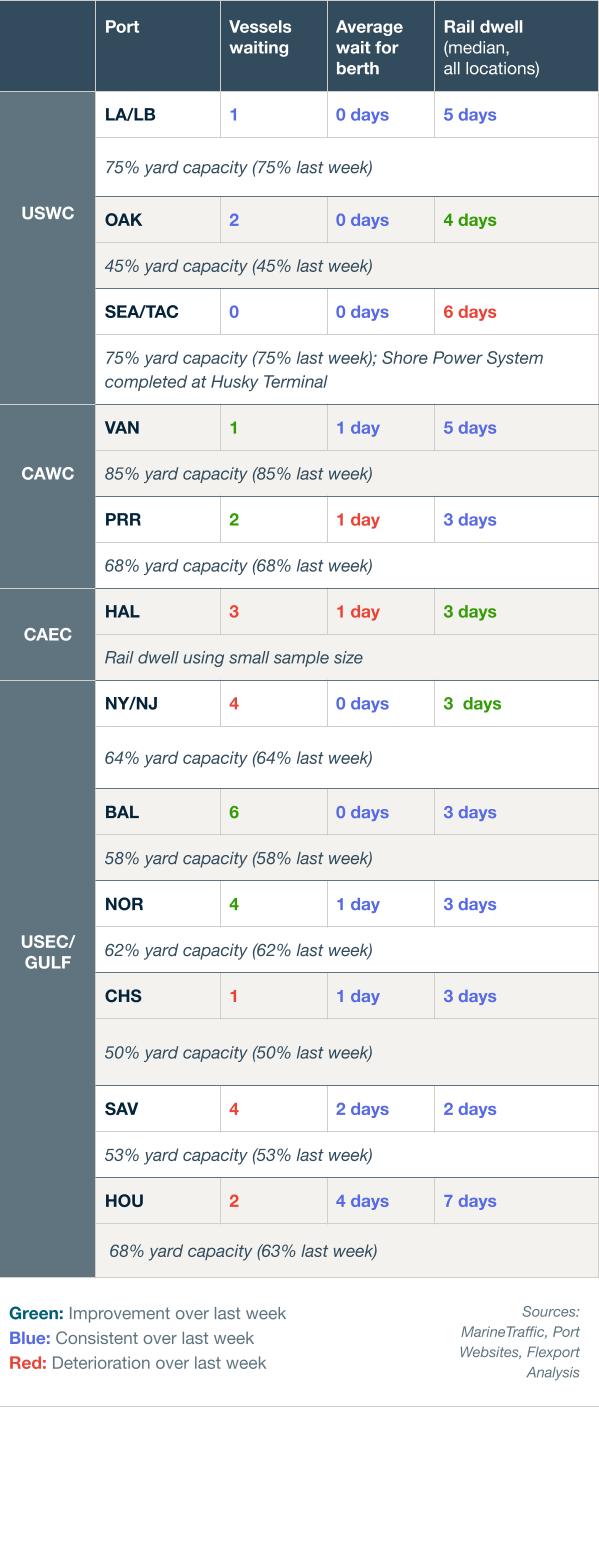

North America Vessel Dwell Times

Upcoming Webinars

European Freight Market Update Live

Tuesday, July 15 @ 15:00 BST / 16:00 CEST

Tariff Trends 2025: Expert Insights on the New U.S. Customs Landscape

Wednesday, July 16 @ 8:00 am PT / 11:00 am ET / 16:00 BST / 17:00 CEST

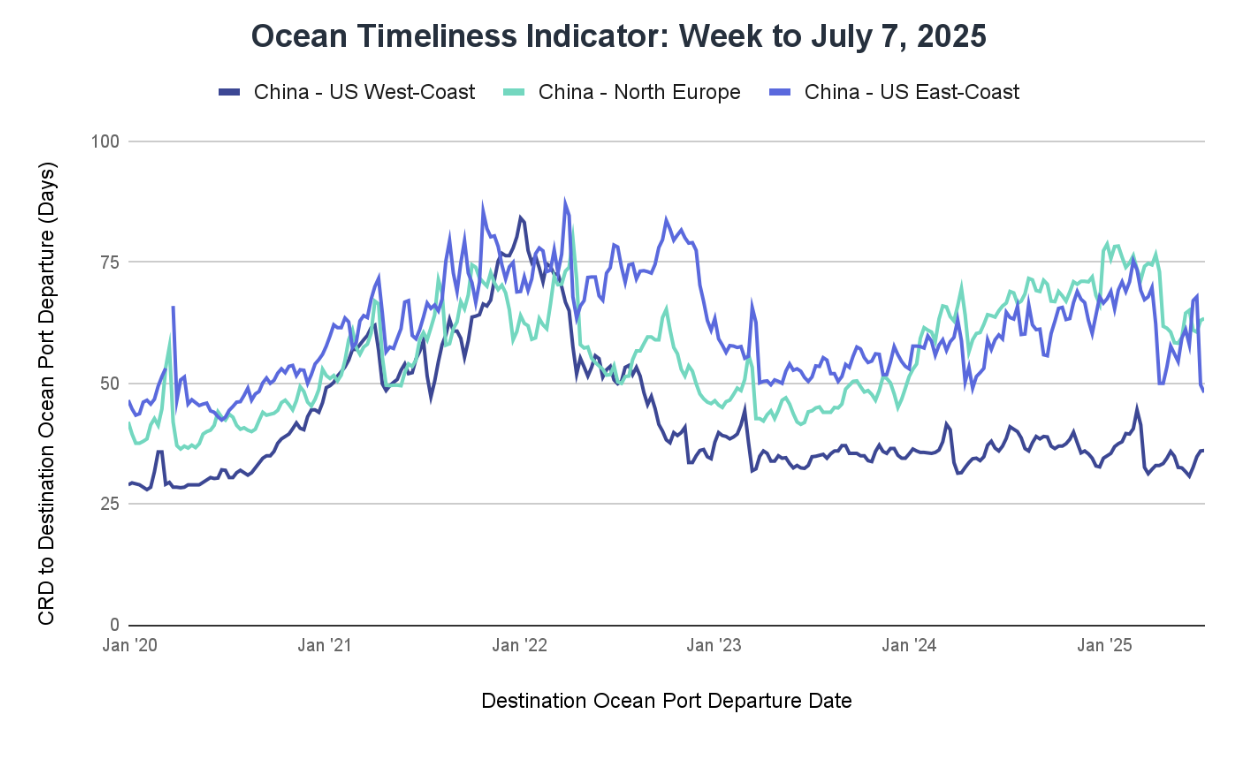

Ocean Timeliness Indicator

Transit times from China to the U.S. West Coast and China to North Europe both experienced modest increases, while the route from China to the U.S. East Coast saw a notable reduction in transit time.

Week to July 7, 2025

Transit time from China to the U.S. West Coast increased slightly, rising by 0.1 days from 36 to 36.1 days. The China–North Europe route experienced a larger increase of 0.4 days, with transit time climbing from 63 to 63.4 days. In contrast, transit time to the U.S. East Coast decreased significantly, dropping by 1.6 days from 49.7 to 48.1 days.

See the full report and read about our methodology here.

About the Author

Related content

![White House GettyImages-603224136 (1)]()

Blog

Live Updates: Trump Administration Tariffs, Trade Policy Changes, and Impacts on Global Supply Chains

![GettyImages-1411182583 1199x800]()

Blog

CBP’s Latest Guidance on Reporting Country of Smelt and Cast for Section 232 Aluminum Tariffs

更多

![GettyImages-1354399056 (2)]()

Global Logistics Update

President Trump Suggests Possible New Tariffs; Demand for Ex-India Air Freight Skyrockets

![Warehouse GettyImages-157558600]()

Global Logistics Update

U.S. Expands Steel and Aluminum Tariffs; European Destination Ports Face Peak Season Congestion

![GettyImages-597662449 1200x800]()

Global Logistics Update

U.S.-China Tariff Truce Continues; Volcanic Eruption Disrupts North Pacific Air Routes