Market Update

Freight Market Update: February 26, 2020

Ocean and air freight rates and trends; customs and trade industry news for the week of February 26, 2020.

Freight Market Update: February 26, 2020

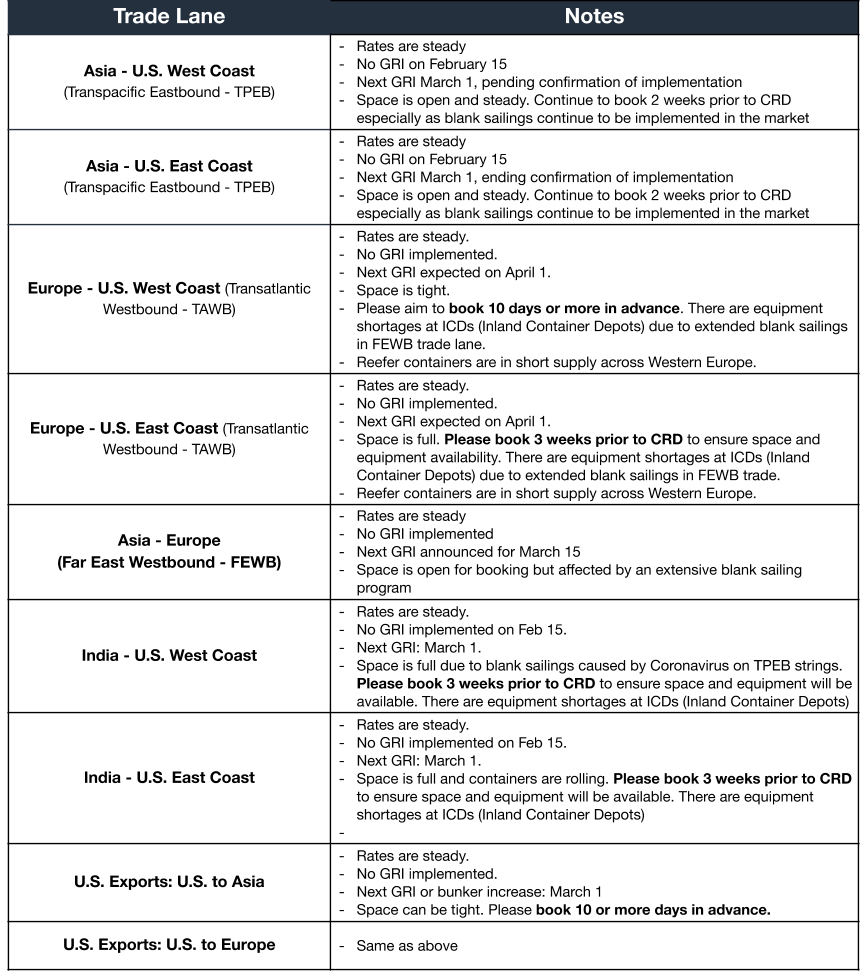

Flexport is monitoring the outbreak of COVID-19 (Coronavirus) and how it’s affecting container flows globally. The temporary slowdown of manufacturing in China and subsequent slow recovery in cargo flows post Chinese New Year, has led to carriers blanking a large number of voyages ex Asia. The blank sailings combined with less cargo arriving in North Europe is likely to be followed by a period of equipment shortage in main ports and depots, at some point in the coming months. To learn more, read our latest Coronavirus update blog.

Want to receive our weekly Market Update via email? Subscribe here.

Ocean Freight Market Update

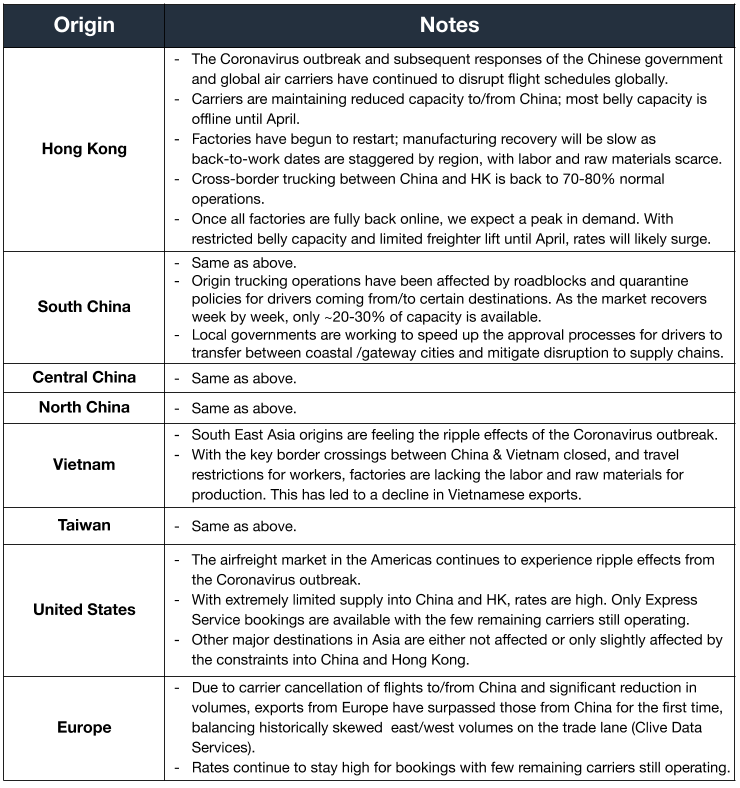

Air Freight Market Update

Freight Market News

Shippers Need Airfreight Post-Coronavirus After a year-plus of declining volume—including urgent adjustments to overambitious capacity increases that never quite closed the supply-demand gap—airfreight executives see light at the end of the runway: per Supply Chain Dive, shippers need fast transport to make up for Coronavirus-related losses as Chinese factories re-open.

New “Tag of Everything” Outperforms RFID MIT researchers have invented an ID tag that can fit on even the tiniest of other chips for a few cents each. Compared to RFID tags, the “tag of everything,” as MIT calls it, transmits data far-range at a frequency hundreds of times higher and optimizes its algorithm to run cryptography on lower power.

Freight Council Seeks Electric Truck Routes The North American Council for Freight Efficiency is starting a three-year program to find the regional corridors best for initial electric truck runs. Transport Topics reports the Council is focusing on data that will monetize electrification for the trucking industry as part of its route identification.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- The IMF Managing Director cut forecasts for the International Monetary Fund’s 2020 GDP estimates from January. Even under an optimistic scenario in which the virus is quickly contained, Chinese growth for the year would fall from a forecast 6.0% to 5.6%, with global GDP growth dropping from 3.3 to 3.2%. The MD added, “But we are also looking at more dire scenarios where the spread of the virus continues for longer and more globally, and the growth consequences are more protracted” without quantifying.

- Significant outbreaks were reported in Italy and South Korea.

- Both French Finance Minister Bruno Le Maire and White House trade adviser Peter Navarro said the outbreak showed overreliance on global supply chains.

- The US shows mixed economic numbers with the IHS Markit composite U.S. purchasing manager indices at a 76-month low in January, indicating a decline in business activity. The downturn was predominantly in the service sector; manufacturing PMI showed a slight expansion, though still at a 6-month low.

- The Conference Board’s Leading Economic Indicators, in contrast, rose 0.8% in January. Key factors included rising home-building permits, high consumer confidence, and cheap credit.

- US Producer Prices rose in January by the most in more than a year, up 2.1% over the last 12 months.

- February’s Euro Zone economic activity numbers were the best in 6 months.

Customs and Trade Updates

Section 301 Exclusions Granted

The USTR published a notice composed of 46 specifically prepared headings and one HTS that was completely excluded from Section 301 list 3. Just like previous exclusions, they will be retroactive to the September 24th, 2018 implementation date and will remain in effect until August 7th, 2020. The USTR also published a product exclusion on Section 301 list 2 for "electric skateboards". This exclusion applies retroactive to August 23rd, 2018 and will expire on October 1st, 2020.

USTR Forms Bilateral Evaluation and Dispute Resolution Office

In an effort to hold China to their commitments in the "Phase One" deal the USTR has formed a Bilateral Evaluation and Dispute Resolution Office. It will address disputes that arise over the implementation of the "Phase One" agreement bi-weekly with designated officials from China.

Trade Agreement Tidbits

USMCA is still being reviewed by the Canadian Parliament before an expected vote in March. A new analysis shows how the agreement will actually lower GDP for the countries involved compared to NAFTA. Back in the US, a group of Senators sent a letter to the USTR urging him to work on a trade agreement between the US-UK. The biggest issue is whether the UK will work on it simultaneously while they work on a much larger deal with the EU, its largest trading partner by far. After President Trump’s visit to India, some had hoped there would be a restoration of some of the GSP benefits. It appears they will not be reinstated in any fashion for GSP and there wasn't a "smaller" deal to be made on this trip.

**For a roundup of tariff-related news, visit Tariff Insider.

Also, pre-register now for FORWARD 2020, a three-day event that brings together the greatest minds in global trade for ideas and insights to advance the industry.