Market Update

Freight Market Update: May 15, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of May 15, 2019.

Freight Market Update: May 15, 2019

Want to receive our weekly Market Update via email? Subscribe here!

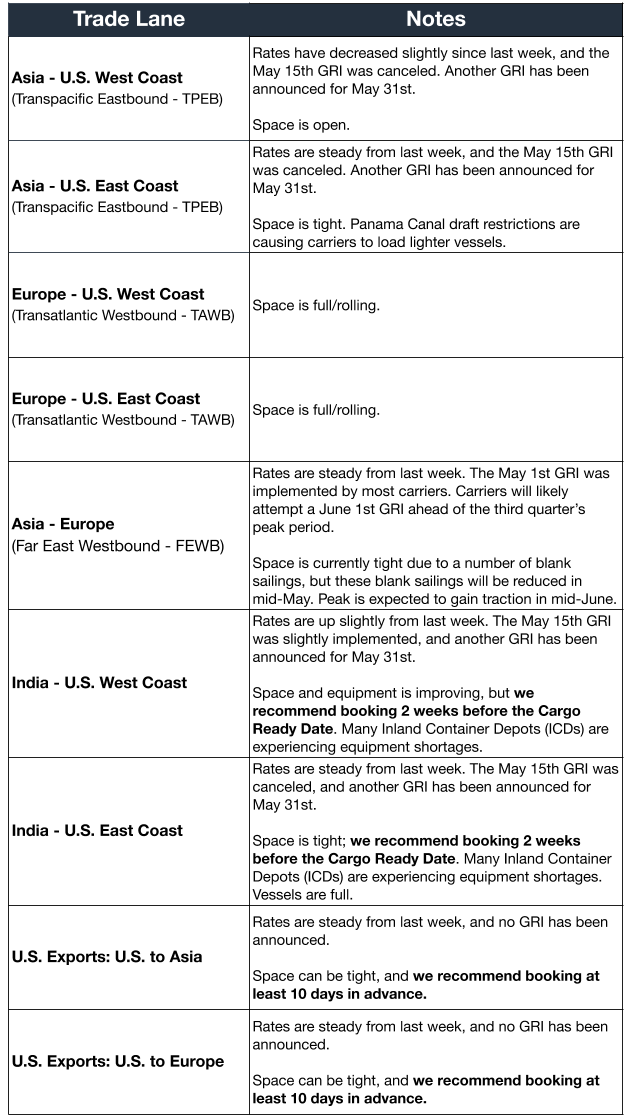

Ocean Freight Market Updates

Weight Restrictions on Panama Canal Shipments

The Panama Canal restricts the draft (how deep the hull goes into the water) of vessels based on the amount of water available in Gatun Lake, which varies based on rainfall, amount of vessels and other factors. Ships must be lighter to meet the draft requirement, so they need to carry less cargo/ballast/fuel or offload cargo to the Panama Canal Railway.

The Panama Canal Authority has announced a further reduction to allowable vessel draft for the Neopanamax locks. A draft restriction has also been announced for the legacy, Panamax, locks. These new draft restrictions will take effect on May 28th, 2019.

Fenix Marine Terminal Closed Until Further Notice

A loss of life accident occurred at the Los Angeles terminal on Wednesday, May 15th, and, per normal procedures, a work stop has been ordered as a result. A timeline for reopening has not been announced, but we will provide updates here as they become available.

U.S. Imports to Jump Up Following Tariff News

Following the announcement earlier this week that a 25% tariff may be implemented on a new fourth tranche of tariffs in June, U.S. retailers are expected to import goods in advance at “unusually high levels.” We saw a similar trend before traditional peak season in 2018, as importers rushed to stockpile goods in the U.S. to avoid higher tariffs.

Additional Carriers Join Digital Container Shipping Association

CMA CGM, Evergreen, HMM, Yang Ming and Zim have joined Maersk, Hapag-Lloyd, MSC and ONE in the Digital Container Shipping Association (DCSA). “The commitment and engagement of many container shipping lines is crucial,” says DCSA’s chief executive, Thomas Bagge. The association’s goal is to drive standardization and digitization throughout the industry.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

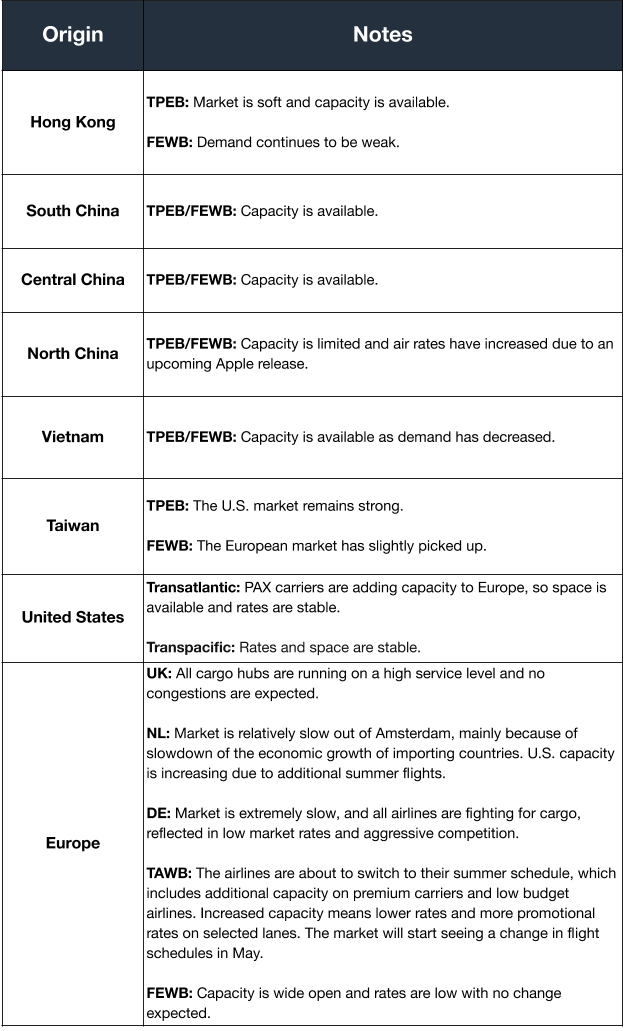

Air Freight Market Updates

**Air Market Sees Small Uptick **

March air cargo volumes were 0.1% higher than last year, marking the first month of growth after four months of no or negative volume change. But trade tensions are creating an uncertain landscape, and according to the International Air Transport Association (IATA),”it would be premature to suggest that the uptick represents a change in the trend growth rate without first seeing signs of confirmation in coming months.”

Weak Market Finally Hits Manchester Airport Group

Manchester Airport Group (MAG) reported declining April cargo volumes in April, across its East Midlands, London Stansted and Manchester gateways. The UK’s second-largest airport operator had a strong 2018, likely because of Brexit and trade war preparations, but is now beginning to experience the weak global market.

Trucking Market Updates

International Roadcheck Coming June 4-6, 2019

The Commercial Vehicle Safety Alliance’s (CVSA) International Roadcheck will take place June 4-6th, 2019. International Roadcheck is an annual three-day event in which CVSA inspectors examine as many trucks as possible, looking for anything that doesn’t meet their safety standards for motor carriers, vehicles or drivers.

International Roadcheck may lead to delays and/or increased costs, for a few reasons:

- Some FTL carriers and drivers choose not to operate during the week of International Roadcheck, constraining overall capacity.

- Non-compliant drivers and vehicles taken out of service will cause reduced capacity and delays.

- All drivers must wait in lines (which are sometimes long) until they are inspected. The inspection itself takes about an hour.

**Trucking Rates Continue to Fall **

April data shows that trucking rates continue to fall since the mid-2018 highs. The weakness in rates is coming from the long-distance trucking market, with FTL rates trending downward and LTL rates remaining unchanged. The capacity added in 2018 to match what was then high market demand coupled with today’s slowing demand has contributed to these falling rates.

Customs and Trade Updates

**More Exclusions Granted for Section 301 Tariffs **

The USTR published another list of exclusions granted for the first tranche of the Section 301 tariffs implemented back on July 6, 2018 on $34 billion worth of Chinese goods. The new excluded tariffs with additional product-specific requirements that were granted are now in effect, and importers can file post-summary corrections to get back duties they already paid.

Those with exclusion requests still under review need to keep track of liquidation dates. If an entry liquidates and is close to the end of the protest period, the importer should file the protest with their exclusion request to get back the duties once a final decision has been made.

**Customs Strategy 2020-2025 **

CBP posted a 28-page strategy document outlining CBP’s plans for 2020-2025. Goals to safeguard the U.S. and its borders were organized into three categories: Mission, Team, and Future. Among the highlights is a focus on leveraging technology to analyze, store, and organize information to streamline processes through IT infrastructure, whether it’s regarding cargo or travelers. The expansion of domestic and international partnerships to promote cross-functionality between more departments and countries is also a goal.

WTO e-Commerce Talks

The World Trade Organization (WTO) held a meeting last week to start negotiating major changes to the e-commerce ecosystem. The organization’s goal is to align governments and the interests of consumer groups representing 15 different countries to ensure the trade functions created positively affect e-commerce for all parties involved. A bulk of the meeting was spent educating the WTO on the pain points experienced by the consumer groups and on the improvements they want to see in customs facilitation, paperless trading, market access, data flows, and transparency.

For a roundup of tariff-related news and the latest on the new fourth tranche, read our Tariff Insider.